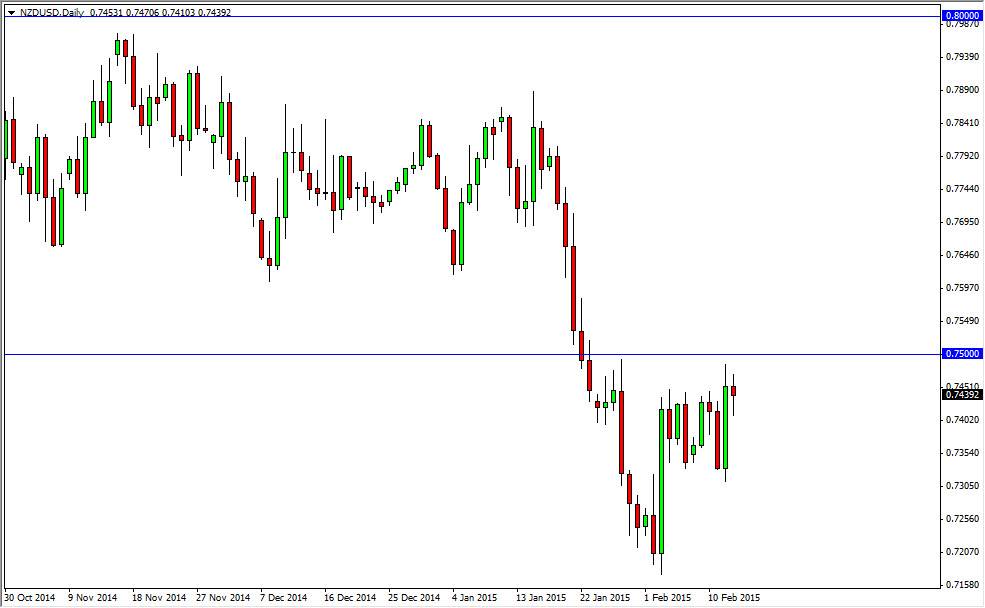

The NZD/USD pair went back and forth during the course of the day on Friday, treading water at the 0.74 handle. By doing so, it looks as if the market is ready to attempt the 0.75 handle again, which of course has been resistive. While I think that we could possibly break above there, I still don’t want to buy this pair. The main reason of course is that the resistance in my opinion runs all the way to at least the 0.76 level as it is a bit of a resistance “zone”, and not barrier in the traditional sense.

October that, even though the commodity markets are oversold I don’t necessarily feel comfortable buying too many of the commodity dollars right now. New Zealand of course is probably the weakest of the three traditionally, so I really don’t think that this is the place to start putting money in.

Royal Bank of New Zealand

The Royal Bank of New Zealand has recently intervened in this marketplace to sell off the Kiwi dollar, and I would not put it past them to do it again. Because of this, I just don’t have any real interest in trying to go long. On top of that, the US dollar is one of the favored currencies around the world, and I don’t think that’s going to change anytime soon. It certainly isn’t going to change against the Kiwi dollar, as it is considered to be a “riskier asset.”

I think that there is a massive amount of resistance above the 0.76 level in the form of a cluster as well, and as a result it’s really difficult to imagine going long at this point. Ultimately, I think we go down and reach towards the 0.70 handle, but is probably going to take a bit of time. I think that the easy money shorting this pair has already been had, and with that you are going to have to hang on through some volatility if you want to short the New Zealand dollar going forward.