USD/JPY Signal Update

Yesterday’s signal was not triggered and expired.

Today’s USD/JPY Signal

Risk 0.75%

Trades may only be entered between 8am London time and 5pm New York time; and then after 8am Tokyo time.

Long Trade 1

Go long following bullish price action on the H1 time frame immediately following the next touch of 115.00.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Long Trade 2

Go long following bullish price action on the H1 time frame immediately following the next touch of 114.00.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 1

Go short following very bearish price action on the H1 time frame immediately following the next touch of 117.90.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 50 pips in profit.

Remove 50% of the position as profit when the trade is 30 pips in profit and leave the remainder of the position to ride.

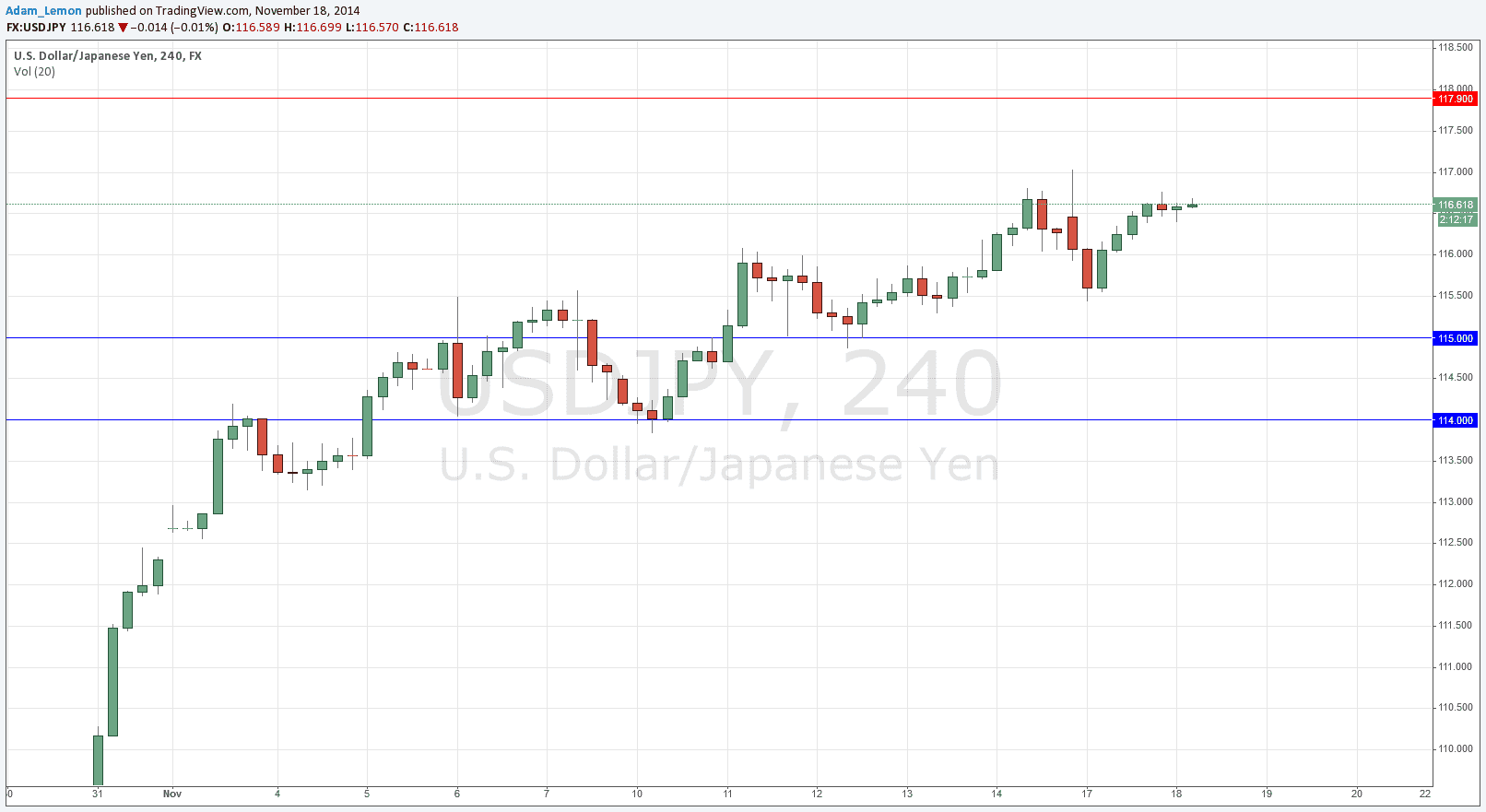

USD/JPY Analysis

Little has changed technically. We have still not returned to the support at 115.00 or broken the multi-year high that was established shortly after Tokyo opened yesterday morning. The USD strength is slowing down but there is still great weakness in the JPY.

The price did recover from the strong fall, but has not been able yet to reach the previous high. The next 24 hours are likely to be important as we have key news from both sides of the pair. If we break below 115.50 and remain there for any length of time, it will be a sign that the upwards trend is starting to slow and perhaps pause. Additionally, if 115.00 fails to hold as support, it will be a sign that conditions are starting to move away from a runaway upwards trend.

Due to the upcoming news, I am prepared to look for a short trade off the key level at 117.90, especially after a spike caused by news.

My colleague Christopher Lewis continues to be bullish, and he also sees likely support at 115.00.

There are high-impact news releases scheduled today likely to affect both the JPY and the USD. At 1:30pm London time there will a release of U.S. PPI data, which will probably affect the USD. Close to the end of the Tokyo session later, there will be a Monetary Policy Statement from the Bank of Japan, which will probably have an impact upon the JPY.