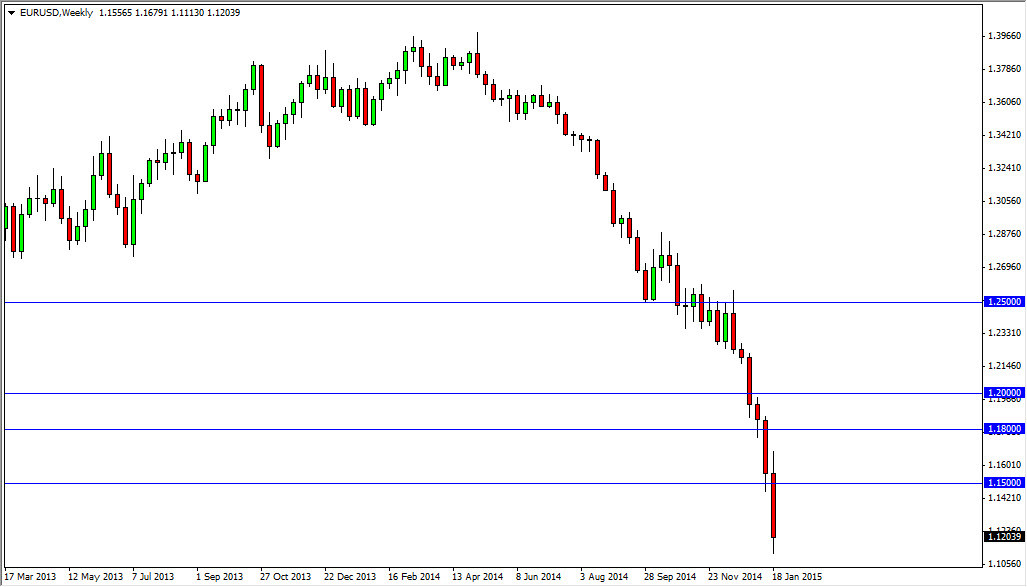

EUR/USD

The EUR/USD pair initially tried to rally during the course of the week, but as you can see sliced below the 1.15 level. The market of course got a bit of a surprise from the European Central Bank and its massive expansion of quantitative easing. Because of this, it now looks as if the EUR/USD pair is going to head to the 1.10 level, which is the next major support level. That area could be a significant bounce waiting to happen, but in the meantime I believe that the market will continue to sell off every time it rallies. I look to short-term charts, and I believe that the 1.15 level above is a massive resistance barrier.

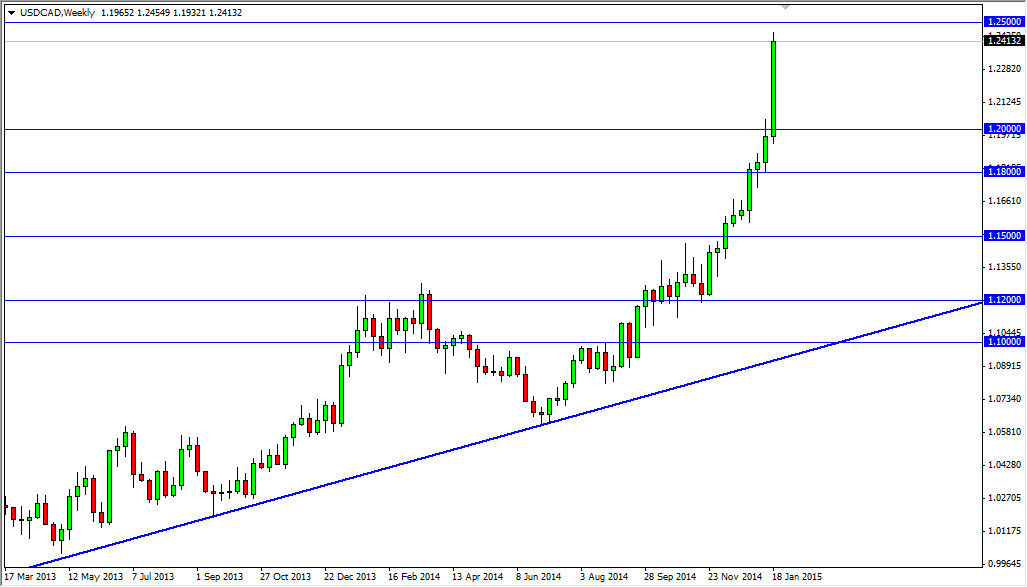

USD/CAD

The USD/CAD pair broke much higher during the course of this past week, as the Bank of Canada had a surprise interest-rate cut. With that, the market shot straight up and we are now well above the 1.20 resistance barrier. In fact, we are getting very close to the 1.25 resistance level, which should cause a little bit of a pullback. If we get that pullback, we are looking for supportive candles in order to get involved as the uptrend is most certainly still in effect.

USD/JPY

The USD/JPY pair initially tried to rally during the course of the week, but as you can see had turned around and ended up forming a shooting star. That being the case, the shooting star suggests that the market is going to go down to the 115 level possibly, but at that point in time I would anticipate seeing quite a bit of support. We could get a bounce from there, and I would be willing to buy that bounce. I have no interest in selling this market, as the uptrend is so strong. It’s probably only a matter of time before we break out above the 122 level, which should send this market looking for the 125 handle.

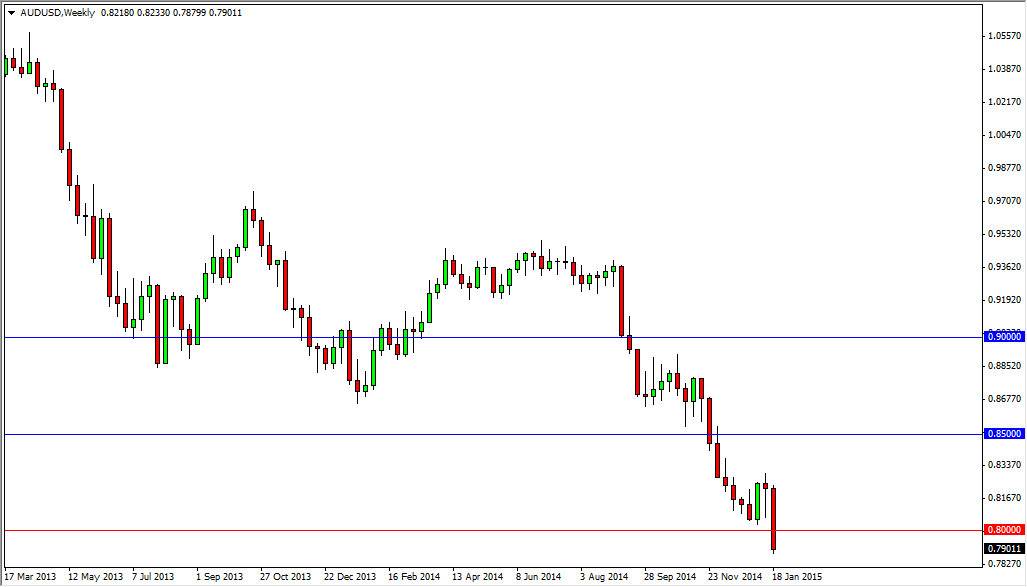

AUD/USD

The AUD/USD pair broke down during the course of the week, and most importantly cleared the 0.80 handle. With that being the case, the market looks as if it’s ready to continue going lower, and short-term charts will more than likely be the way that I continue to sell this market. This market is not reacting positively to the gold markets rising, and that tells me just how soft the Australian dollar truly is. I believe that the 0.75 handle will be targeted.