As we all get ready to see in 2015, a moment of truth arrives. We are bold enough to make predictions for an entire year at the start of each calendar turn, so in the interests of transparency let’s take a look and see how good our forecasts we made at the start of 2014 turned out to be. We covered three of the major pairs and also one pair that was pretty hot in 2013: EUR/USD, USD/JPY, USD/CHF and AUD/USD. Here’s how they turned out.

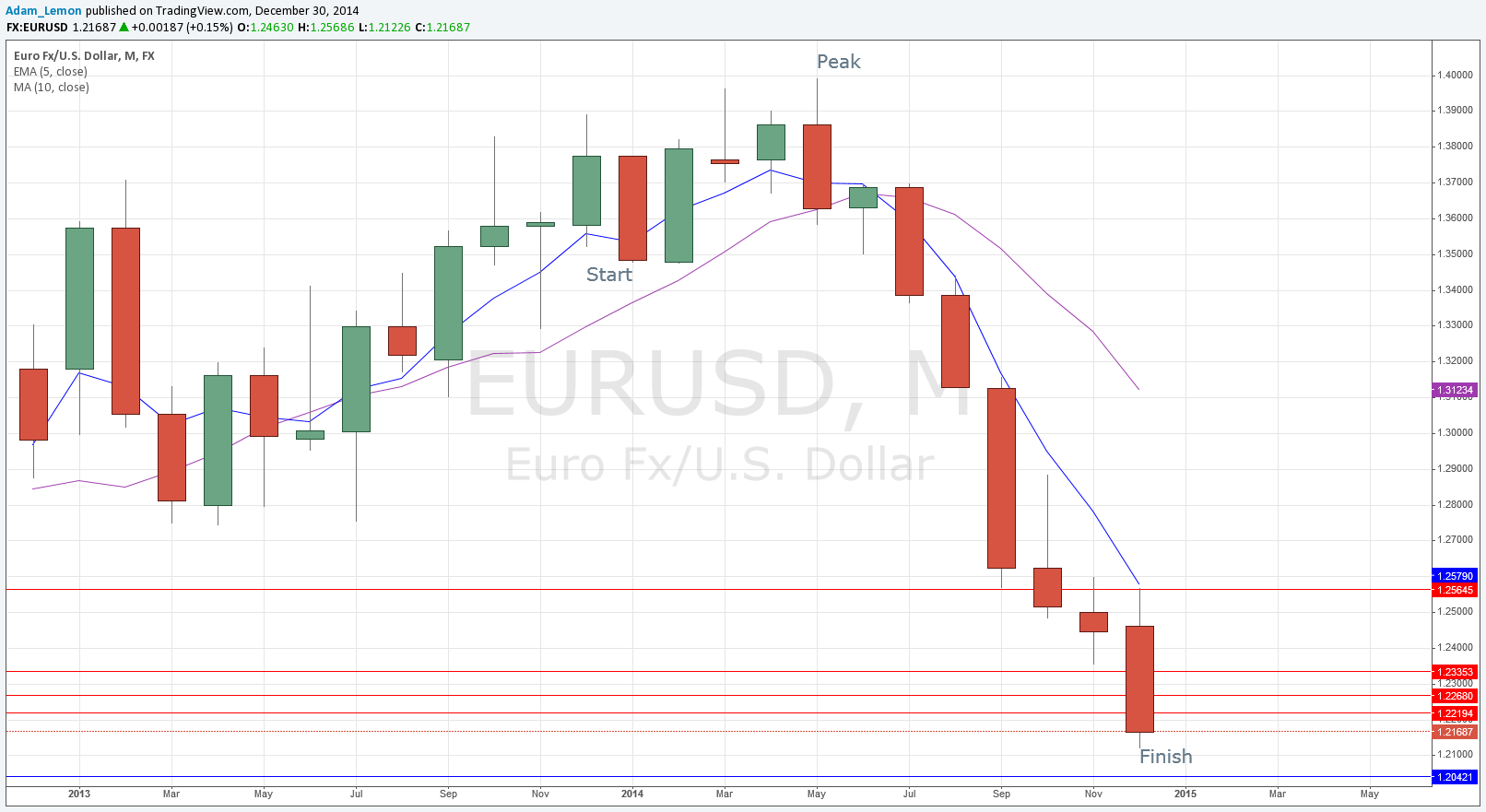

EUR/USD

The forecast was for the pair to spend the first six months of the year rising, peaking at about 1.45, before spending the second half of the year falling to around 1.20.

