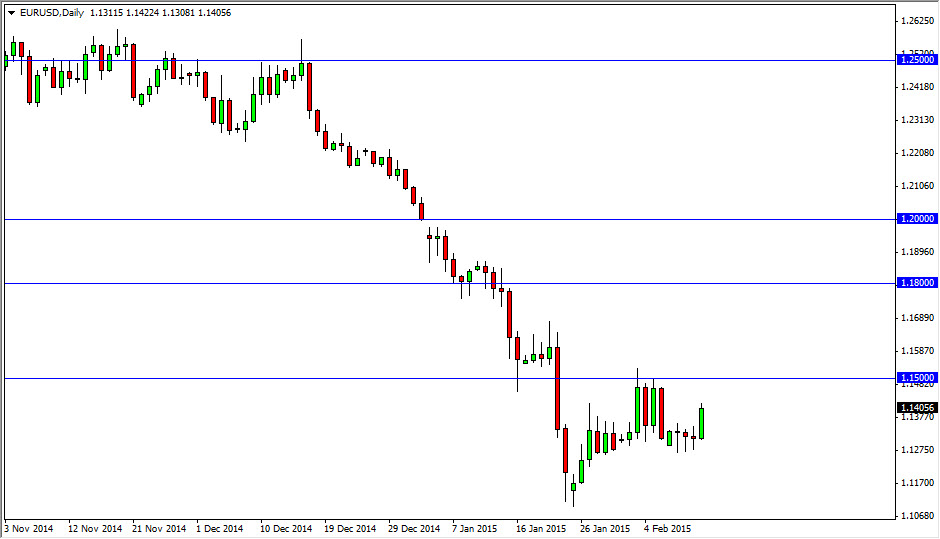

The EUR/USD pair broke higher during the course of the session on Thursday, as we cleared the 1.13 support barrier. Having said that though, I’m still fairly negative on this market as I believe the 1.15 level above offers resistance. In fact, I am actually ignoring the fact that we went higher during the session on Thursday, and simply waiting to sell out that higher region as it represents value in the US dollar. On top of that, I think that the resistance goes all the way to the 1.1650 handle, so really at this point in time there is no way whatsoever that I see in buying this pair.

Making matters worse, I think that there is even more resistance at the 1.18 level, and it extends all the way to the 1.20 handle. In other words, we need to get above the 1.20 handle for me to even consider buying this pair. That could change based upon the longer-term chart, but right now I don’t have any signals that make me think it’s worth risking.

Fading rallies

I believe that fading rallies on short-term charts will be the way to go going forward. I think that it’s only a matter time before we head back down to the 1.13 handle, and more importantly break through it. Once we get below there, I think the market then heads to the 1.11 handle, which will open the door to the 1.10 handle which I think is a longer-term target. I believe that we go below there given enough time, especially of trouble continues in the Greek debacle. However, during the session on Thursday we get a little bit of good news out of the Ukraine, and that of course help the euro.

I think that this will be more or less a short-term trader’s type of market, so I’m not looking for big moves anytime soon. I think only those who can watch the charts all they should be bothered with this pair, which is something that I don’t do very often.