GBP/USD Signals Update

Last Thursday’s signal expired without being triggered as although the 1.4853 level was hit, there was no bullish price action reversal until the price had moved well below it.

Today’s GBP/USD Signals

Risk 0.75% per trade.

Trades may only be entered before 5pm London time.

Long Trade 1

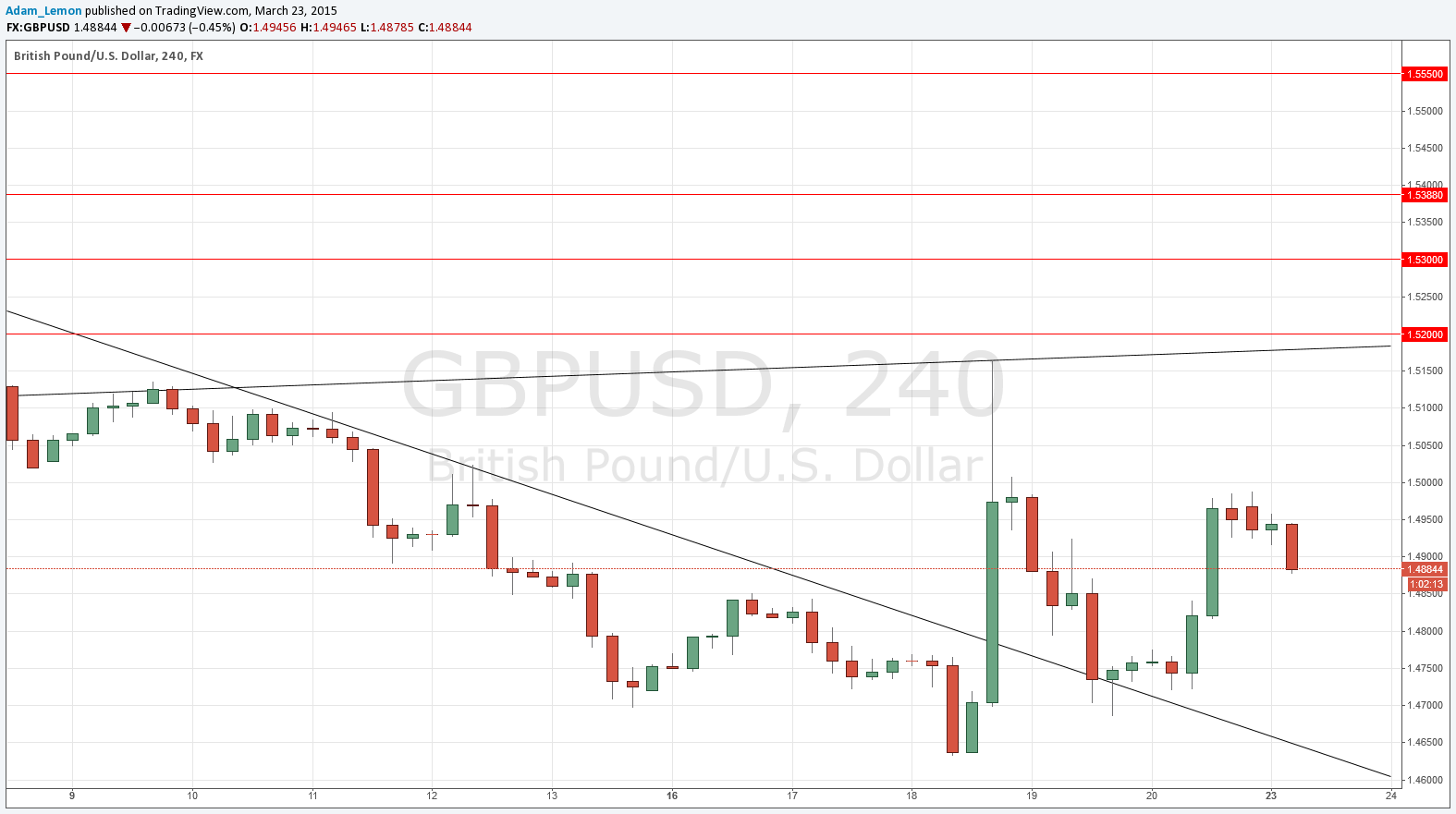

Go long following a bullish price action reversal on the H1 time frame immediately upon the first test of the broken bearish trend line currently sitting at around 1.4650.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 25 pips in profit.

Remove 50% of the position as profit when the trade is 25 pips in profit and leave the remainder of the position to run.

Short Trade 1

Go short following a bearish price action reversal on the H1 time frame immediately upon the first test of the trend line currently sitting at around 1.5175.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 25 pips in profit.

Remove 50% of the position as profit when the trade is 25 pips in profit and leave the remainder of the position to run.

GBP/USD Analysis

The nearest levels where I would look for either long or short trades are a long way away from the current price, so it extremely unlikely that either level will be reached today.

I had expected that the most likely scenario was one in which the price found support at 1.4853 and then continued to move upwards. In fact, the price fell further, before moving up to around 1.5000, from where it has fallen again. It seems quite possible that the psychological importance of 1.5000 will keep this level as resistant for at least a while, although I am not looking for any short trade to set up there.

After the very large, fast swings that were made after the FOMC announcement, this pair is probably going to consolidate for a while, albeit with a bearish bias. The broader picture shows a slackening in USD bullishness across the board, with signs that USD is strength is being eclipsed by the NZD and threatened by some other currencies over the medium term. However, the GBP has now become very weak, so while this week might well close up, I suspect the best day trades will be short.

My colleague Christopher Lewis is bearish on this pair: he sees the price heading down to 1.4500.

There are no high-impact events scheduled today concerning either the GBP or the USD.