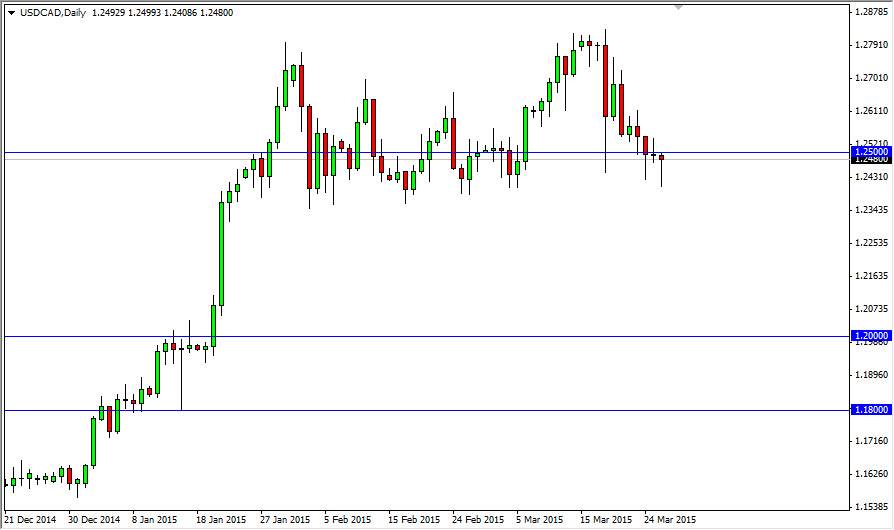

The USD/CAD pair initially fell during the course of the session on Thursday, but as you can see found enough support near the 1.24 level to turn things back around and form a nice-looking hammer. Quite frankly, this hammer is at just about as perfect of a place as you can find, and with that I am very happy to start buying once we get above the 1.25 handle. I don’t know that I’m necessarily in a rush to do so, because a nice daily close above that level might be what I need to feel confident enough to start buying. However, I believe that once we do get above the 1.25 handle, we should then head to the 1.28 level given enough time. The Canadian dollar has been soft for some time, so would not surprise me at all to see this market go higher yet again.

Pullbacks going forward on short-term charts should offer buying opportunities, as the market continues to favor the US dollar in general. On top of that, keep in mind that the oil markets are very soft at the moment as well, so it makes sense that the US dollar will continue to strengthen while the Canadian dollar continues to falter.

Interest-rate differential

Remember, the Bank of Canada recently had a surprise interest-rate cut, and that of course has people worried about the interest-rate differential between the two economies. With the central bank in Ottawa doing that, it should a lot of confidence in the Canadian economy. After all, the only reason central banks cut interest rates is because they are concerned about something. I recognize that it’s based mainly upon the oil markets, but nonetheless it’s not exactly a confidence building of that when that happens.

I think that if we can get a daily close above the 1.25 handle, that the market will then head to the 1.28 level as it is the top of consolidation. I have no interest in selling, because I believe the 1.24 level of course is the bottom of the support, and then below there we might have a little bit of a significant drop but I believe that the 1.20 level is even more vital as support.