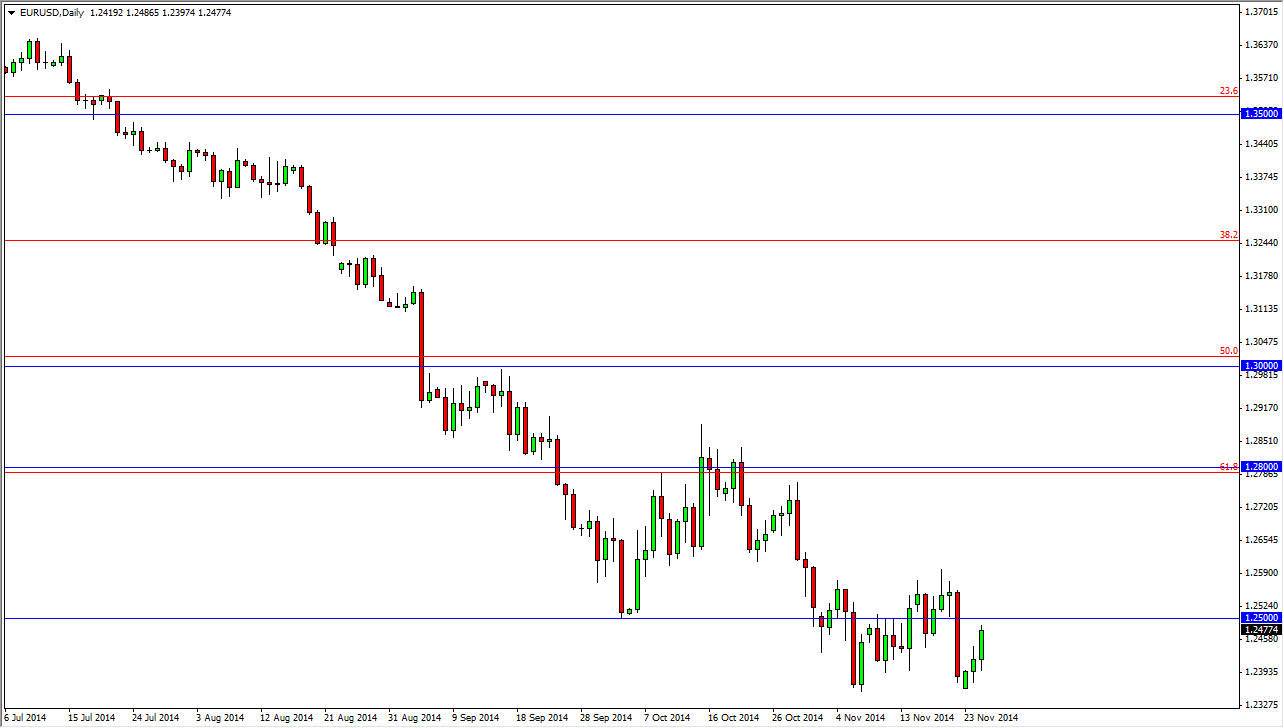

The EUR/USD pair tried to break down a little bit during the session on Tuesday, but as you can see the buyers stepped in and pushed the market higher. It appears that we are going to test the 1.26 level again, which of course has been resistance. I believe that a resistant candle in that region is probably an excellent selling opportunity, and as a result I am looking for resistive candle in that region in order to do exactly that. I believe that this market ultimately goes down to the 1.2050 level, an area that is the beginning of the uptrend. With that being the case, the market looks as if it is one that can be sold every time it rallies, and as a result it’s only a matter time before we break down significantly.

Central bank divergence

The central banks in both of these currencies of course are diverting from what they are doing from each other. The Federal Reserve of course has left the quantitative easing game, while the European Central Bank looks to continue its monetary policy being very loose going forward. In fact, it is possible that they have to expand upon it, and with that the markets will ultimately find themselves selling off again and again. The interest-rate differential will start to tighten yet again, and that of course will flow money into the United States.

The US economy continues to be one of the better performing economies out there, and as a result I believe that the US dollar will continue to strengthen over the longer term anyway, pushing this pair down quite a bit. With that being said, the market looks as if it is ready to be sold all the way up to the 1.28 level, which I have as a massive resistance barrier. With that, I don’t see an opportunity to buy it all, and I think only the foolish would do so. Follow the trend, that’s where most of the profits will be found in this pair.