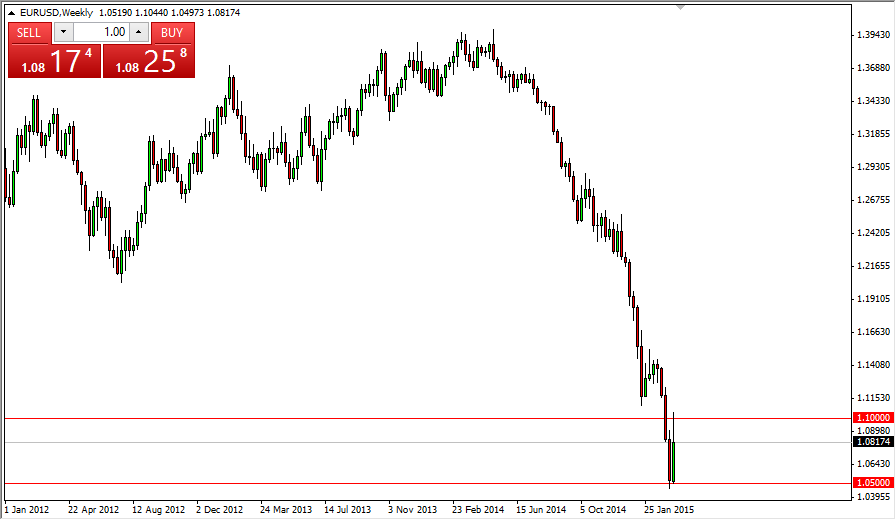

EUR/USD

The EUR/USD pair rose during the course of the week, testing the 1.10 level at one point. However, it appears that the marketplace has rejected that area as appropriate, as the downtrend most certainly continues. At this moment, I feel that the market will continue to bounce around between the 1.05 level on the bottom, and the 1.10 level on the top. Ultimately though, I am much more comfortable shorting this market and will continue to do so but probably off of the short-term charts.

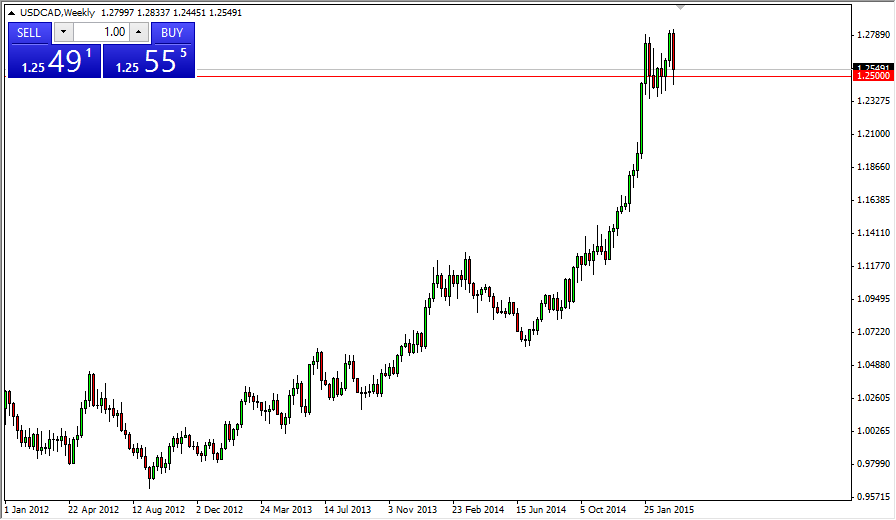

USD/CAD

The US dollar fell against the Canadian dollar during the week, testing the 1.25 region for support. We obviously found it, but keep in mind that the oil markets may be pulling back a little bit from the massive downtrend that we have seen recently. Because of this, this could bring strength back into the Canadian dollar for the short-term, but I still looking any pullback from here as a potential buying opportunity. I believe that there is massive support of the 1.24 level, as well as even more massive support at 1.20 level. I still believe the US dollar will trade at 1.30 against the Canadian dollar of the course of the next month or so.

