Gold prices fell $2.56 an ounce on Tuesday, extending the previous day's losses, as caution set in ahead of important data releases. The XAU/USD pair dipped to a low of 1195.27 before bouncing back to the 1206 level. Although gold prices dropped two days in a row, we are still trapped within the trading range of 1222 and 1197. The U.S. dollar's strength against other currencies is pressuring gold prices but rebound off the $1197 support level suggests that buying interest continues to emerge on dips.

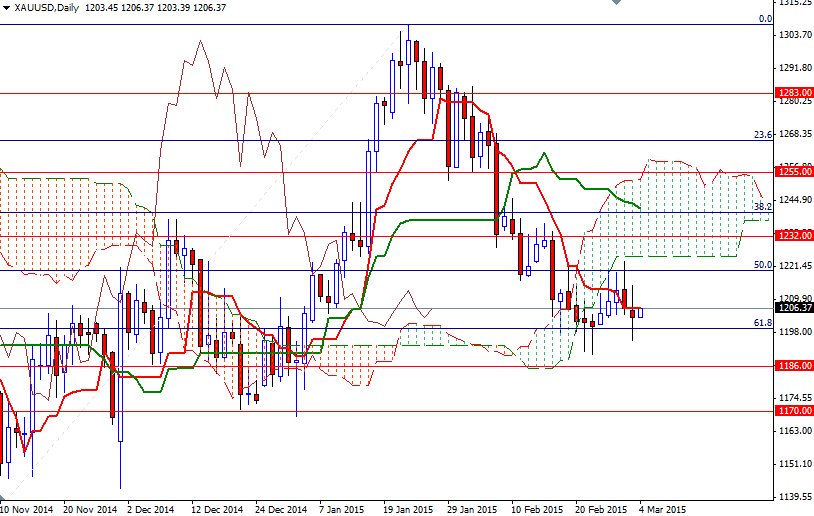

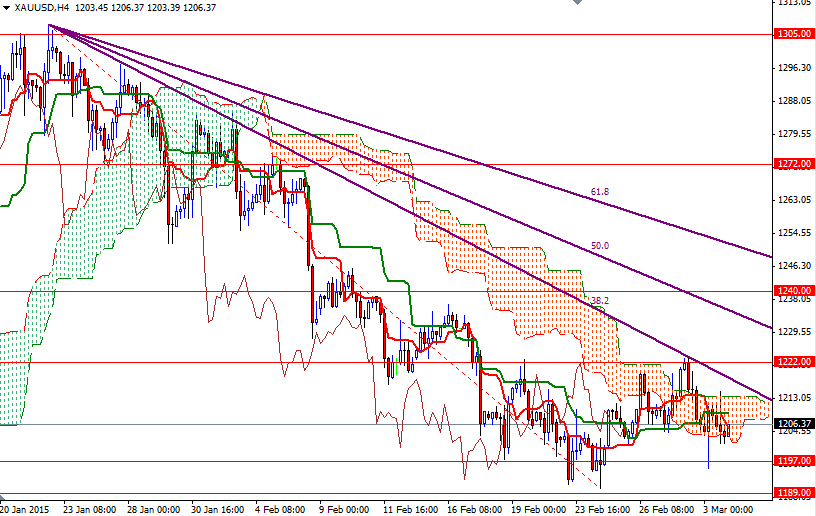

Technically, the odds favor further downside as long as the XAU/USD pair remains below the cloud on the daily time frame. Bearish Tenkan-Sen (nine-period moving average, red line) - Kijun-Sen (twenty six-day moving average, green line) crosses on both the daily and 4-hour charts also support this view. However, trading within the boundaries of the Ichimoku cloud (4-hour chart) suggests there is an intense battle going on.

As I mentioned in the monthly analysis, I expect a range-bound movement until the market overcomes certain levels. Clearing the resistance at 1225/2 would open the doors to the 1232 and 1240. The XAU/USD pair will have to penetrate the 1240 level, where the 38.2 retracement of the bullish run from 1131.96 to 1307.47 and the daily Kijun-Sen converge, in order to approach the 1258/5 area. To the downside, I will be keeping an eye on the support around the 1197 level. A close below this level would increase the downward pressure and take us back to the 1189/6 support. If the market dives below the 1189/6 area, then prices will probably fall to the 1170 level before finding some support.