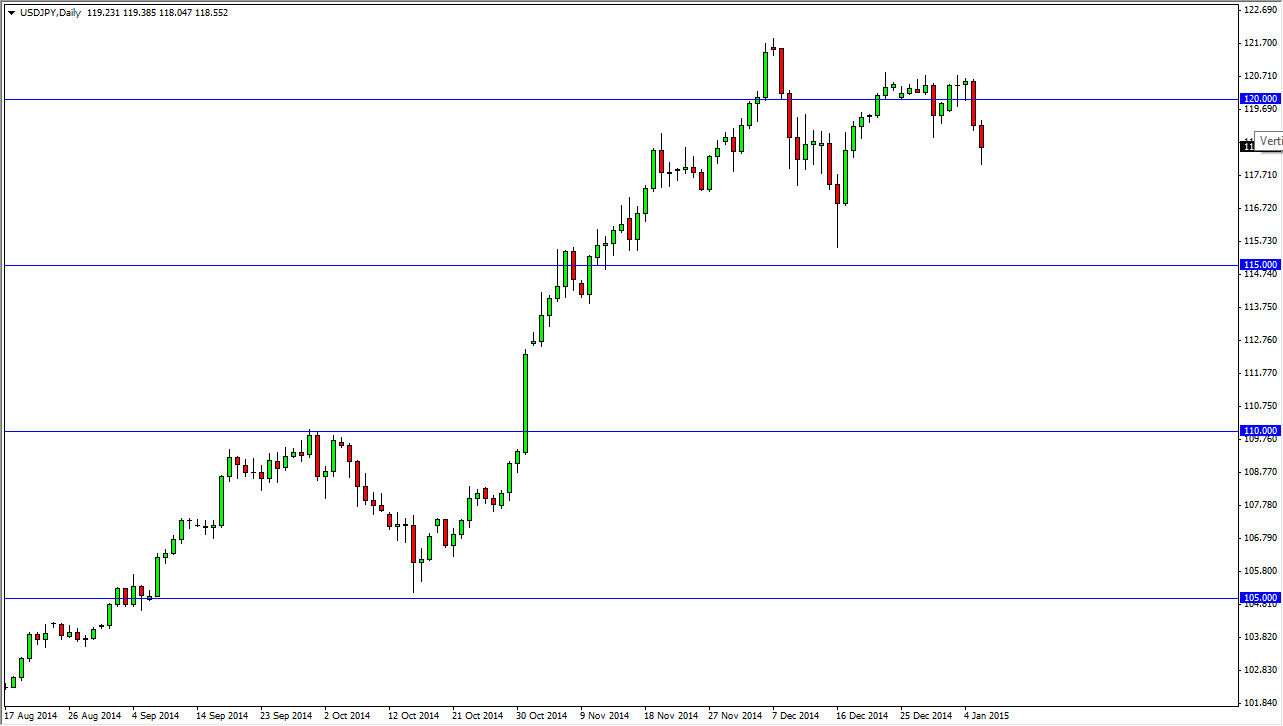

The USD/JPY pair fell slightly during the session on Tuesday, but as you can see is still well elevated overall. It would take a significant meltdown to change the trend of this pair, so I am essentially either buying or sitting on the sidelines. With the interest-rate differential certain to widen over the course of the next several months, I can’t make it a case to start selling.

I believe that the 115 level is massively supportive, and that the 110 level is probably even more so. The shape of the candle for the Tuesday session isn’t quite a hammer, but it does look suspiciously like one. With that being the case, I believe that if we break the top of the candle, we will more than likely head back to the 120.50 region again. Can we break out above there? Of course we can, but nonfarm payroll is coming.

Remember, this currency pair is highly sensitive to nonfarm payroll numbers.

Remember, this pair is rather sensitive to the nonfarm payroll announcement, and as a result it tends to be fairly quiet couple of sessions before hand. That’s because most traders know that this market will make a significant move. Quite frankly, I would love to see some type of massive pullback in order to find value in the US dollar. I think that if this pair pulls back, you have to look at it as being “on sale”, as the longer-term looks to be set at this point in time.

I think that we can continue to buy on the dips going forward, as the Japanese yen continues to sell off. On top of that, the US dollar is without a doubt the favored currency in the Forex markets right now, so really we have a bit of a “perfect storm” when it comes to trading this market. With that, I believe that we will break out to a fresh new high over the course of the next several weeks, and then eventually head to the 125 level.