EUR/USD Signal Update

Yesterday’s signals suggested a short off bearish candlesticks at around 1.1010 which resulted in a losing trade.

Today’s EUR/USD Signal

Risk 0.75%

Trades should only be taken between 8am and 5pm London time.

Long Trade 1

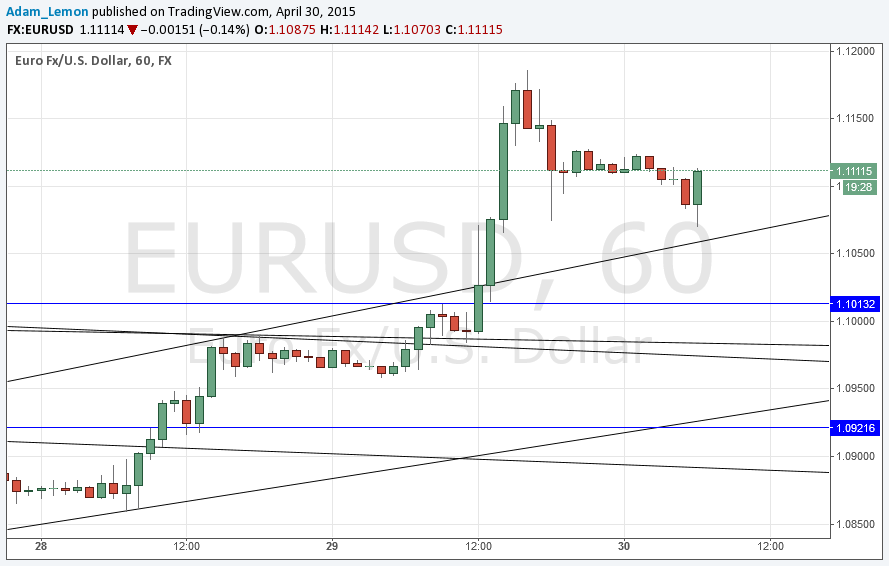

Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of the bullish trend line currently sitting at around 1.1059.

Put the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Long Trade 2

Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of the broken bearish trend lines currently sitting at around 1.1013.

Put the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Long Trade 3

Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of the broken bearish trend lines currently sitting at around 1.0980.

Put the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Long Trade 4

Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of the bullish trend line currently sitting at around 1.0928.

Put the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

EUR/USD Analysis

Yesterday was a very interesting day for this pair as the Euro rose very strongly across the board and the USD began to look weak in view of its disappearing prospects for a rate rise any time soon. There were several key resistance levels, trend lines, and key psychological numbers that the pair broke up past with ease, even before the poor U.S. GDP data was released.

Although the price has fallen off from yesterday’s highs, and the USD may claw back some lost ground, it seems likely there will be a more bullish than bearish bias worth taking at least for today. There are no very clear resistance levels until 1.1260 but the area above 1.1200 should start to see resistance kicking in, generally.

There are high-impact events scheduled today concerning both the USD and the EUR. There will be a release of the Eurozone CPI Flash Estimate at 10am London time, followed later by U.S. Unemployment Claims data at 1:30pm.