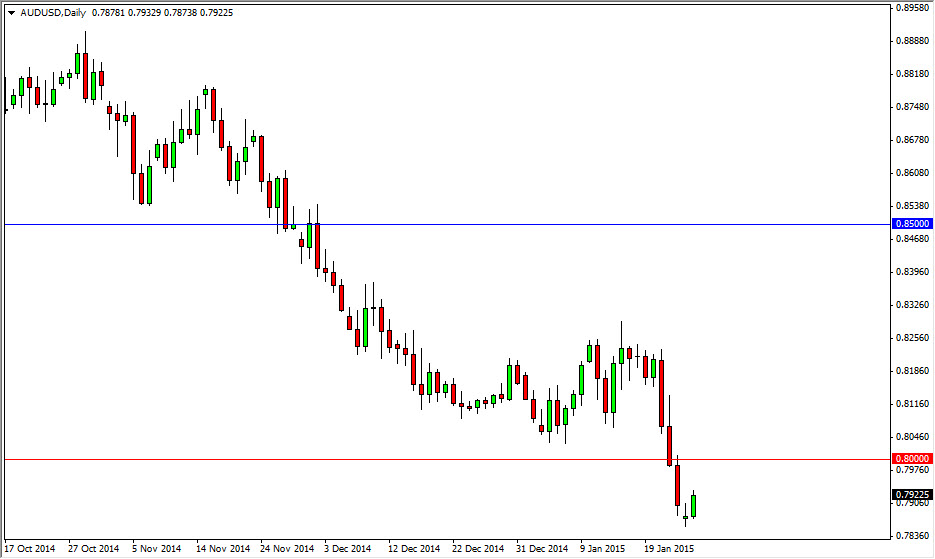

The AUD/USD pair initially gapped lower at the open on Monday, as Greek elections have the markets in a general “risk off” type of attitude. However, we turned back around and close towards the highs of the session. Nonetheless, this doesn’t exactly change the opinion of the Australian dollar in my mind, as the breaking below of 0.80 was in fact a major deal. That was an area that was a 16 year high at one point, and the fact that we have broken through it so decisively suggests that a certain amount of bearish pressure continues.

On top of that, the gold markets have not bailed out the Aussie like it typically will. Because of that, I believe that the Australian dollar is in quite a bit of trouble, and is more than likely going to at least aim for the next major figure of 0.75. The US dollar continues to be the strongest currency in the world, and I have a hard time believing that any of the commodity currencies are going to have an easy way of it anytime soon, and the Aussie of course will be punished for that exact reason.

The 0.80 level isn’t the only problem for buyers

Although I think the 0.80 level of course is massively important, the truth is that there should be a significant amount of resistance all the way up to the 0.83 handle, so it’s not until we get above there that I would even consider buying. At that point in time, we could go as high as 0.85, but truthfully I don’t see that happening in the near term. I believe that we will simply be able to continue to sell rallies going forward as resistance should show itself time and time again on not only the daily charts, but the short-term charts as well. Ultimately, the Aussie needs the markets to come down to even remotely become interesting for traders, and at this point in time there is far too much uncertainty for it to be en vogue.