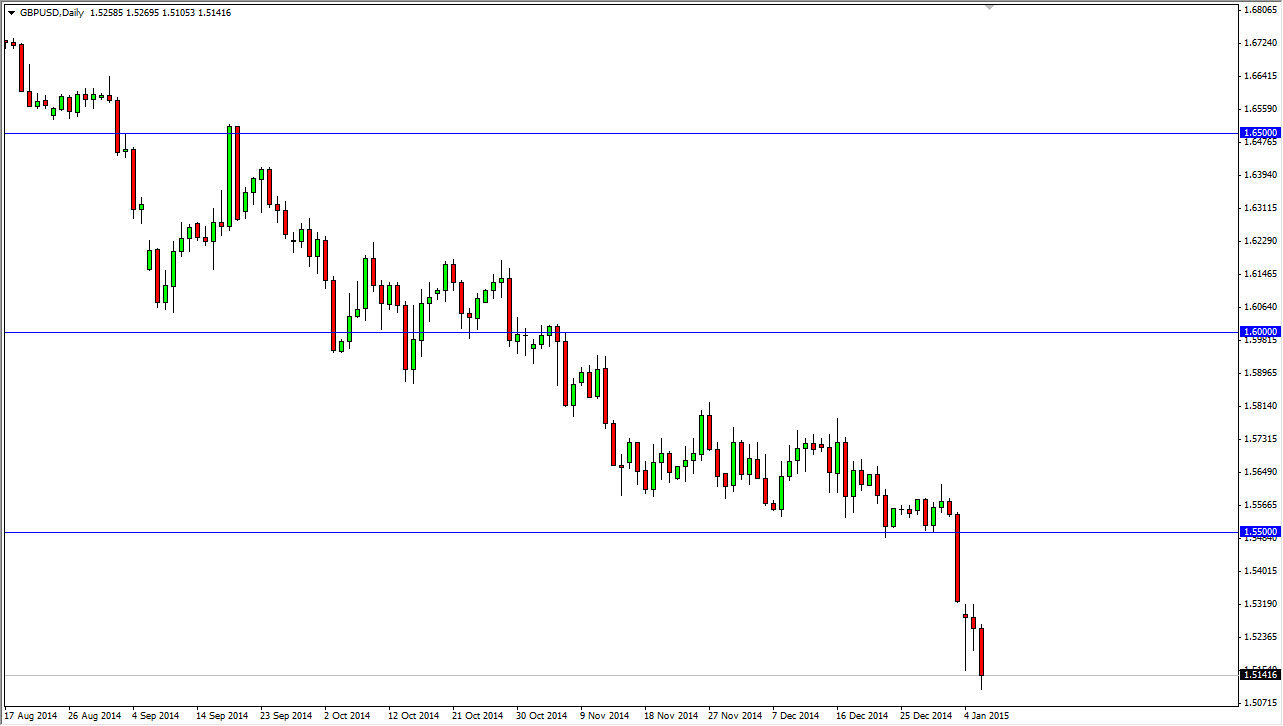

The GBP/USD pair broke down during the course of the Tuesday session, and even broke below the hammer that had formed on Monday. This is an extraordinarily soft sign, as the market has broken below the 1.5150 level. With that, we feel that this market then goes down to the 1.50 level, as it is the next large support area on the longer-term charts. However, keep in mind that today is the FOMC Meeting Minutes announcement, so that of course can have an effect on the value of the US dollar in general. With that, you could expect some volatility, but really I believe that the longer-term trend will prevail eventually.

That being said, I believe that any bounce from here has to be looked at as a potential selling opportunity, and that the 1.55 level should be massively resistive as it was once massively supportive. With this obvious area, I will be very interested in seeing resistive candles on rallies.

Follow the trend

I do not have a scenario in which I buy this pair at the moment. That of course could change we break above the 1.55 level on a daily close, but until then I don’t anticipate doing so. I don’t think that’s going to be very likely though considering the fact that we broke the back of a hammer during the session on Tuesday, which of course is an extraordinarily negative sign. A hammer supposed to be assigned a serious support, and any time they gets blown through that shows significant selling pressure. Because of this, I believe that the sellers are still in control, and will continue to push his pair lower given enough time. I don’t necessarily think that it will be an easy drop to the 1.50 level, so some of you may wish to use short-term charts to sell rallies again and again, at least until we get down to that level. I would anticipate a significant amount of support down at the 1.50 level, and in fact might even anticipate that being the end of the downtrend.