AUD/USD Signal Update

Last Tuesday’s signals were not triggered as the price never reached either 0.7898 or 0.7750.

Today’s AUD/USD Signals

Risk 0.75%

Trades may only be taken between 8am London time and 5pm New York time only, or after 8am Tokyo time later.

Long Trade 1

Go long following some bullish price action on the H1 time frame immediately upon the first test of 0.7727.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 1

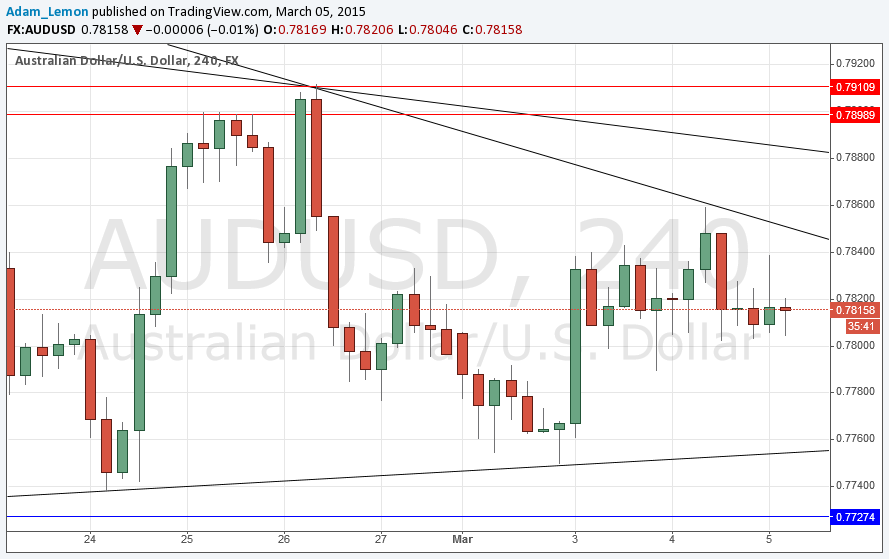

Go short following some bearish price action on the H1 time frame immediately upon the first test of the zone from 0.7898 to 0.7910.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

USD/JPY Analysis

The most interesting feature technically is a very long-term bearish trend line that is located not far above the current price. In the chart below, it is the closest trend line above the current price. Unfortunately this trend line is problematic as there is some ambiguity as to exactly where to place it – it is arguably higher. There is also another shorter-term bearish trend line nearby, and a likely resistance zone confluent with the whole number at 0.7900. For these reasons, the best trade in the near time is likely to be a short trade, but it will be safer to look for this reversal at the zone close to or at 0.7900.

It is also possible to get a long trade first if the price initially drops down to support at 0.7727 and reverses bullishly, but I have little faith in that short-term bullish trend line currently sitting slightly above that level.

There are no high-impact events scheduled for the AUD today. Regarding the USD, there will be a release of Unemployment Claims data at 1:30pm London time.