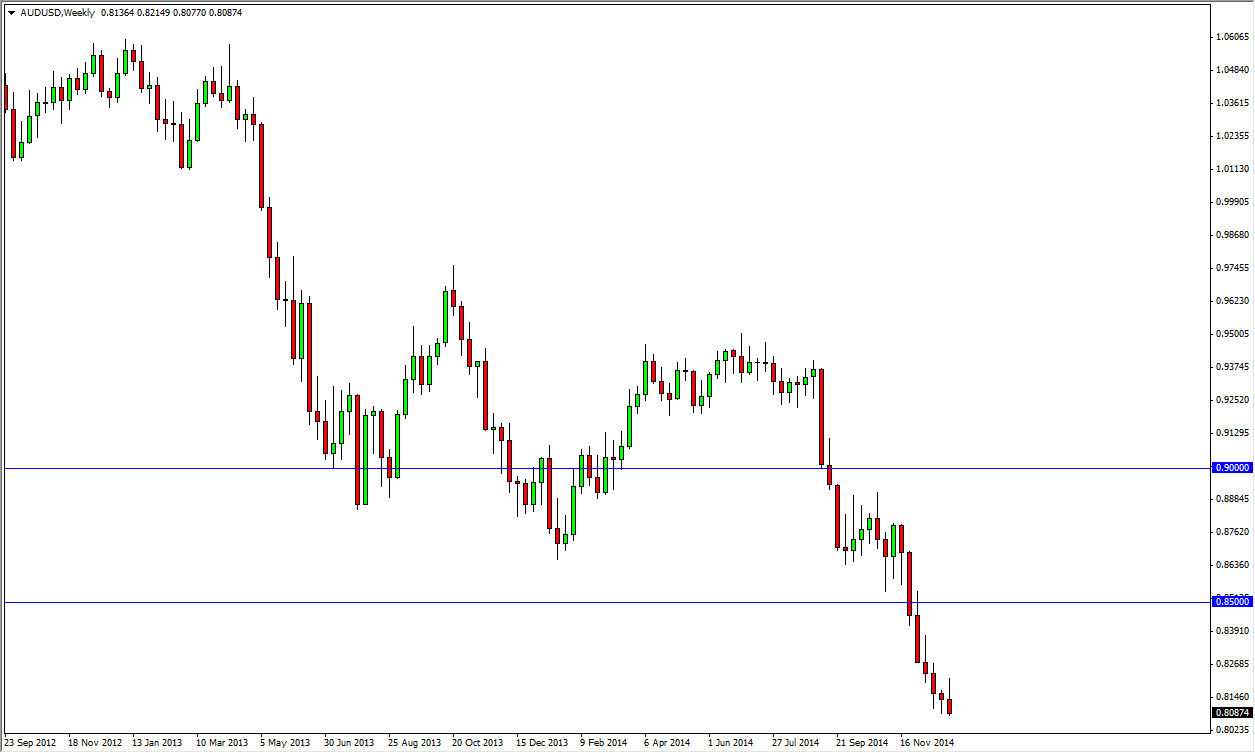

AUD/USD

The AUD/USD pair initially tried to rally during the course of the week, but as you can see gave back all of the gains in ended up forming a hammer. The hammer sits just above the all-important 0.80 handle, so at this point in time I would be a little bit leery of selling this pair. In fact, it’s very likely that the 0.80 level will end up being massively supportive. After all, that is an area that was massively resistive for over 16 years, so when we broke out of there it meant something. The question then becomes whether or not the buyers are still down there.

