Gold snapped three consecutive days of gains as the greenback edged higher and global equities markets saw a modest rebound after upbeat U.S. private sector jobs data boosted optimism. The Automatic Data Processing Research Institute said private sector added 241000 jobs in December, above expectations of 227000. A separate report from the Commerce Department showed the trade deficit shrank to $39 billion in November from a revised $42.2 billion in October. Although the ADP's numbers aren't so reliable predicting the government's data, they are pointing to a better non-farm payrolls reading on Friday.

Minutes of the Federal Open Market Committee's December meeting offered no new clues on when the Fed will move. However, records also showed that "the Committee might begin normalization at a time when core inflation was near current levels, although in that circumstance participants would want to be reasonably confident that inflation will move back toward 2 percent over time". It appears that subdued inflation along with prospects for a U.S. rate increase in mid-2015 will continue to weigh on the market over the long term.

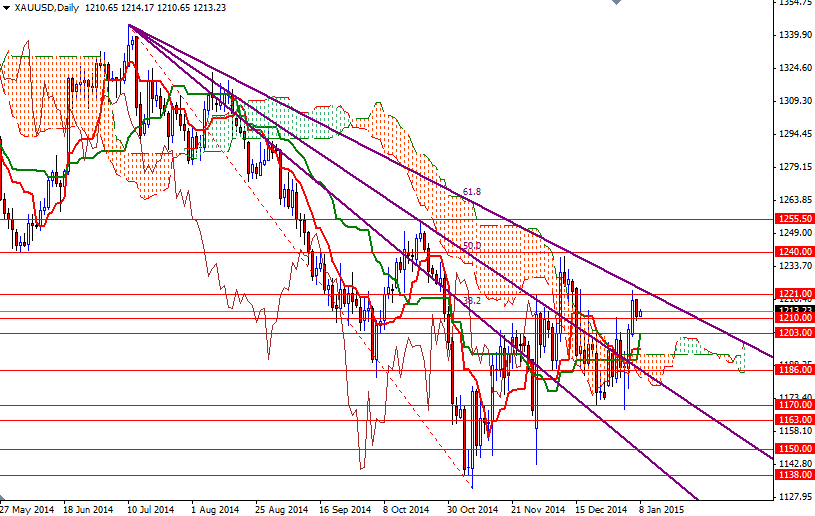

From an intra-day perspective, I think the key levels to watch will be 1221/5 and 1212/0. If prices slip below the support at 1210, it is likely that the market will be testing the 1203 level where the Kijun-Sen (twenty six-day moving average, green line) currently resides on the daily chart. The bears will have to capture this point so that they can make a fresh assault on 1193.54. Technically, short term charts are positive while trading above the Ichimoku clouds but the bulls will have to break through the 1221/5 resistance level in order to gain more traction. Breaking above 1225 could signal a run up to the 1235/40 area.