By: Stephanie Brown

Yahoo! Inc. (NASDAQ:YHOO) is aggressively pushing for market share in the search engine business, a field it has struggled in over the years thanks to stiff competition from Google Inc. (NASDAQ:GOOGL). Yahoo recently signed an agreement with Mozilla to become the default search results provider for Firefox’s web browser.

The search engine giant is now informing its users to ‘Upgrade to the new Firefox link’ once they click on any Yahoo property. The move is intended to get as many people to start using Firefox as opposed to Google Chrome.

Google was initially the default search engine provider for Firefox, but Mozilla opted out of renewing their contract as it felt it was playing second fiddle to Chrome. Mozilla reportedly does not have any objection on the placement of its Firefox logo on Yahoo, as it is sure to enhance its popularity. Yahoo has already redesigned its Search design for Firefox that looks exactly the same as Google as one of the ways of attracting more users. It waits to be seen whether the Yahoo-Mozilla deal will be ultimately be a game changer.

Technical Analysis

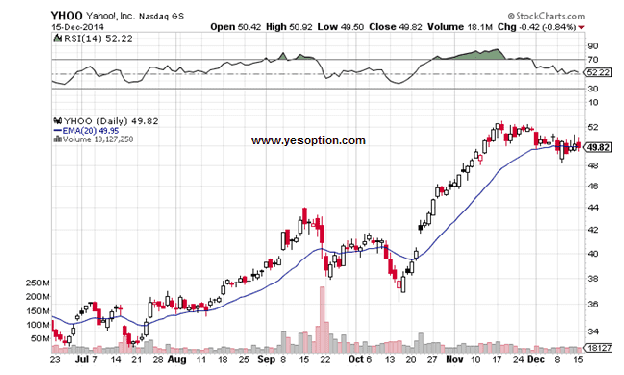

Yahoo has recently been trading in quite a narrow range and finally fell during yesterday’s trading session, closing below its 20-Day EMA of $49.95, with an RSI of 52.22. Currently, the stock is taking support at $49, $48.2 on the downside, whereas resistance stands at $50.8, $52 on the upside.

Actionable Insight

Sell Yahoo! Inc. (NASDAQ:YHOO) below $49.6 for target of $49.1, $48.5, with a stop-loss of $49.85.