Since 2011, the Swiss Franc has been effectively pegged to the Euro at 1.20, meaning that a currency which comprised one of the 4 major currency pairs effectively became irrelevant to most traders.

Now that the Swiss National Bank removed the cap last Thursday, the Swiss Franc is back as an independent instrument in its own right. Far from being pegged to the EUR, it is fluctuating more against the EUR than against any other currency. The CHF is truly “floating” again, and this represents an opportunity for traders that should be carefully considered.

The CHF is a major global currency thanks not just to the strength of Swiss exports, which are considerable, but mainly due to the primacy of Switzerland as an offshore banking centre and the huge amount of foreign deposits kept in Swiss banks. As a “safe haven” currency, the CHF traditionally appreciates during “risk on” environments, in a highly positive correlation with the price of Gold.

Technical Analysis

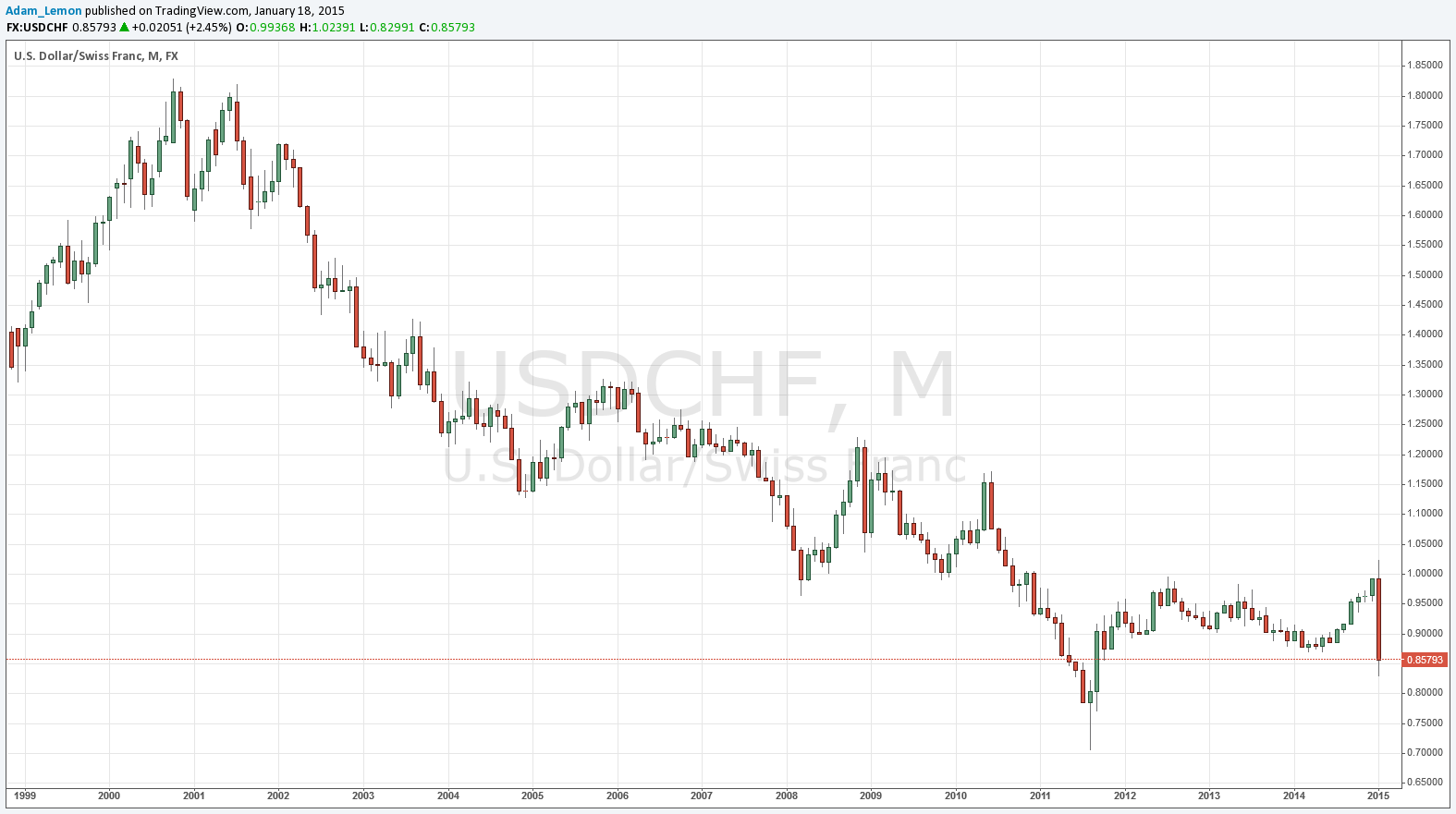

The CHF closed the week up just under an incredible 17% against a trade-weighted basket of currencies. It is stronger than any major global currency over every single time frame including up to 1 year ago. The USD/CHF pair closed the week at 0.8579, a level not seen since October 2011.

The major technical question is whether, following a sudden move of this unprecedented size, the CHF will continue to strengthen, or pull back after such a sudden price shock? It should be noted that the closest recent precedents seen in the CHF and the JPY of very strong and sudden moves, have all followed through over the next several months. This suggests that the momentum behind such a strong move should tend to continue for a while, giving us a CHF at even higher prices over the coming weeks. Additionally, the precedent of the GBP against the Deutschmark in 1992 also suggests a continuation, as the GBP continued to fall in that case for several weeks against the Deutschmark following its exit from the Exchange Rate Mechanism.

A case can be made that the CHF is actually likely to stabilise after such a sudden shock, with mean-reverting price swings gradually declining in volatility.

Note that the price of Gold is relatively high against the USD, which is another sign that the CHF rise may continue.

Price charts may not be very useful in this example, except to show that the CHF has been in a very long-term upwards trend over the past decade, but that it may find it difficult to break past 0.75 against the USD:

Trading Tips

Volatility in all CHF pairs is very high, so if you are going to trade the CHF, use very small position sizes. Volatility on the shorter time frames is about 6 times higher than it was before the announcement, based upon average true range calculations. Therefore it would make sense to trade with only about one-sixth of a normal position size – at least. You might also wish to consider using guaranteed stop losses, if your Forex broker offers them.

The weakest currencies are currently the EUR and the CAD, so the logical directional trades to look for are short EUR/CHF and short CAD/CHF.