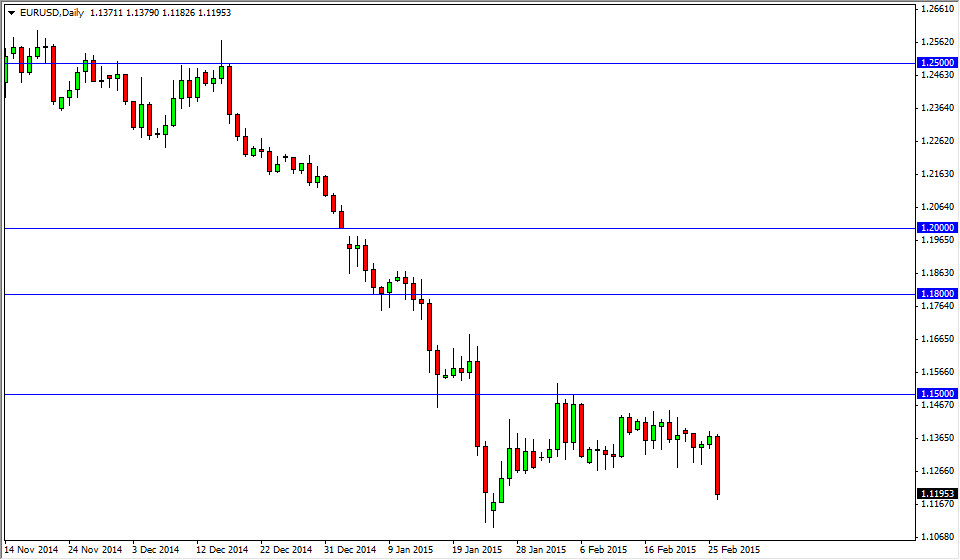

The EUR/USD pair fell hard during the session on Thursday, breaking well below the 1.12 level. Because of this, the market looks like it’s ready to continue going lower and perhaps aiming for the 1.11 handle, which has been my target for some time now. With that, I believe that short-term rallies will continue to offer selling opportunities as the European Union continues to face deflation. With that, the European Central Bank should continue to offer liquidity to the marketplace, and that of course drive down the value of the currency. On the other side of the Atlantic, you have the Federal Reserve, a central bank it looks like it’s ready to perhaps stay away from quantitative easing for good now. With that, this market should continue lower.

Also, you have to keep in mind that the situation in Greece is in exactly over with either. Yes, they came to a short-term arrangement, but that’s been the case for several years now, and it seems like no matter what happens this problem simply will not go away.

Follow the longer-term trend

I’m going to continue following the long-term trend, as the marketplace should continue to offer selling opportunities on short-term charts. Every time this market rallies, I’m looking for value in the US dollar. I believe that not only will we tested the 1.10 level eventually, but if we get below there we will hit the parity level given enough time. After all, there is very little in the way of support on the longer-term charts below the 1.10 level, and at that point in time I feel that the floodgates would be open.

The 1.15 level above is the ceiling, but extends all the way to the 1.1650 level, meaning that we have a massive amount of bearish pressure above, and is going to be almost impossible to imagine being able to buy this market anytime soon. In fact, I would have to see a buying opportunity on a longer-term chart such as the monthly chart in order to be convinced at this point.