Gold rose slightly on Thursday, helped by a drop in the U.S. dollar after economic data on retail sales and jobless claims missed forecasts, but the market is poised for its third weekly loss. The Commerce Department reported that retail sales declined by a seasonally adjusted 0.8% in January and the Labor Department said first-time claims for unemployment insurance climbed by 25K to 304K. However, some people remain rather bearish about gold's upside prospects and continued to price in an interest rate hike by the U.S. Federal Reserve in the second half of the year.

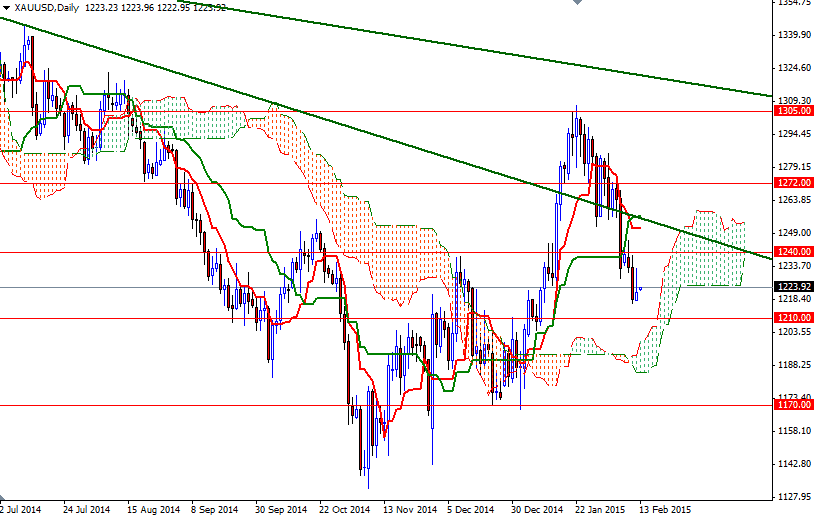

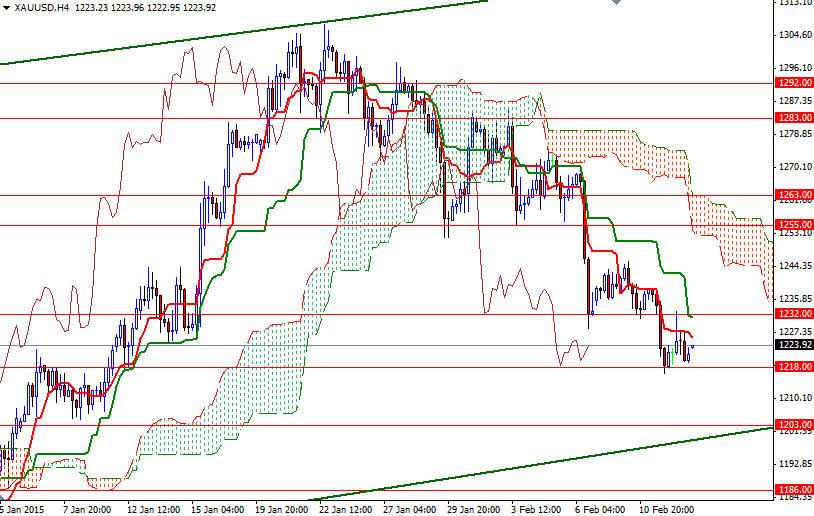

The XAU/USD pair is trading within yesterday's range for the time being and as I previously said 1216.50 and 1232 was the key levels to watch from an intraday point of view. Speaking strictly based on the charts, the short-term and mid-term charts point opposite directions. Prices are moving under the Ichimoku clouds on the 4-hour time frame but we are still above the clouds on the daily chart.

I think climbing above yesterday's high could attract some more buyers and open the doors to the 1240 level. If the bulls build some steam and shatter the 1240 barrier, we will probably be heading towards the 1252/5 area where the Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-day moving average, green line) lines reside. If prices fall rather than rise and successfully break below 1216.50, then 1210 will likely be the next target. The bears will have to capture that point so that they can march towards the 1200 level, the top of the daily cloud.