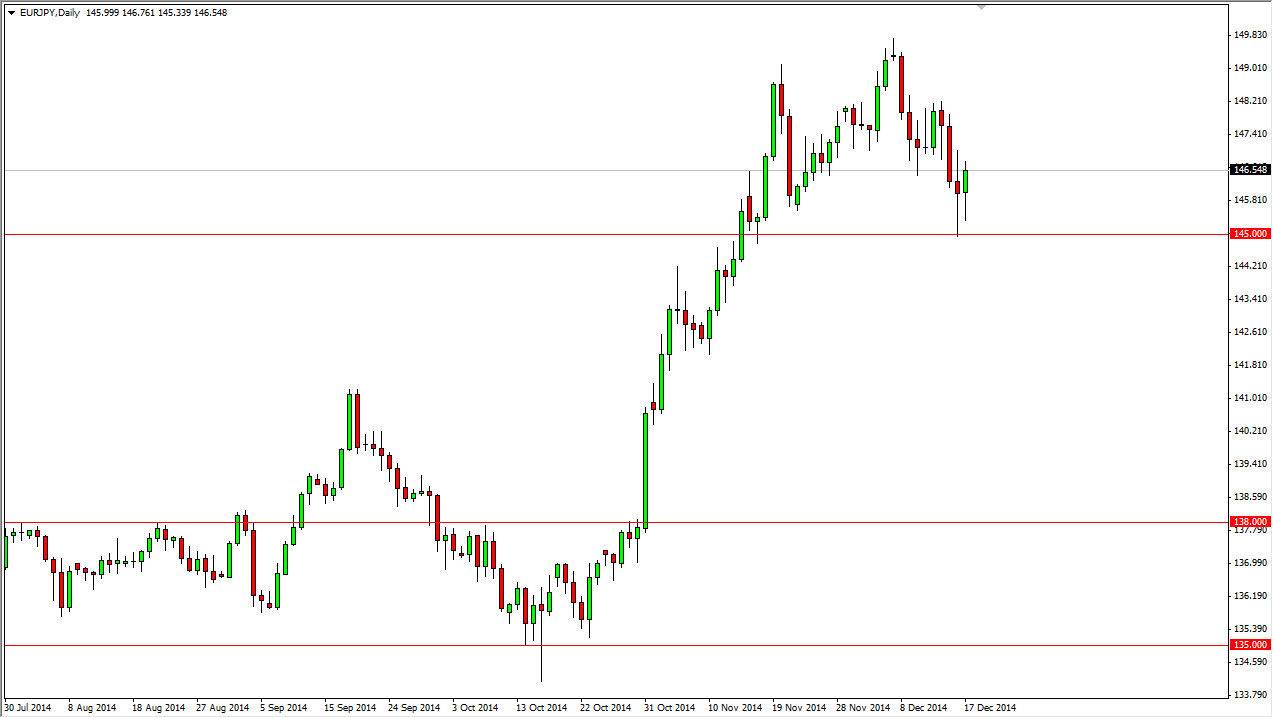

The EUR/JPY pair fell during the course of the day on Wednesday, but found support near the 145 level for the second day in a row. The resulting bullish action send this market much higher and ended up forming a hammer. This hammer suggests that the market is going to continue to go higher from here and perhaps go back to the top of the consolidation area that I had spoken about yesterday, all the way to the 150 level. I believe that the 145 level right now is a bit of a “floor” in this market, and I think that there is even more support just below there.

It’s only a matter of time before this market grind its way even higher, so having said that I think that the real focus in this particular market is on the Japanese yen, as the Euro certainly isn’t loved at this moment in time. I believe that this market will continue to be one that you can buy on the dips, and could be much like the USD/JPY pair, just simply one that you can buy every time it dips and make a bit of a career trade out of it. I know that the Euro isn’t the currency that you want to own in general, but the Japanese yen is just simply the worst.

Bank of Japan continues to influence this market

The Bank of Japan continues to influence this market through its quantitative easing program as far as the Japanese yen is concerned. With that being the case, the market looks as if it’s one that could go much higher over the longer term, but it’s only a matter of time before you get some decent pullback. A pullback should be thought of as value in the Euro, even though it’s not exactly our favorite currency at the moment is it? Nonetheless, I think that we will see the 150 level tested it in the next couple of weeks, and that of course much higher levels once we get through the holidays.