Gold prices advanced to their highest levels since early March as concerns over escalating tensions in the Middle East hammered stocks and sent market players toward safety plays. Some investors pulled money out of equities and flocked to gold after Saudi Arabia and its allies conducted air strikes in Yemen. As a result, the market climbed above the 1198 resistance level and at one point traded as high as $1219.56 an ounce.

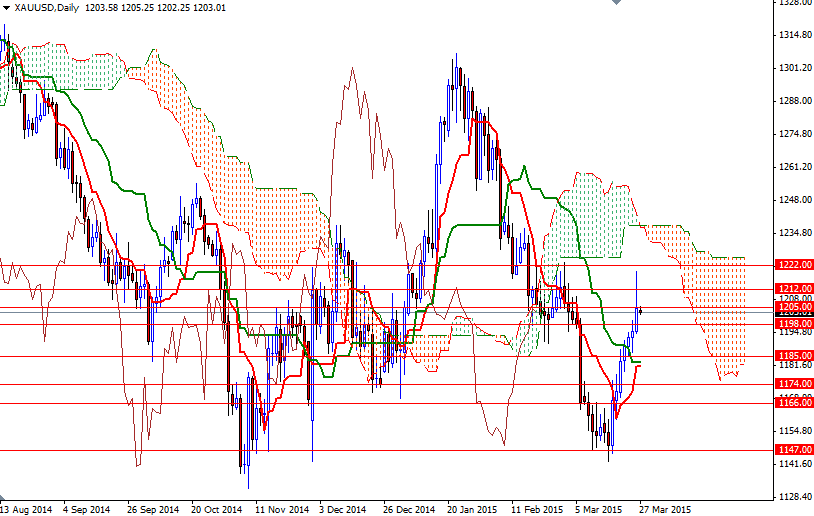

Although the situation in the Middle East is likely to create a floor under the market, long wick to the upside indicates that people remain wary over gold's outlook. Past geopolitical flash points had transitory impacts on the precious metal as the markets maintained a positive view for the dollar. The XAU/USD pair pulled back below the 1205 level after jobless claims and services sector data came out better than forecasts.

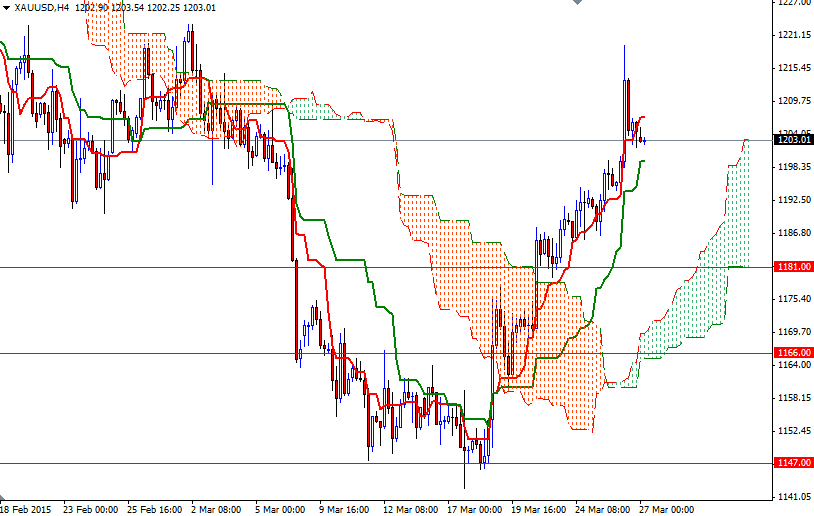

The bulls have been dominant since we climbed above the 1174 resistance level and they will have an advantage in the short term while the XAU/USD pair is trading beyond the Ichimoku cloud (4-hour chart) and the Tenkan-Sen line (nine-period moving average, red line) is moving above the Kijun-Sen line (twenty six-day moving average, green line). XAU/USD is currently trading between these two lines so I will keep an eye on 1207 - 1205 and 1199.38 - 1198. Buyers will need to push prices above 1207 so that they can test the 1214/2 area. If this resistance is broken then the next stop will be 1225/2. However, if the bears take the reins and drag prices back below 1198, it is likely that we will return the 1191 level. Falling through the 1191 level would suggest that the bears are getting ready to challenge the support at 1185.