USD/JPY Signal Update

Yesterday’s signal was not triggered and expired.

Today’s USD/JPY Signal

Risk 0.75%

Trades may only be entered between 8am London time and 5pm New York time; and then after 8am Tokyo time.

Long Trade 1

Long entry following bullish price action on the H1 time frame immediately following the next touch of 117.03.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

USD/JPY Analysis

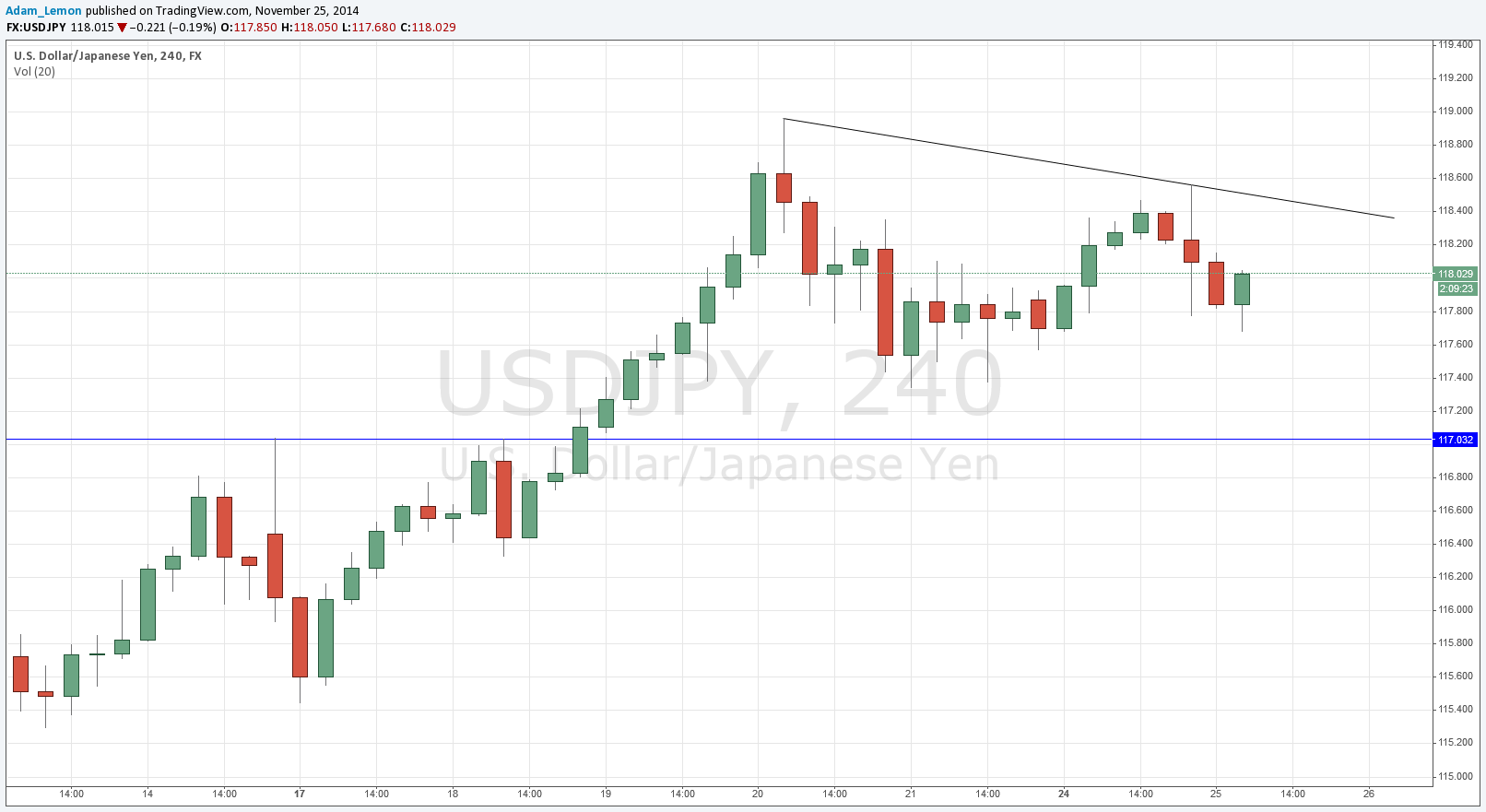

Not much changed yesterday. The price tried to rise before falling off again during the Tokyo session that has just ended.

There is local support at around 117.40 but the level that looks likely to prove to be truly supportive lies just above the resistant double top that was formed at 117.03.

A descending bearish trend line is beginning to form, which is not worth using to short just yet. A breakout above the trend line however, followed by a retest of the broken line, might be a long opportunity, but that does not look likely.

It seems that any bullishness is fairly weak; we seem to need a pull back before any strong bullish momentum can be rekindled. A test of the 117.00 level should be revealing, if it is breached easily with no bounce, that would be a bearish sign.

There are no high-impact data releases scheduled today that will directly affect the JPY. Regarding the USD, at 1:30pm London time there will be a release of Preliminary GDP data, followed later at 3pm by CB Consumer Confidence. The New York session is likely to be more volatile than the earlier London session.