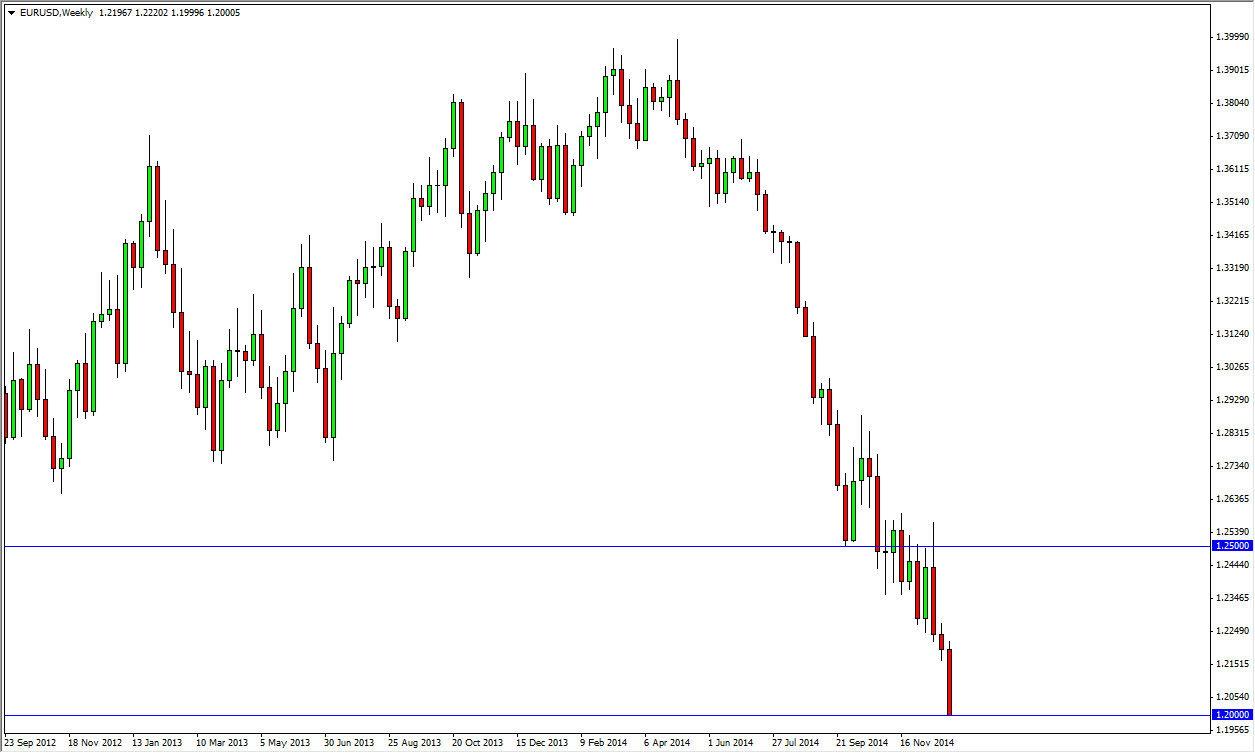

EUR/USD

The EUR/USD pair fell apart during the course of the week, slamming into the 1.20 level. Much like in the AUD/USD pair, we are at a massive support area. Because of this, I think that will we could see is a bit of softness early in the week, followed by a potential buying in the later part of the week. Be very close attention to how the weekly candle in soft, because this could be a signal for reversal. The 1.20 level has been massively supportive for over five years, so we are most certainly it an important point.

