By: Stephanie Brown

Ex-CEO of Citigroup Vikram Pandit, has come out in support for Bitcoin and believes that the innovative product has the potential of changing the way transactions happen. Mr. Pandit believes that if companies promoting Bitcoin are able to take care of its security problems and allow the digital currency to be more transparent, it will ultimately attract more users. This should greatly assist Bitcoin’s overall growth and move away from being only considered a financial asset.

Additionally, mcxNOW has decided to change its name to mtMOX and plans to take over the Bitcoin exchange in near future. Many users and are not happy with the name of mtMOX as it reminds of infamous Mt.GOX, which led to the infamous crash that caused Bitcoin to plummet from $1,000 to its current price.

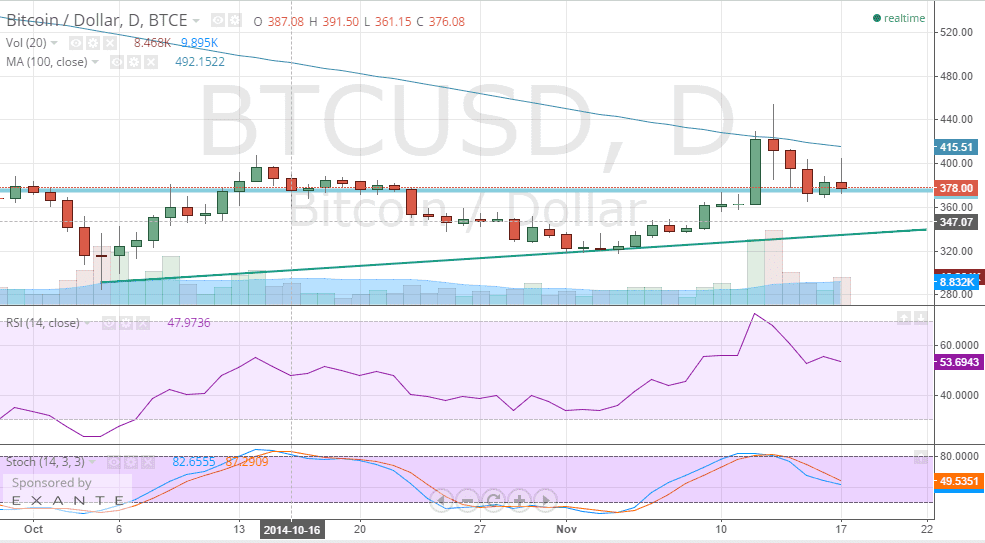

The BTC/USD continues to find resistance at the psychological level of $400. Additionally, the stochastic oscillator is giving a clear sell signal, which is indicative of a shift in momentum towards the sell side. Furthermore, the relative strength index continues to display no signs of reversing any time soon. It is significant to note however, that the crypto-currency is falling due to above average volume, which is of course bearish. Lastly, a close above $400 should provide some sort of a reversal for the BTC/USD in near future, while fall below $371 could take it to as low as $300.

Actionable Insight:

Short the BTC/USD if it moves below $371 for an intermediate target at $280, with a stop loss above $400.

Long the BTC/USD if it moves above $400 for an intermediate target at $421, with a stop loss below $380.