EUR/USD Signal Update

Yesterday’s signals were not triggered as although we did reach 1.0950 there was no bearish price action there.

Today’s EUR/USD Signals

Risk 0.75%

Trades should only be entered before 5pm London time.

Protect all open trades before 6:30pm London time.

Long Trade 1

Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.0921.

Place the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 1

Short entry following a bearish price action reversal on the H1 time frame immediately provided no close above the confluent bearish trend lines at around 1.0980.

Place the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 2

Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of the broken bullish trend line currently sitting at around 1.1010.

Place the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 3

Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.1050.

Place the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

EUR/USD Analysis

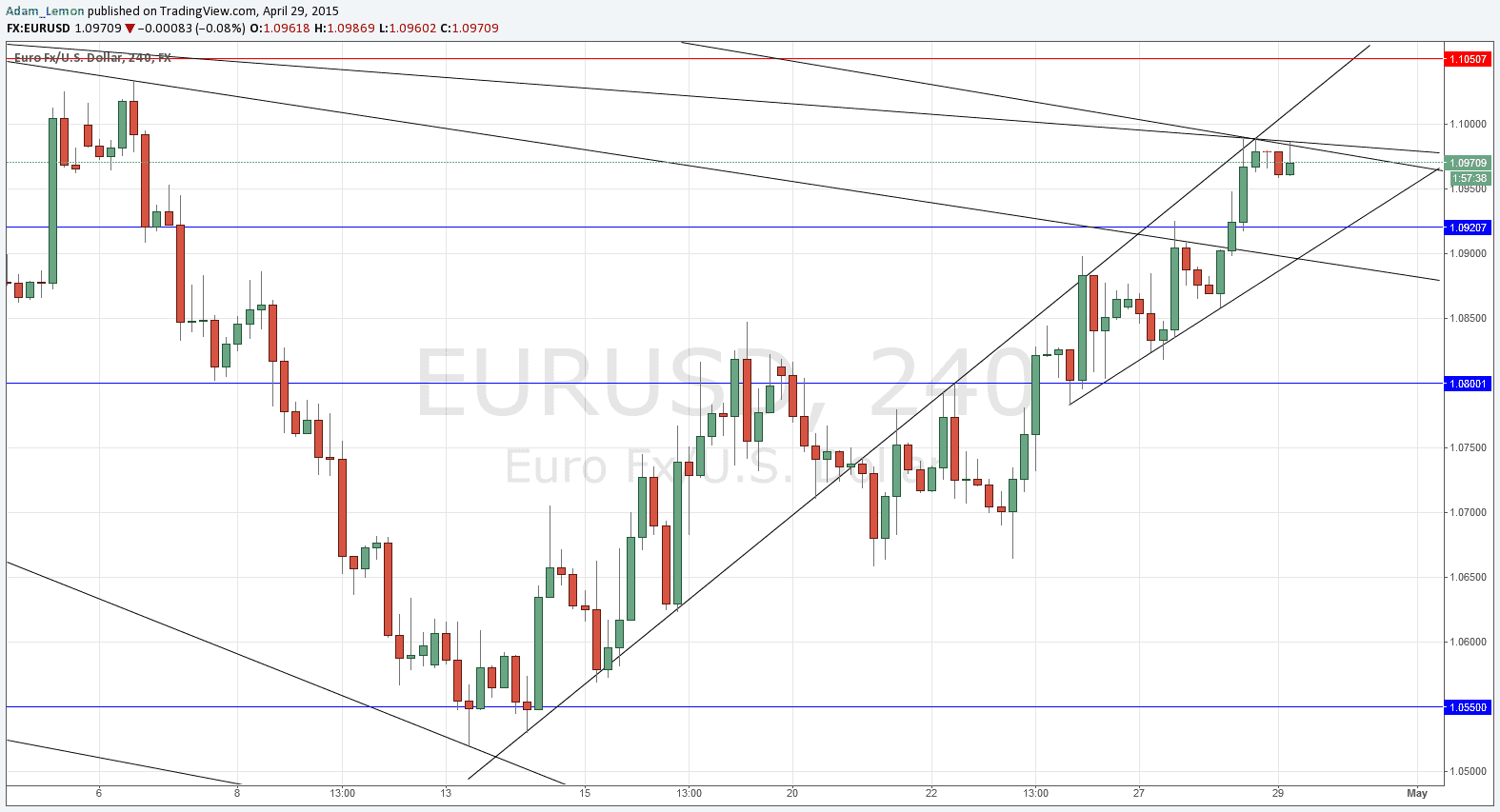

Yesterday saw a lot of USD movement across the board. Although the EUR is one of the relatively weaker currencies, this pair rose and broke through key resistance and that cannot be ignored. The chart looks bullish even as we approach some very significant resistance that has held for a long time.

The chart below shows that this pair has been respecting meaningful trend lines recently, and we are now within a zone where the price may be trapped between both supportive and resistant trend lines.

However most immediately there is a confluence of trend lines now at 1.0980 and this is holding the price as I type.

There is a very important USD announcement later that can easily blow all this technical analysis away so be warned.

There are high-impact events scheduled today concerning both the EUR and the USD. Regarding the EUR, there will be a release of German Preliminary CPI data at some unspecified time during German business hours. As for the USD, there will be a release of Advance GDP data at 1:30pm London time, followed later at 7pm by the very important FOMC Statement and Federal Funds Rate announcement.