Gold prices ended Friday's session down 0.46%, or $5.51, to settle at $1198.07 an ounce as traders took profits from a seven-day run of gains. Despite Friday's losses, gold prices ended the week with a gain of 1.3% on speculations that the U.S. Federal Reserve will not lift rates off of zero until September. The declines in global equities sparked by the turmoil in the Middle East also increased the appeal of the precious metal as an alternative investment.

It appears that desire to buy gold as a hedge against the volatility in the markets will only give a temporary boost. The latest data from the Commodity Futures Trading Commission (CFTC) revealed that speculative traders on the Chicago Mercantile Exchange increased their net-long positions in gold (first advance in eight weeks) to 54281 contracts, from 53093 a week earlier. As I said last week, geopolitical tensions had little lasting impact on financial markets over the past few years and I don't think Yemen will be any different. The path of interest rates in the United States, performance of the global equity markets and inflation expectations will be the long term drivers.

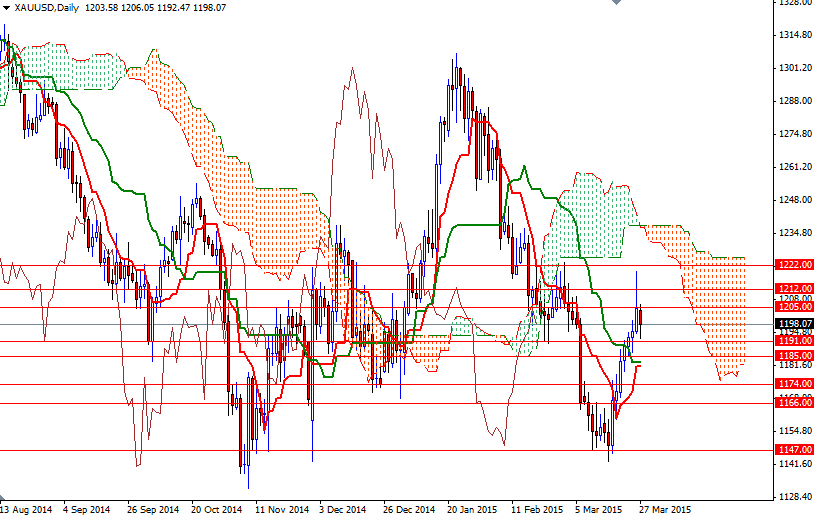

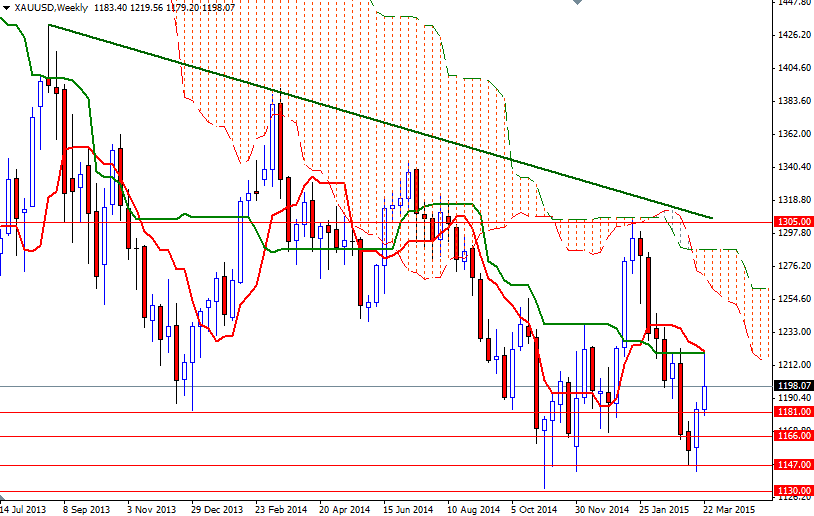

Even though I have been bullish since the XAU/USD pair passed through the 1174 resistance and started trading above the Ichimoku cloud on the 4-hour time frame, I remain rather bearish about gold's upside prospects in the long term - as I expect witnessing a range bound movement with negative bias. If the market continues to move above the cloud, then I can't rule out the possibility of a push up towards the 1240/37 area. To the upside, there are hurdles on the way such as 1205 and 1212. But as you can see on the weekly chart, the 1225/2 zone where the Tenkan-sen (nine-period moving average, red line) and Kijun-sen (twenty six-day moving average, green line) coincide is a strategic camp for the bulls to conquer. The bears have to drag prices below the 1191 support so that they gather enough strength to challenge the bulls at 1185 and 1181. If this support gives way, I think the XAU/USD pair will visit the 1174 level again.