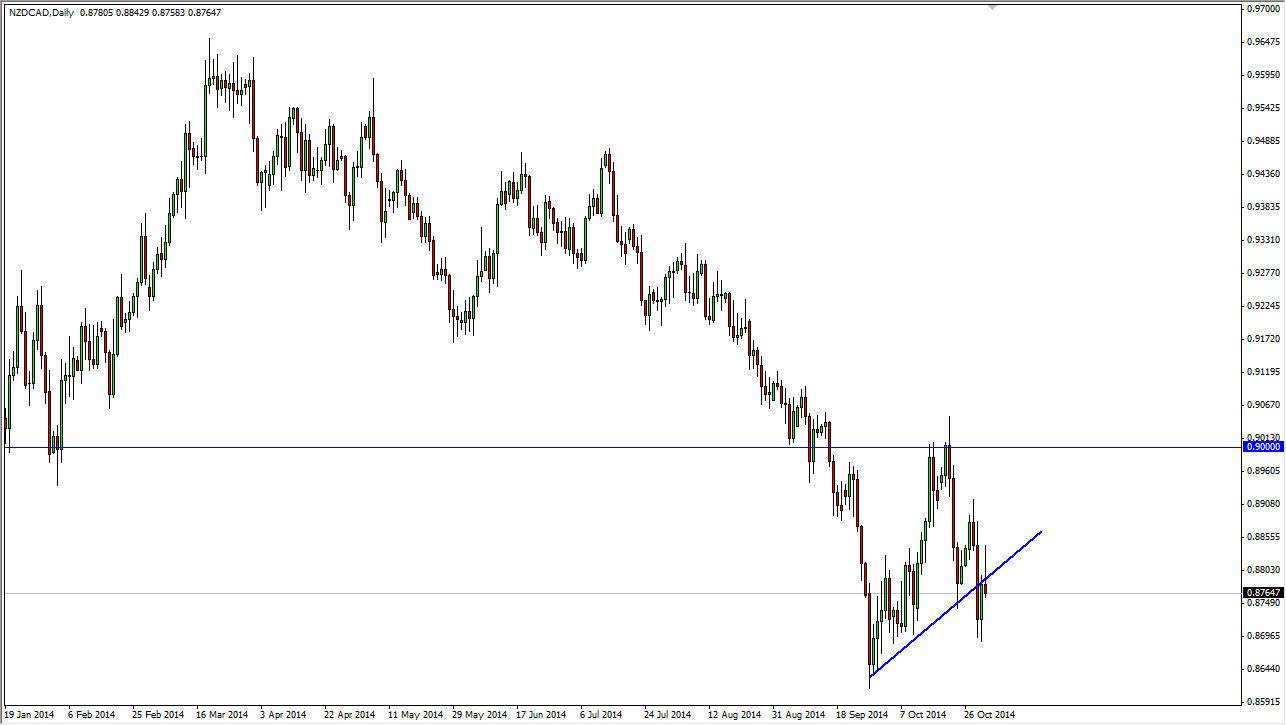

The NZD/CAD pair initially tried to rally during the course of the day on Friday, and as you can see failed. On the chart, you can see where I had the uptrend line from a couple of days ago marked, and where the market simply could not stay above that line. Because of this and the fact that it ended up forming a nice-looking shooting star, I believe that we will see continued downward pressure and continuation in this marketplace. With that being the case, the market should continue to go much lower, at least testing the 0.86 level in the relatively short term as it was the most recent low.

Because of that, I believe that selling on a break of the bottom of the shooting star for the Friday candle is in fact the trade that I am looking for. I like this because we have the New Zealand dollar which of course has a central bank that has been selling it recently, heading to much lower levels which is exactly what you would expect.

North American currency

One of the biggest advantages for the Canadian dollar is the fact that it is a North American currency. That of course is a good thing to be at this moment in time as well, simply because the US and the Canadian economies are two intertwined markets. With that being the case, there is a little bit of a “knock on effect” from the greenback on the Canadian dollar.

I believe that the longer-term move is probably down to the 0.85 level, and then eventually the 0.80 level given enough time. After all, the New Zealand dollar should continue to fall based upon central bank intervention and wishes out of Wellington, and with that we should have more of the so-called “knock on effect” in this marketplace mentioned above. Although both of these are commodity currencies, they certainly are not equal. One is based upon Asian demand, while the other one is based upon American demand. And that is what’s driving this pair.