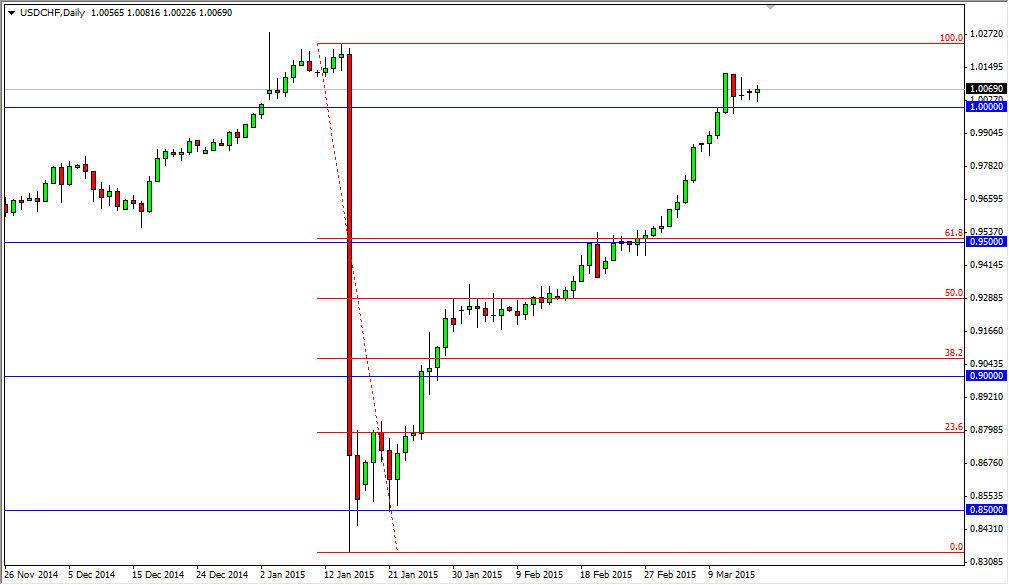

The USD/CHF pair initially fell during the course of the session on Monday, but found enough support just above the parity level to turn things back around and form a hammer. That hammer of course suggests that the market should continue to go higher. After all, the US dollar is the strongest currency in the Forex markets, and as a result it’s difficult to short this market anyway. That being the case, the market looks as if it should act as the rest the Forex markets, favoring the US dollar.

Keep in mind, the massive selloff had to do with the Swiss National Bank removing the currency peg against the Euro which once stood at the 1.20 level. Because of this, the market flooded the Swiss franc, as almost the entirety of the Forex market found themselves on the wrong side of the EUR/CHF pair, making demand for the Swiss franc massive around the world in a sudden meltdown.

The US dollar is a bit different though

The US dollar is a bit different though, because quite frankly the market should continue to treat it very positively, as this pair was sold off more or less as collateral damage. After all, the US economy is doing better than the European economy most certainly, and the biggest problem that the Swiss have is that they send 85% of their exports into the European Union, meaning that the Swiss are going to suffer because of the lack of economic activity in the European Union. In other words, the Swiss economy is going to suffer right along with the Europeans. With that, it makes sense that money will continue to flow out of the continent of Europe, and into North America. I believe that this pair will head to the 1.02 level next, which of course is the beginning of the massive selloff. If we get above there, the market should then become more or less a buy-and-hold situation. I have no interest whatsoever in selling.