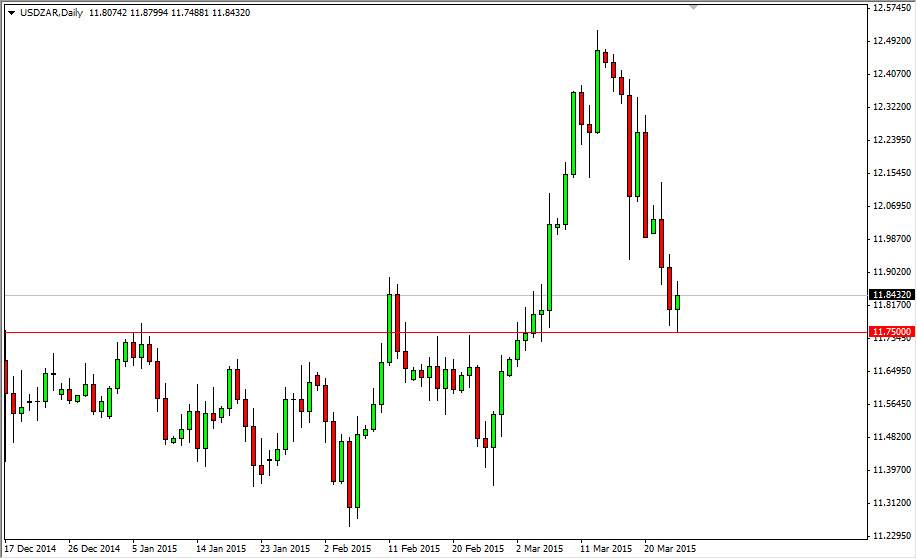

The USD/ZAR pair fell initially during the session on Wednesday, but found quite a bit of support at the 11.75 level, an area that has been resistive and supportive recently. That being the case, it makes sense that we could very well bounce from here, as we have seen a pretty significant sell off recently. If keep in mind that the South African rand is extraordinarily sensitive to the price of gold, and the US dollar tends to be the “anti-gold” currency. So in other words, this is a pair that tends to move very much opposite of the gold markets themselves.

Over in the gold markets, we have seen quite a bit of resistance of the 12.0000 level, and as a result it looks like the market might struggle. If it does, it would make perfect sense for this pair to turn things back around and break much higher. If we can break the top of the candle for the session on Wednesday, I believe that this market will then head towards the 12.5000 level, which was the most recent high.

Wide spreads and lots of volatility

The thing about trading this particular market is that you have to be prepared for the volatility and the large spreads that you can see at times. This is a long-term trade waiting to happen, and not the type of market that can be traded on a short-term chart. In fact, I don’t get involved in this pair unless of course I’m looking to be involved for several weeks. With that being said, I think if we can break above the top of the range for the session on Wednesday, the market should then find bullish pressure overall for the next several weeks, offering an opportunity to take advantage of the US dollar strength and the softness that we have seen in the gold markets. Also, keep in mind that South Africa is an emerging market, and that of course makes it a bit of a play on the Third World as well. Right now, people prefer American assets over more risky ones.