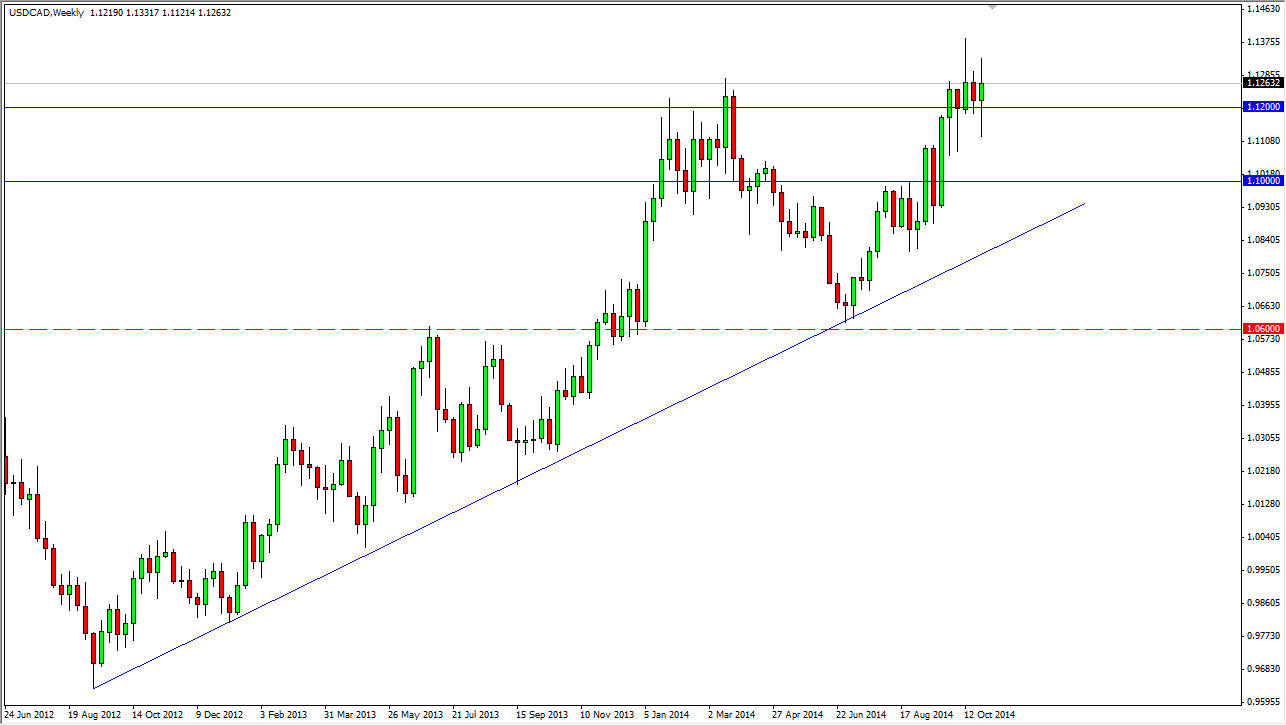

USD/CAD

The USD/CAD pair went back and forth during the course of the week, testing the 1.12 level for support. We did in fact find it there, but as you can see we are essentially “stock” at this level, and as a result it’s a bit difficult to get overly excited about trading this pair in this present state. However, we believe that longer-term traders should continue to buy this market as it should first head to the 1.14 level, the 1.15 level, and then possibly even higher than that. We have no interest whatsoever in selling this market as there is such significant support all the way down to the 1.10 handle.