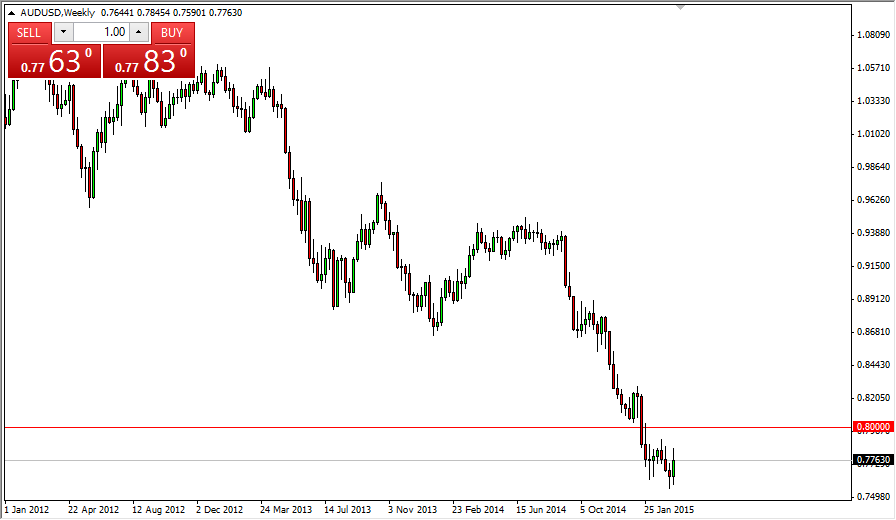

[CAD:FXAcademy CTA #121]AUD/USD

The Australian dollar got a bit of a reprieve this week, but keep in mind that it is highly sensitive to the gold market. With gold markets being so volatile, it’s difficult to be invested in the Australian dollar to the long side anyway, and let us not forget that the US dollar still is one of the favorite currencies around the world. I think that we are going to get a bit of rally, but as soon as we get close to the 0.80 level, the Australian dollar should taper off and money should start flowing from left to right across the Pacific again.

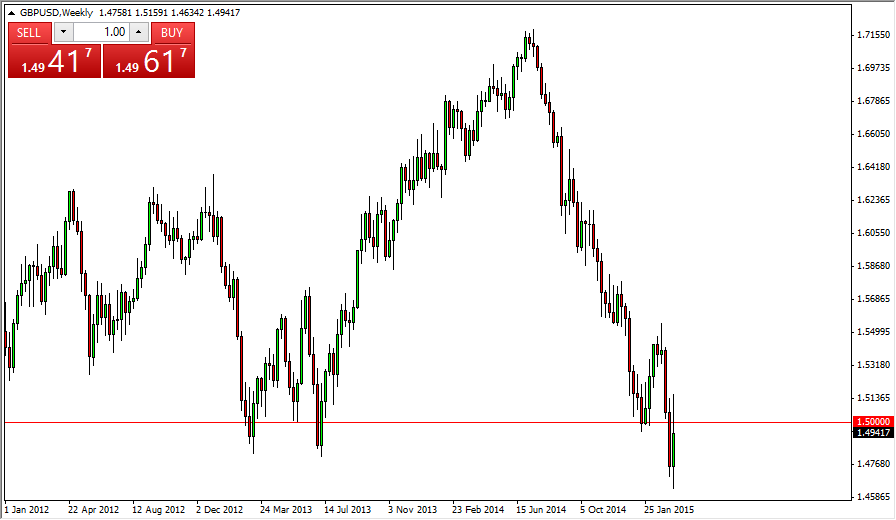

GBP/USD

The British pound got a bit of the surge on Wednesday after the Federal Reserve hinted that perhaps the monetary policy would be loose for a little bit longer than anticipated. However, remember that the United Kingdom has its own issues and one of them being the fact that its largest trading partner is the European Union. With this, expect money to go flowing out of the United Kingdom still, and the fact that we pulled back so significantly from the 1.50 level right away suggests to me that we are in fact going to continue going on. I continue to sell rallies of the British pound.