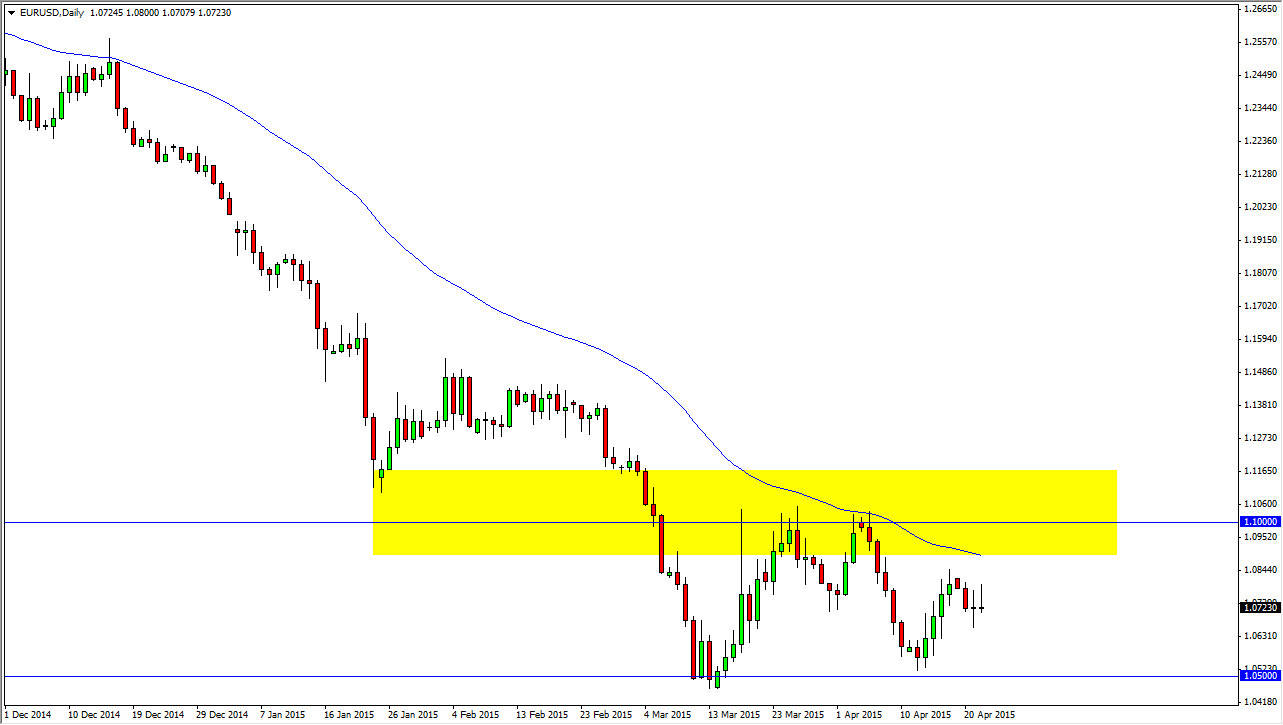

The EUR/USD pair tried to rally during the session on Wednesday, but gave back all of the gains in order to form an unchanged candle. More importantly, we ended up forming a shooting star, and that of course is bearish. When I look at this pair, I cannot help but wonder why somebody would be tempted to buy the Euro. There was a point in Mike trading career that I would try to “pick the bottom” of a currency pair, but quite frankly that is a “fool’s errand.” With this, I have learned to trade with the trend until the trend dies. At this point in time, the trend to the downside looks very comfortable.

I recognize that the candle from the previous session was neutral, and that could cause a little bit of volatility. However, when I look at the longer-term trend I see nothing that makes me want to buy the Euro. We have the 100 day exponential moving average just above, and it is sloped decidedly bearish. I believe that longer-term traders will continue to short this pair, especially considering how many issues there are in the European Union at the moment.

Consolidative, with a bearish twist

I believe that we are simply consolidating between the 1.05 level on the bottom, and the 1.10 level on the top. I think that there is much more bearish pressure though, and ultimately the sellers will win. If we can get below the 1.05 handle, I believe that the market will then aim for parity given enough time.

As you can see, I have a yellow rectangle on my chart that reminds me that we are in a very bearish market, and that there should be a resistive “zone” in this general vicinity. Even if we break the top of the shooting star from the Wednesday session, I’m still looking to sell this market on resistive candles. In fact, at this point time I have no idea what would make me change my opinion of this pair. I think there are far too many problems in Europe to be bothered owning that currency, especially against the US dollar.