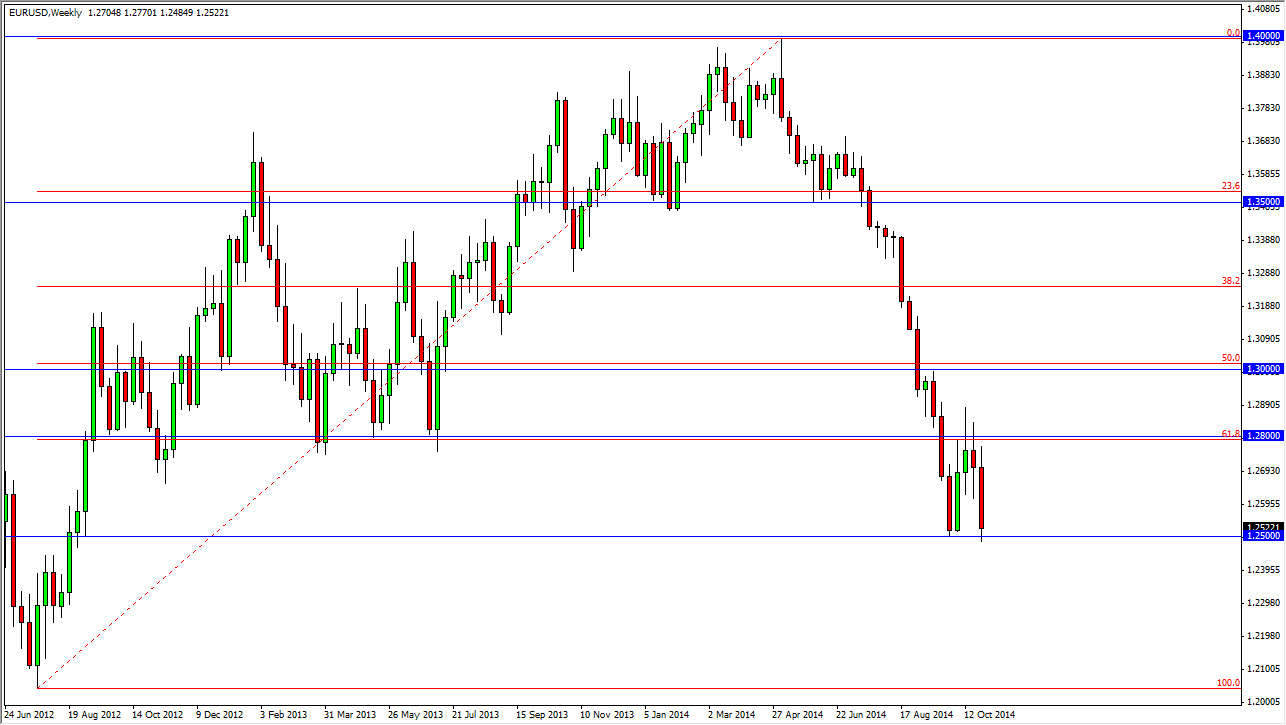

EUR/USD

The EUR/USD pair initially tried to rally during the course of the week, but as you can see the 1.28 level has offered enough resistance to turn this market back around, and send it looking for the 1.25 level. The 1.25 level being broken to the downside is what I anticipate seeing this week or two coming out, and I believe that the market should go down to the 1.2050 level given enough time. I will continue to sell this market every time it bounces.

