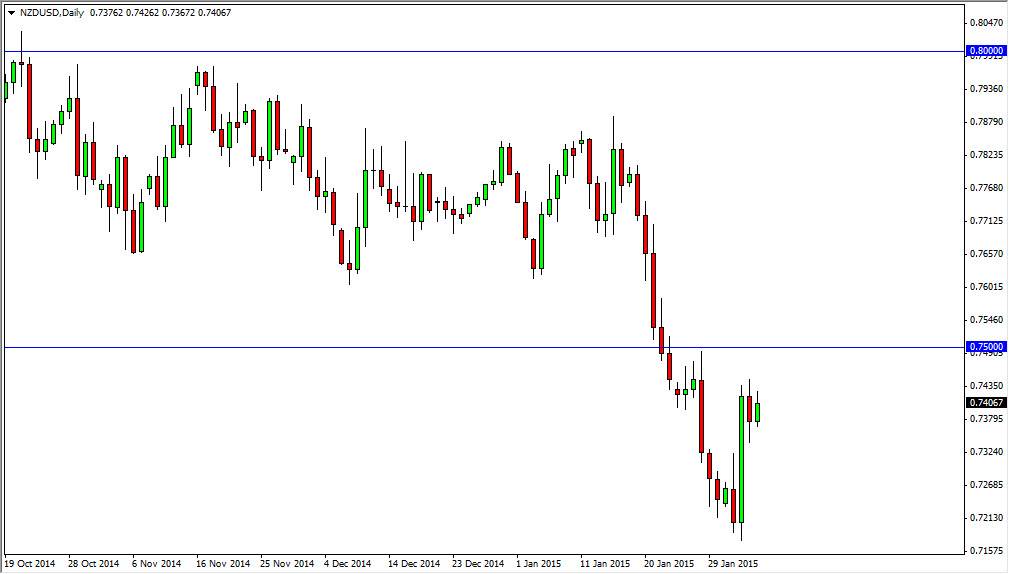

The NZD/USD pair struggled during the session on Thursday to make any real gains, as the area just below the 0.75 level offered quite a bit of resistance. Because of this, the market looks as if it’s ready to selloff again as the downtrend could continue today. After all this is the nonfarm payroll Friday, and that means that we will have some type of movement more than likely.

The 0.75 level above extends resistance all the way to the 0.76 level, which I think is quite a bit of strong selling pressure. Ultimately, the market looks as if it is going to selloff from here, and perhaps head down to the 0.70 level. That is our longer-term target in my opinion, and as a result I am a seller of breakdowns and resistive candles above as I think the aforementioned area is going to simply be far too strong for the buyers to take out.

Possible central bank interference

It’s possible that the Royal Bank of New Zealand will interfere with this market because too high anyways. After all, they have sold off the Kiwi dollar recently, and as a result it would not surprise me if this market was sold off by the central bank at higher levels. With that in mind, I know that the Royal Bank of New Zealand interfered in this marketplace previously, and the market will keep that in the back of its collective mind. If the jobs number out of the United States is strong, expect a lot of volatility in this pair but ultimately any rally at this point time looks like a selling opportunity to me, because the weight of the market is certainly leaning lower, and should continue to push.

It is not until we get above the 0.79 level that I think this market would change bias, and quite frankly it might even be the 0.80 level before we see that. With that, I am very bearish of this market and looking for opportunities to pick up the US dollar “on the cheap.”