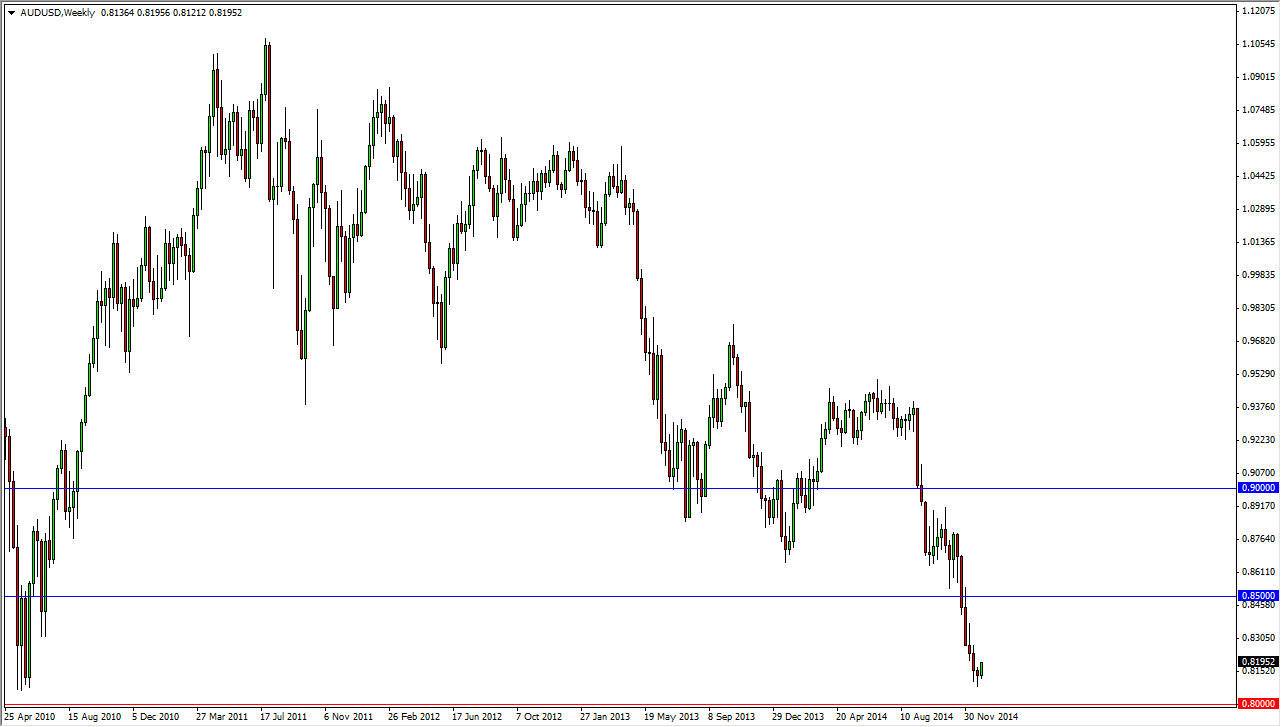

The AUD/USD pair has fallen off of a cliff essentially over the last couple of months. That being the case, I feel that the month of January will almost certainly be one that the market will have to regroup in, as we simply have gone too far, too fast. Ultimately though, I am watching the 0.80 level, as it is a massive barrier to the sellers and was a massive barrier for the buyers previously. Because of this, I believe that this market will in fact find quite a bit of support in that general vicinity, and quite frankly it would not surprise me at all if the downtrend ends soon.

The gold markets of course will have an influence on the Australian dollar, but they are starting to show signs of possibly stabilizing. With that being the case, I am looking for buying opportunities but I recognize that it probably will be a bit of time before we see that on a longer-term chart. After all, a lot of times when trends change, you see a lot of noise and volatility initially, and I think that’s what most of the month of January will be.

0.80 is massive in its implications

The 0.80 level is massive in my opinion, as when we broke through it a few years ago, it was a 16 year high being smashed. I remember that day very clearly, as I had been making quite a bit of money shorting the Australian dollar at that level. However, we eventually gave way and shot straight up. It was in fact what had to be overcome in order for the Aussie to finally reach parity with the US dollar.

Ultimately, I think that the buyers will come in and pick up this pair somewhere near that level. Because of this, I am looking to start buying the Australian dollar towards the back half of the month, and holding onto that trade for some time. If we do break down below the 0.80 level though, that in fact would be massively bearish.