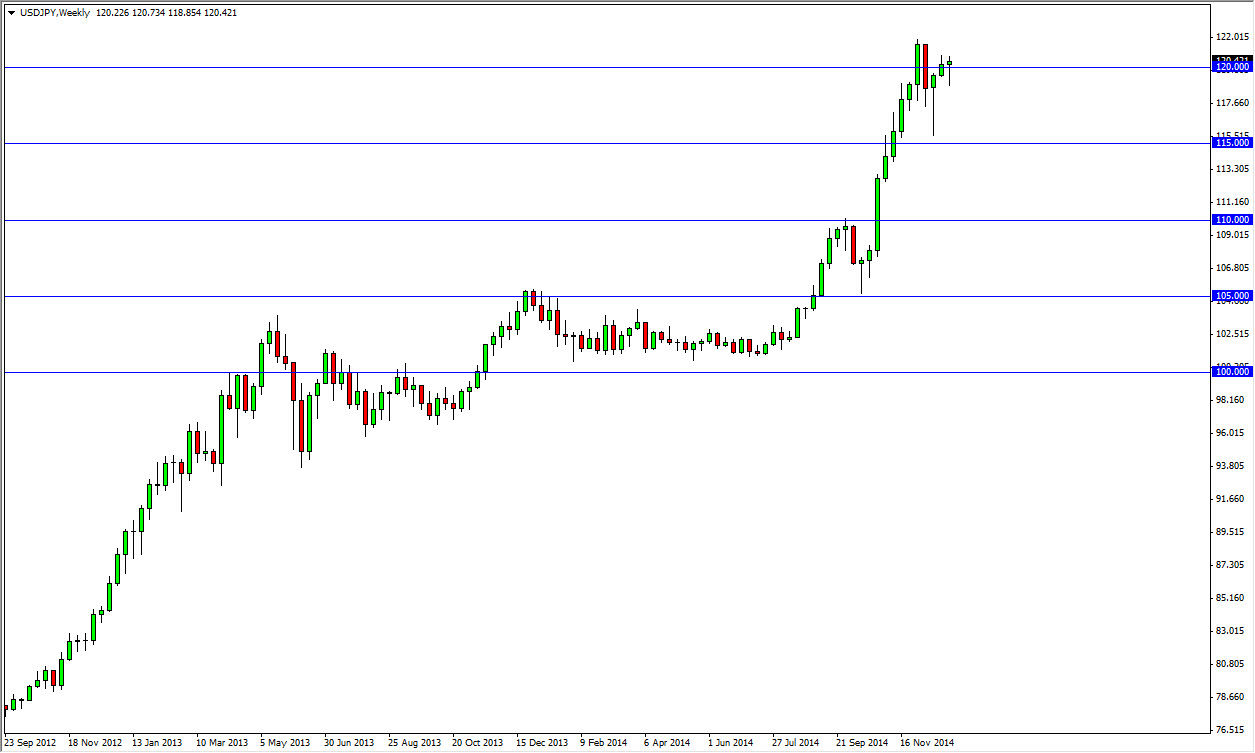

USD/JPY

The USD/JPY pair fell initially during the week but found enough support below the 120 level to form a hammer. With that, it’s very likely that we continue to grind higher, but we are a little bit overbought at this point. I think that it will be a slow grind higher with 115 being the floor. I have absolutely no interest in selling this market, at least not until we break well below the 110 level, which is something that we are not going to see anytime soon. I believe that “buying on the dips” will continue to be the way to play this market.

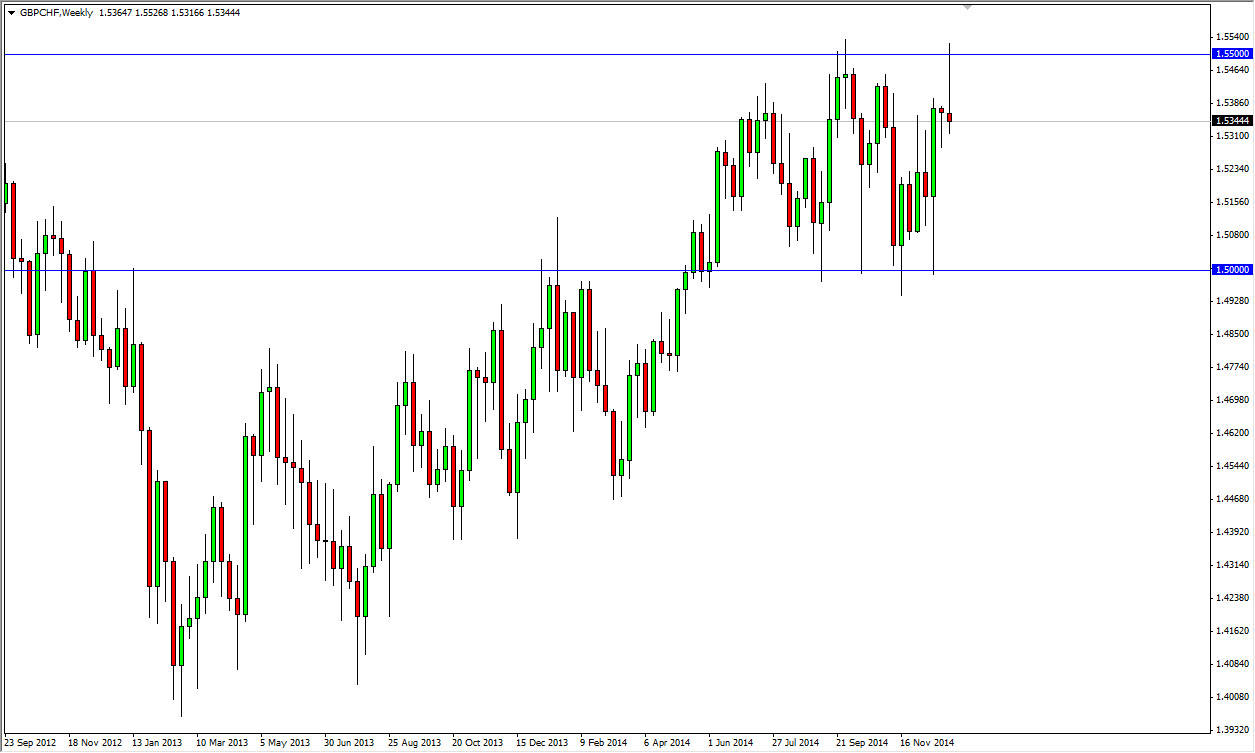

GBP/CHF

The GBP/CHF pair broke out towards the upside during the week, but as you can see ended up forming a massive shooting star at the top of the consolidation area that we have been stuck in. Because of this, I feel that this market will more than likely soften up a little bit this week, maybe drifting closer to the 1.50 level. Nonetheless, I do recognize of the breakout above the 1.55 level that is massive in its implications, as it not only shows a break of resistance, but it shows that we are getting ready to have the next leg higher.