Here is the monthly chart:

This forecast was stunningly accurate, although inevitably not quite perfect. The price actually did rise until May, peaking just underneath 1.40, before spending the rest of the year falling heavily and ending just a little was above. Chris even said he didn’t think we would see 1.20 until 2015 and with 2 days left to go, he was even right about that.

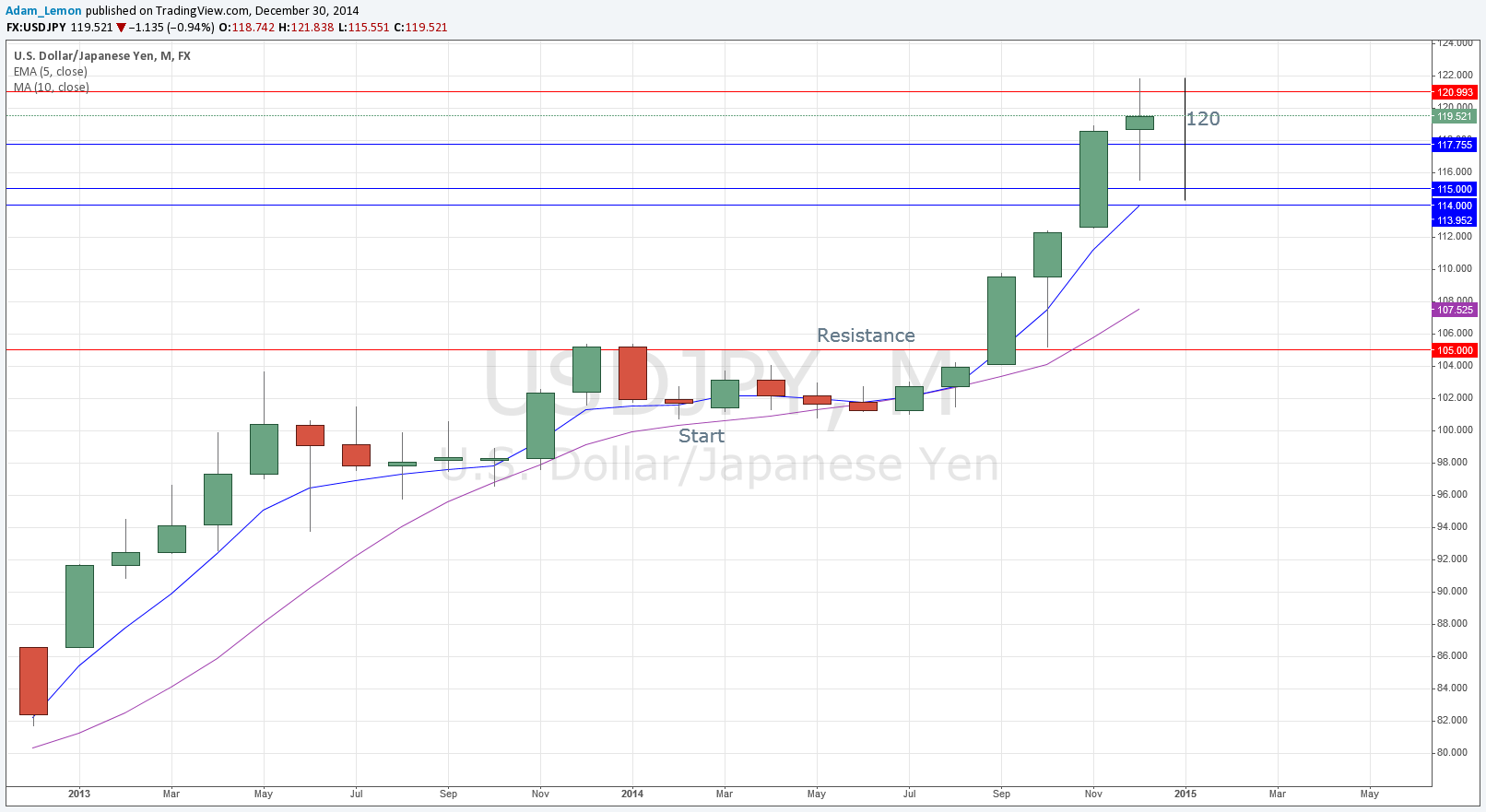

USD/JPY

The forecast was for stubborn resistance at 105, followed by a break upwards through that level, leading to a rise to 120 by the end of the year.

Here is the monthly chart:

This was another amazingly good forecast, with the price taking several months to break above 105, before moving swiftly upwards, reaching 120 towards the end of November. This could hardly have been a more accurate prediction.

