USD/CHF Signal Update

No signal was given yesterday.

Today’s USD/CHF Signals

No signal is given today, due to the expected heavy market turbulence that is likely to occur soon after that start of today's New York session.

USD/CHF Analysis

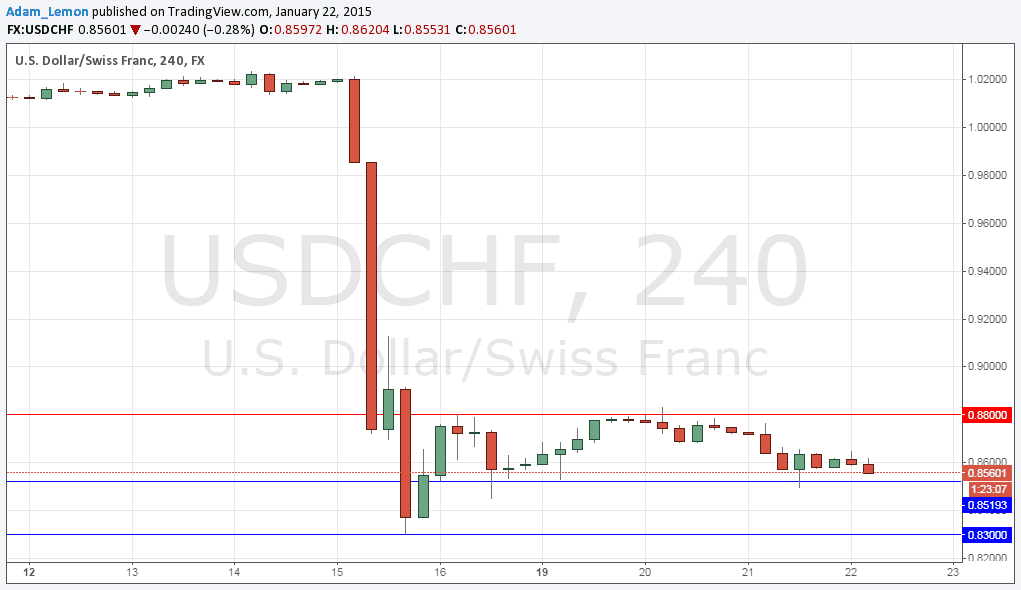

I wrote yesterday that beyond identifying possible support at around 0.8700, it was still not very possible to be confident of anything regarding this pair. The only dominant feature technically is the resistance at 0.8800. I was also relying on whole, round numbers to be important as we are at trading around levels that are not really very “known” to the market. This seems to be the case still, and a new development that is starting to become apparent is the emergence of the key psychological and whole number of 0.8500 as a supportive level. In fact, the support seems to have been kicking in a little above that number, at around 0.8525. We are close to that now, but as we have such big news later, it is very unsafe to trade yet.

There are no high-impact data releases scheduled today directly concerning the USD or the CHF, but it will be a huge news day for the EUR. At 12:45pm London time the ECB will announce the Minimum Bid Rate. At 1:30pm the ECB will open a press conference in which they are expected to announce the launch of a detailed program of Quantitative Easing. This is highly likely to have an impact upon the CHF, but as it is now uncoupled from the EUR, we really do not know what kind of correlation we will see.