By: Ben Myers

New York Superintendent of Financial Services Benjamin Lawsky, who has been trying to introduce a BitLicense legislation for all companies that are working with Bitcoin is rumoured to be stepping down in 2015. Industry experts are considering this a relief, as they are of the view that the proposed legislation by Lawsky was anti-business. They additionally feel that his exit will allow start-ups to have more breathing space and allow companies to flourish under free market situations.

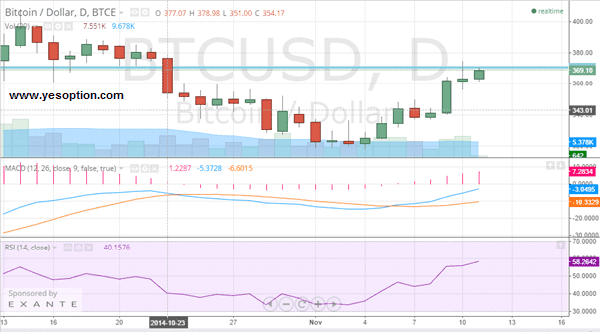

The BTC/USD continued its upwards trend during the overnight session but was unable to sustain itself higher levels. Now in the morning session, the BTC/USD started trading higher but like last night it has been unable to endure these conditions. Its resistance continues to remain around $370 leading analysts to believe only a move above this level should start a reversal. Meanwhile, support on the downside still lingers at $320.

The crypto-currency continues to trade below its daily moving averages, while its momentum indicator is in fact trending higher. Additionally its relative strength index is producing a buy signal, which is of course a bullish sign in the short-term. It is imperative to note that the upwards momentum that the BTC/USD experienced over the past couple of days is due to above average volumes, This should undoubtedly calm analysts nerves who have recently been speculating regarding the waning interest in the crypto-currency.

Actionable Insight:

Long the BTC/USD if it moves above $370 for a short term target at $400, with a strict stop loss below $347

Short the BTC/USD if it moves below $330 for a short term target at $280, with a strict stop loss above $347