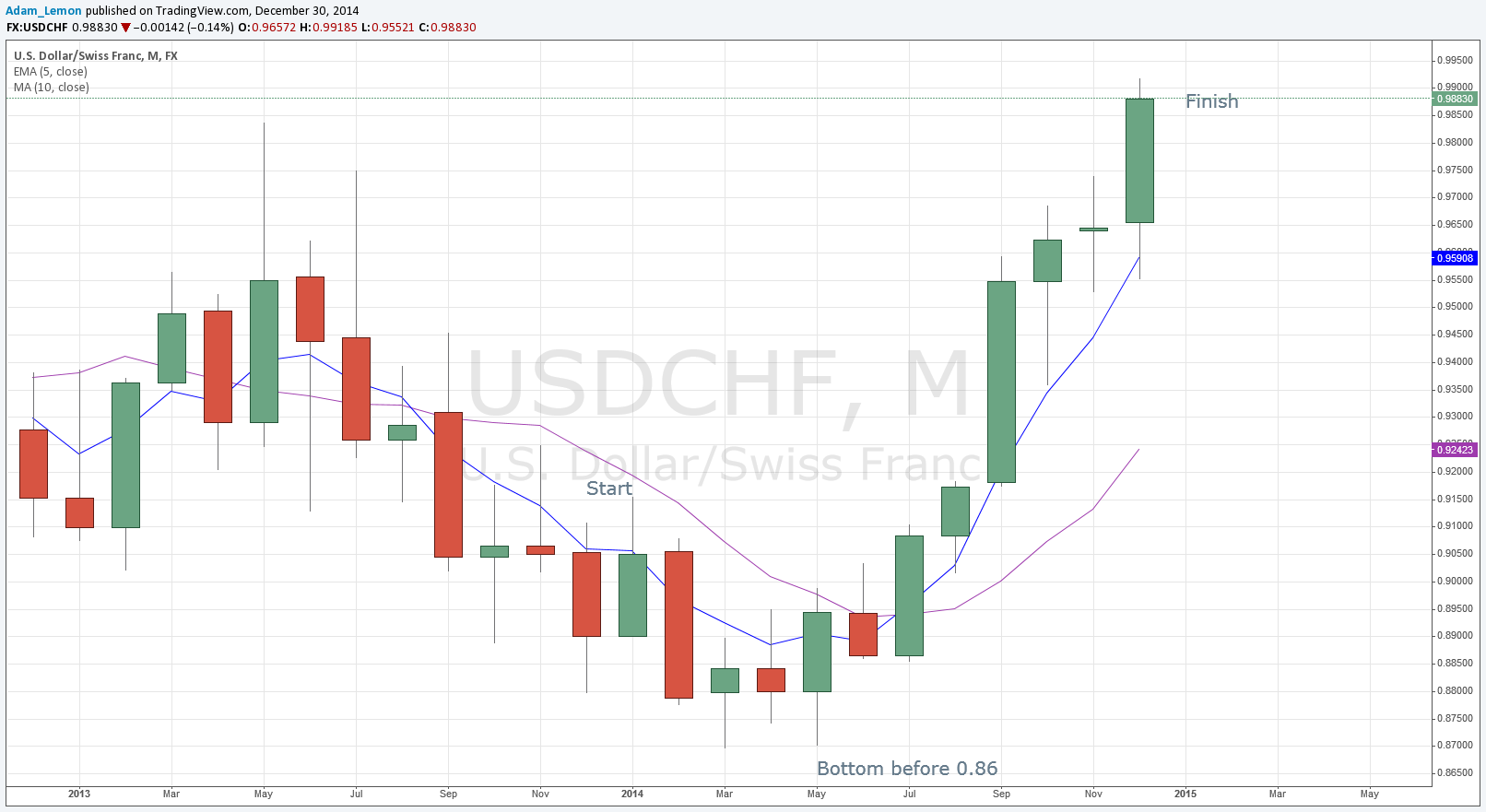

USD/CHF

The forecast was for an initial drop below 0.88 down to around 0.86 which would probably hold. Chris also thought that if this was broken then the level at 0.70 would certainly hold. He suggested that the price action was going to be bearish during the early part of the year.

Here is the monthly chart:

Chris was correct that the area between 0.88 and 0.86 would be tested and would probably also hold. However the action over the year was less bearish than Chris anticipated. He did point out that this would be a very tough pair to forecast.

