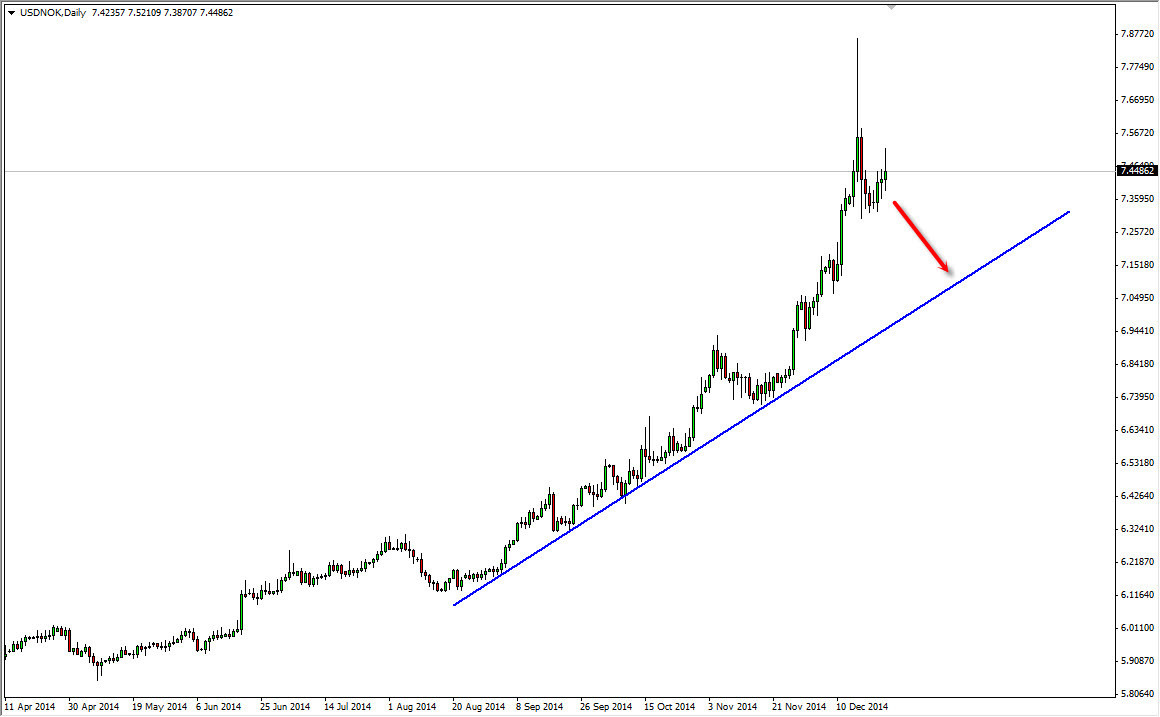

The USD/NOK pair formed a shooting star during the session on Wednesday after initially trying to break out above the 7.45 handle. The fact that we formed a shooting star does suggest that weakness is coming into the marketplace, but I think if we pullback that is a good thing. Quite frankly, this pair had gotten way ahead of itself as the oil markets fell apart.

Keep in mind that Norway is a major exporter of oil, so it makes sense that the Norwegian krone is highly sensitive to the oil markets. With that being the case, it makes sense that the US dollar continues to strengthen over the longer term, but I am a bit concerned about going long at this point. You can see that there is a trend line that I have drawn on this chart, and quite frankly I would love to see this pair drop back down to that area. So having said that, even if we break down here am not willing to sell this pair, I just simply am looking at it as a potential longer-term trade at lower levels.

Commodity currencies are still toxic in my opinion

Commodity currencies in general are fairly toxic in my opinion. Granted, some of them do better than others such as the Canadian dollar, but at the end of the day when you have a currency that is highly leveraged to one particular commodity that isn’t doing that well, it makes sense that it will be especially sensitive to the way that the commodity markets are moving in general. Oil has been absolutely miserable, and with the Norwegian krone been so highly leveraged to it makes sense that it does fall. In the case of the Canadian dollar, although it’s been losing value the reality is that Canada is highly leveraged to the United States itself, given it a little bit of insulation from that.

All things being equal, pullbacks to show signs of support are buying opportunities in this pair, but quite frankly this point time I’m willing to sit on the sidelines and pray that we get a move down to the blue trend line on the chart. That to me would be an excellent buying opportunity.