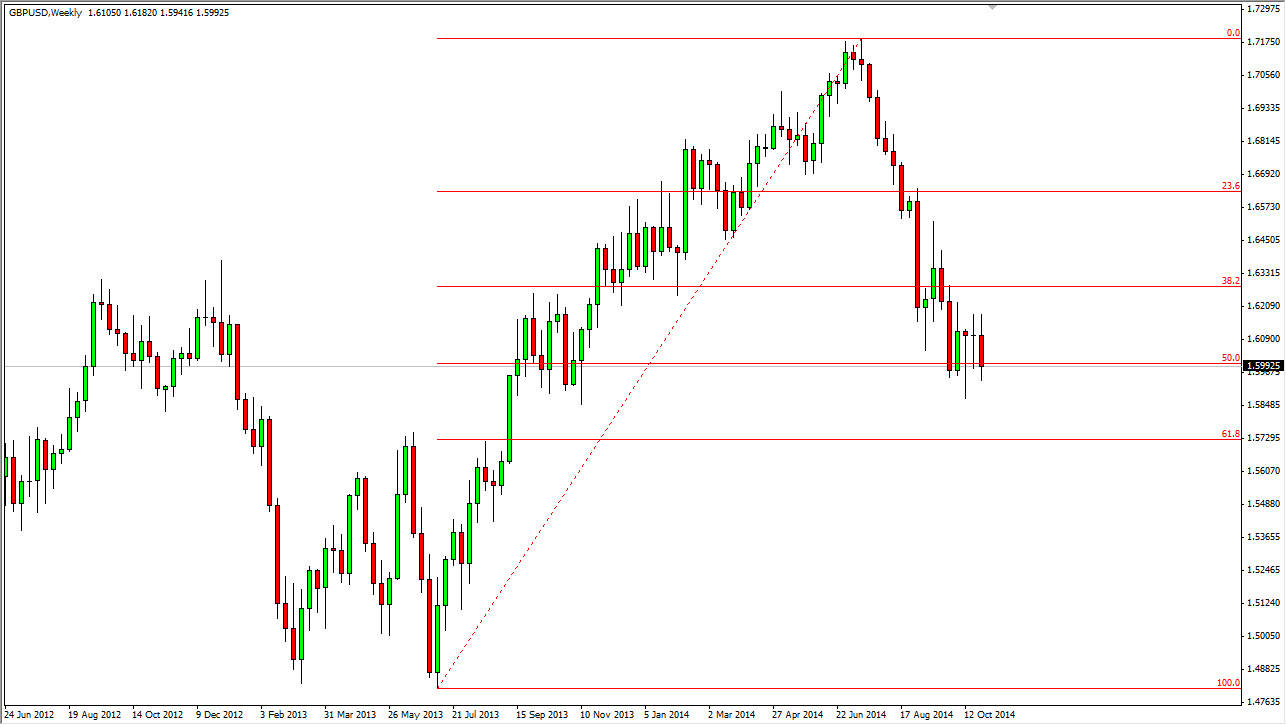

GBP/USD

The GBP/USD pair as you can see initially tried to rally during the week, but fell at the 1.62 level yet again and testing the 1.60 handle again. This is an area that has been massively supportive, and the fact that it is the 50% Fibonacci retracement level from the original uptrend should bring in buyers to eventually push this market higher. Yes, I am aware the fact that the US dollar should continue to be one of the strongest currencies out there, that this market might be a bit of an anomaly.

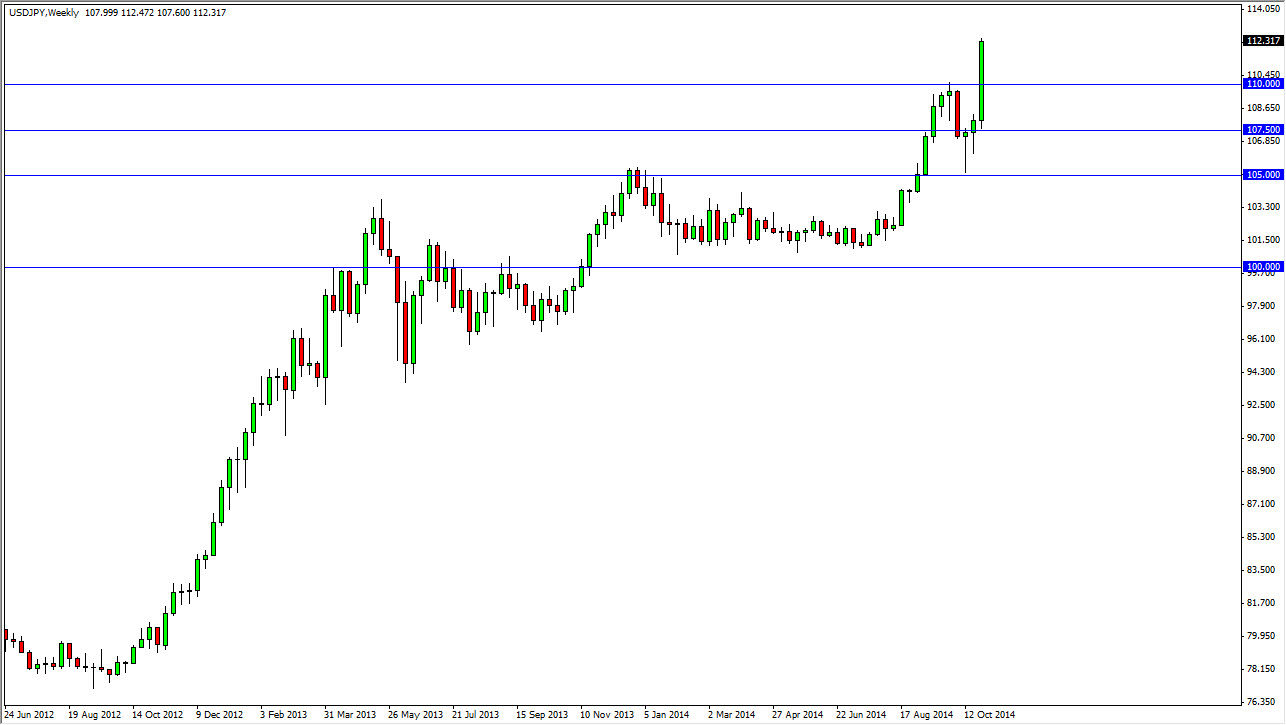

USD/JPY

The USD/JPY pair broke higher during the course of the week, with Friday being the breakout session. The fact that we are above the 110 level tells me that the market should go to the 115 level given enough time. Pullbacks at this point in time should be thought of as buying opportunities as it should represent “value” in the US dollar. I have no interest in selling, and I do believe that this market goes much, much higher.