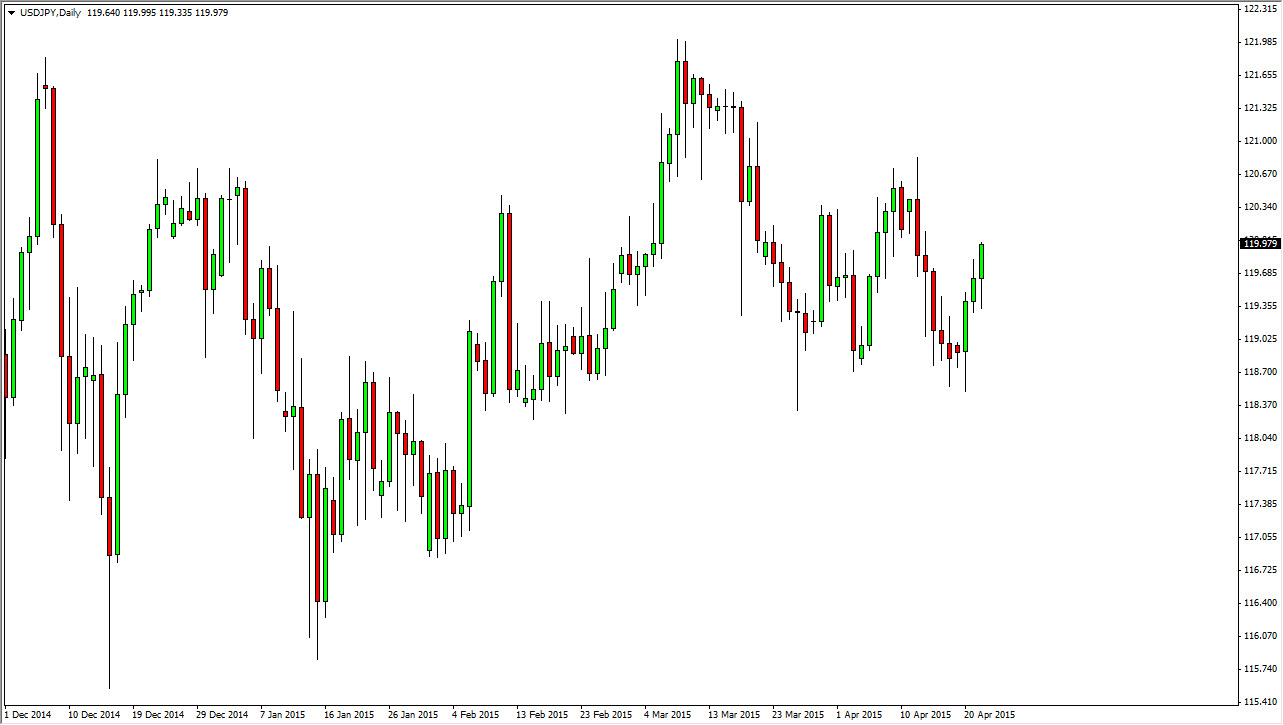

The USD/JPY pair initially fell during the day on Wednesday, but found enough support below to turn things back around and form a very bullish candle. We ended up crashing into the 120 level, an area that of course has psychological significance due to the fact that it is a round number. However, this is an area that we have broken above and below several times in the past, so it’s a bit of a stretch to think that it will have a massive effect on what goes on later in this pair. I believe that this market does break higher, probably testing the 121 level over the next couple of sessions.

Pullbacks should continue to be buying opportunities as the US dollar is favored among currency traders right now, and of course the Bank of Japan is flooding the markets will liquidity, driving down the value of the Yen in general.

Longer-term uptrend

I believe that we are starting a longer-term uptrend in this pair, and that it’s only a matter of time before we break out to the upside. I think that every time we pullback there is going to be a sense of “value” in the US dollar, and I also recognize that there is probably a “floor” in this market somewhere close to the 118.50 handle. It has served as support several times recently, and with that I think that the market will continue to be a “long only” scenario.

The 122 level above should continue to be a barrier, but I think we will get above their and head to the 125 level after that. The market continues to find reasons to buy the US dollar overall, and although the Japanese yen is a bit of a safety currency, I still feel that ultimately this is a matter of two central banks with massively opposing monetary policies. This of course will continue to drive interest rates in opposite directions, and favor the United States.