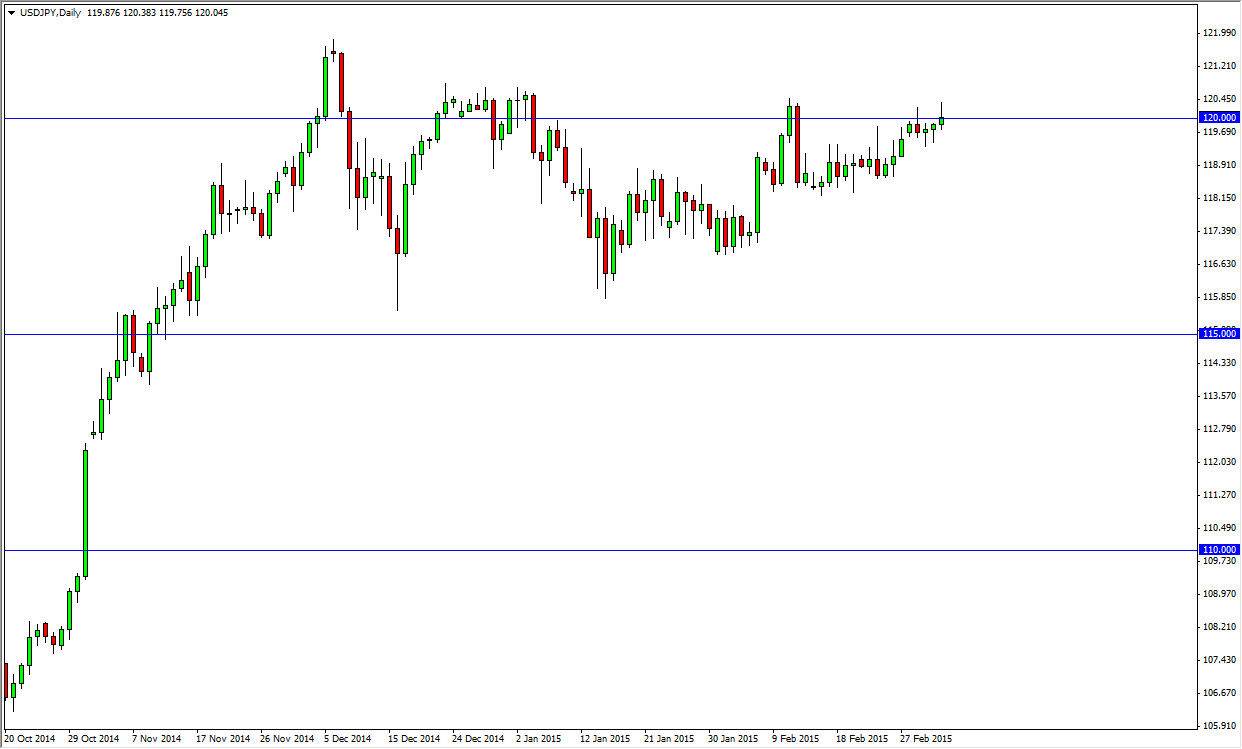

The USD/JPY pair took out to the upside during the session on Thursday, but as you can see struggled above the 120 handle. That’s not surprising, as this pair tends to be very sensitive to the nonfarm payroll announcement out of the United States, which of course comes out today. With that, it’s difficult to imagine that too many people would have wanted to put large amounts of money into this market. Ultimately, this is a pair that tends to be very volatile during nonfarm payroll Fridays, so it’s likely that we will get quite a bit of motion.

Any pullback at this point in time is a buying opportunity as far as I can see, as there is most certainly quite a bit of upward pressure. With that, I am looking at pullbacks as value in the US dollar, as it is the favored currency around the world. While the Bank of Japan continues to keep a very loose monetary policy, driving interest-rate differentials in favor of the US dollar.

One-way trade.

I believe that this is a one-way trade going forward, as there are far too many supportive levels below. With that, I believe that the buyers will come back into this market again and again, and with that, there’s no real reason to sell this market. Quite frankly, if you are patient enough, you should have plenty of buying opportunities in this market as we continue to see upward pressure. Eventually, we will break out and above the resistance, sending this market looking for the 122 handle. Once we get above there, I think we will eventually head to the 125 handle, which is a longer-term target of mine.

I think that the 115 level is without a doubt the “floor” in this market, and they do not see this market going below there again. If we do break down below there, that would be disastrous for this particular pair, and we would go much lower. However, I highly doubt that’s going to happen.