USD/JPY Signal Update

Yesterday’s signal was not triggered because although the price did reach 119.00, the price action on the H1 chart was not sufficiently bullish at that level.

Today’s USD/JPY Signal

Risk 0.75%

Trades must be taken before 5pm New York time, or after 8am Tokyo time.

Long Trade 1

Go long following bullish price action on the H1 time frame immediately after the price first reaches 117.85.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 25 pips in profit.

Remove 50% of the position as profit when the trade is 25 pips in profit and leave the remainder of the position to run.

Long Trade 2

Go long following bullish price action on the H1 time frame immediately after the price first reaches 117.03.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 25 pips in profit.

Remove 50% of the position as profit when the trade is 25 pips in profit and leave the remainder of the position to run.

Short Trade 1

Go short following bearish price action on the H1 time frame immediately after the price first reaches 120.19.

Put the stop loss 1 pip below the local swing high.

Adjust the stop loss to break even once the trade is 25 pips in profit.

Remove 50% of the position as profit when the trade is 25 pips in profit and leave the remainder of the position to run.

Short Trade 2

Go short following bearish price action on the H1 time frame immediately after the price first reaches 120.98.

Put the stop loss 1 pip below the local swing high.

Adjust the stop loss to break even once the trade is 25 pips in profit.

Remove 50% of the position as profit when the trade is 25 pips in profit and leave the remainder of the position to run.

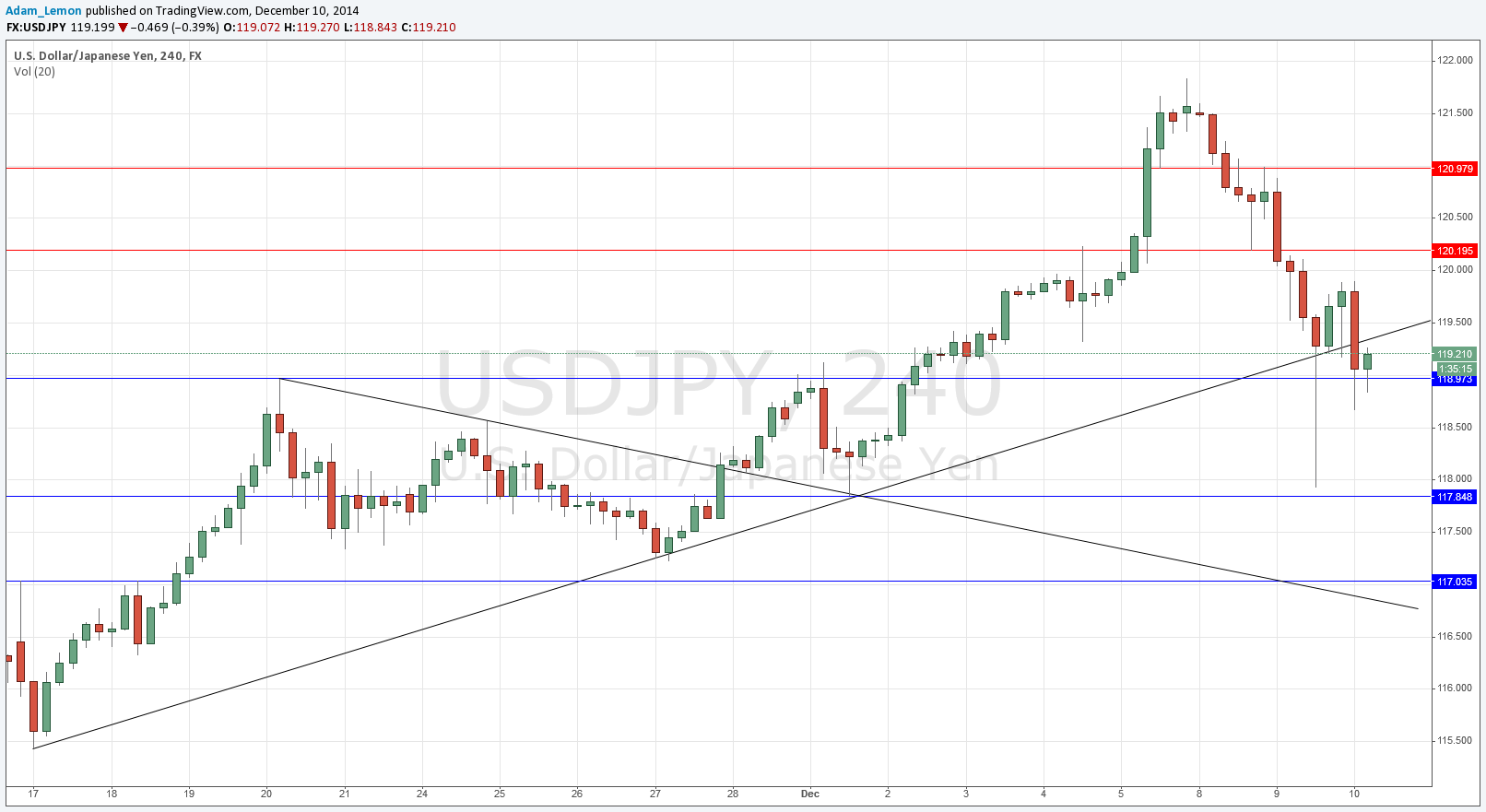

USD/JPY Analysis

I wrote yesterday that the 117.85 level is likely to be a pivotal point if and when reached. The price fell very hard yesterday, coming to within a few pips of this level, before bouncing back. It is interesting to note that despite the sharp fall, there was a recovery, and even though the price fell well below the earlier support level of 118.97, it has not managed to stay there for long. The chart shows that there is some demand left down there, with not a single candle closing below that level yet on the H4 chart.

There are two more important developments. The bullish trend line has been broken and may begin to act as resistance, but it is too early to tell.

Additionally, the pair has printed some flipped support to resistance levels, at 120.19 and close to the round number at 121.00, so it is possible to look for shorts here. The level at 120.19 looks much stronger so would be preferred.

We might well now be entering a more ranging, choppy phase.

There are no high-impact data releases scheduled today that will directly affect either the USD or the JPY.