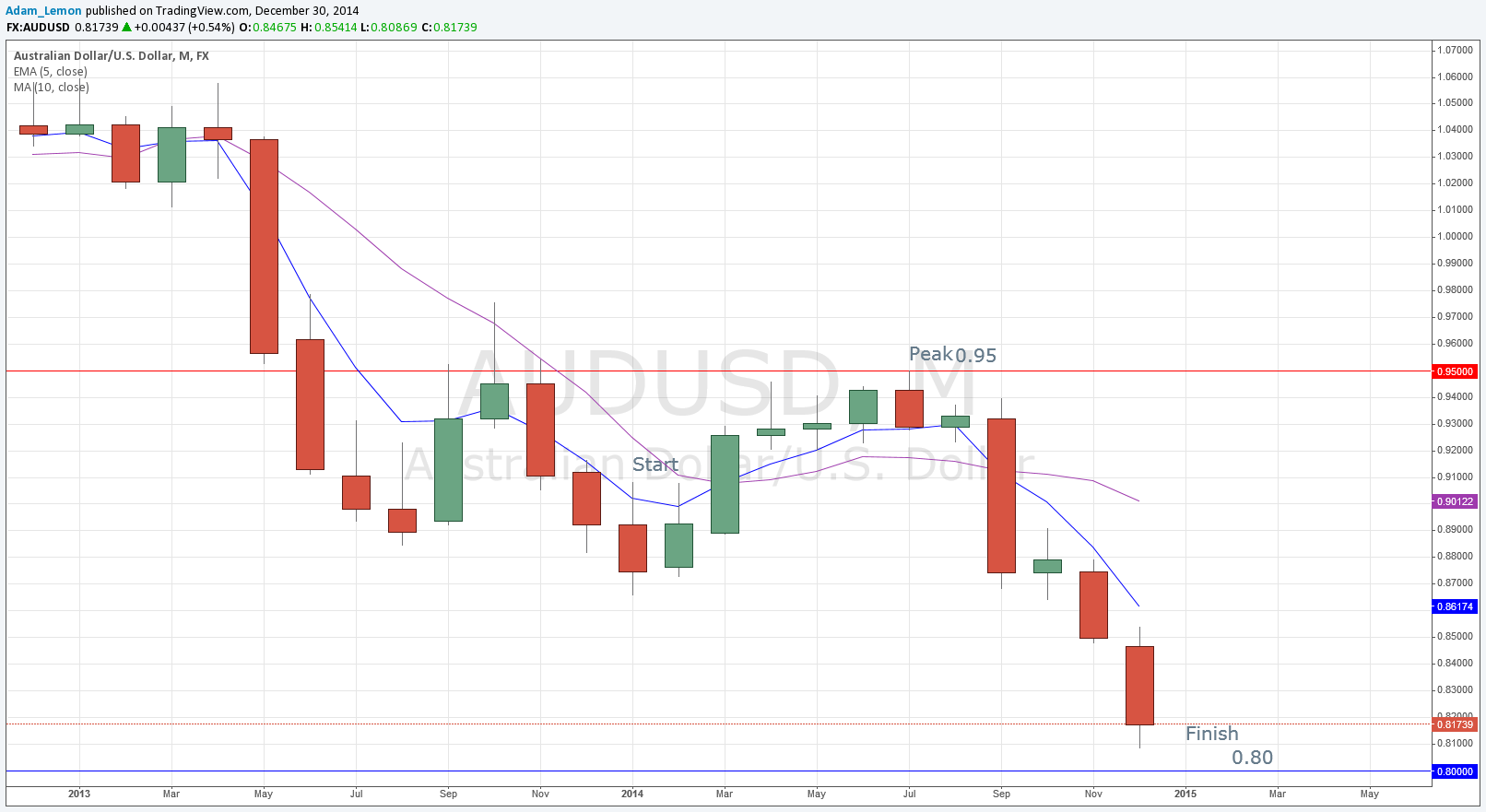

AUD/USD

The forecast was for the pair to show continued weakness during the first half of 2014, eventually reaching 0.80 which would be extremely strong support. Chris also thought that there would be very strong selling at 0.95.

Here is the monthly chart:

Although Chris’ timing was off, his prediction of a fall to 0.80 was right overall on the yearly direction, and his call of 0.95 as likely to attract a lot of selling was a stroke of genius, correctly predicting the yearly high to within 4 pips!

We hope you enjoyed Chris’ forecasts for 2014, which turned out to be an excellent and profitable roadmap to the major pairs in the Forex market. Even if you missed it, here are his predictions for the major pairs in 2015!