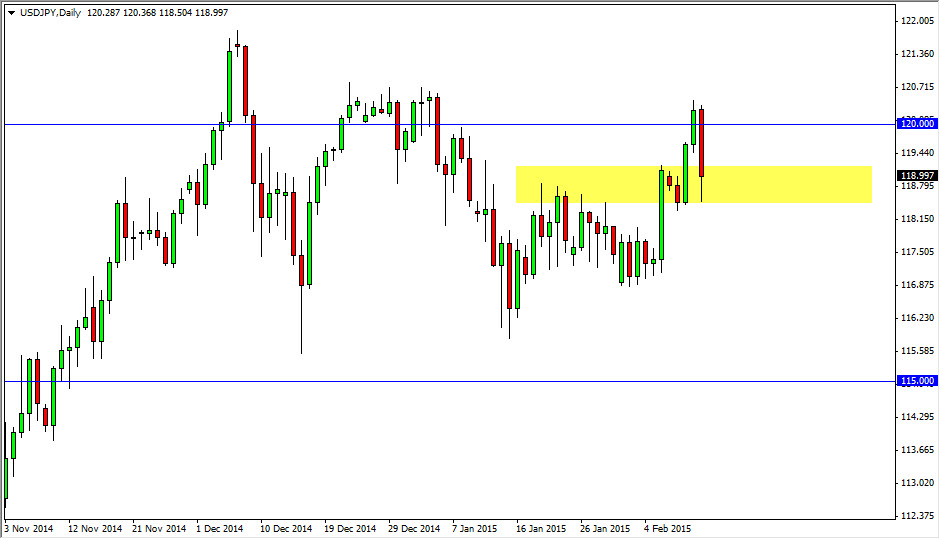

The USD/JPY pair fell during the course of the session on Thursday, testing the 118.50 region. That area of course offered support as it is a region that is massively noisy, and was once consolidation. Ultimately though, I feel that the market should go higher from here, as the Federal Reserve has step away from quantitative easing. With that being the case, you have to look at the Bank of Japan which of course is keeping a very loose monetary policy, and that of course sets up a little bit of a “perfect storm.”

The 121 level above will more than likely be targeted, just as the 122 level will be given enough time. Ultimately though, I believe that this market should go much higher, turning itself into a “buy-and-hold” type of situation. At that point in time, we should end up being in a situation where we could end up buying on dips.

No interest in selling

I have no interest in selling this market, because I believe there is so much in the way of support below that it just simply won’t make sense. On top of that, US dollar is the strongest currency in the Forex markets right now, with perhaps the exception of the Swiss franc. Ultimately, I feel that the Japanese yen will continue to suffer because of the Bank of Japan and its monetary policy.

With that being said, I think that this could be a longer-term bullish move, and you have to keep in mind that the pair tends to be very sensitive to the economic health of the US stock markets, with the S&P 500 being a great coinciding market. As long as the stock markets look healthy in the United States, and they do, this pair should continue to go higher. In fact, the NASDAQ broke out during the session on Thursday, and the S&P 500 looks like it’s about ready to. With that and the fact that this market had such an impulsive move higher last year, I feel that it’s only a matter of time before we continue the uptrend.