Gold prices ended Tuesday nearly unchanged, taking a breather after dropping 1.5% the day before yesterday, as the uncertainty in the market and lack of volume caused prices to remain subdued. The XAU/USD pair initially tried to break through the $1186 resistance level but pulled back to the $1174/0 area after figures from the Commerce Department revealed that gross domestic product advanced at a 5% annual rate in the third quarter, up from a prior reading of 3.9% and an initial estimate of 3.5%. Other economic reports mostly came in worse than expected but that wasn't enough for the bulls to overtake the bears.

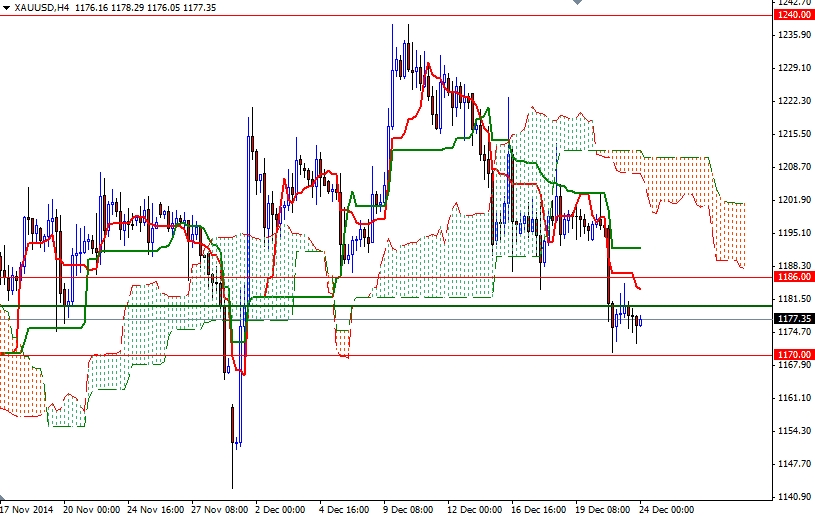

There have been clear signs the world's largest economy is on a stronger footing today and last week the Federal Open Market Committee stressed that economic data will dictate the timing of any interest rate hikes. Apparently, growing perception that gold is going to struggle once the Fed embarks on tightening monetary policy puts a certain amount of pressure on the market. However, as always, I will be paying more attention to technical levels (on the 4-hour chart) at this point.

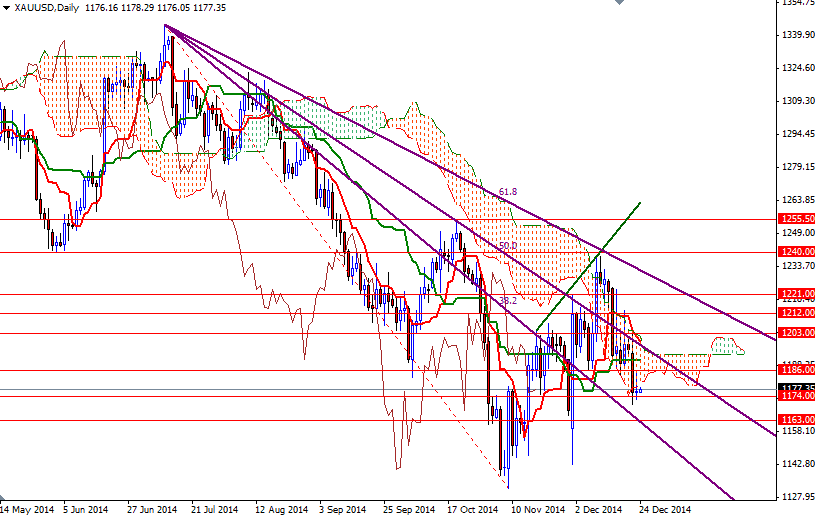

Currently, the market is still stuck between the 1186 and 1170 levels and I think the market participants will be reluctant to open new positions ahead of Christmas holiday. The bears will indeed need to break below 1174/0 before they march towards the 1163 level. Breaching this level might confirm that selling could continue to the next support area between 1155 and 1150. To the up side, the bulls will have to climb above the Ichimoku clouds on the daily chart in order to gain some traction and test the 1203 level. Of course, if they intend to approach that resistance level, they have to overcome the first hurdle which sits at 1186.