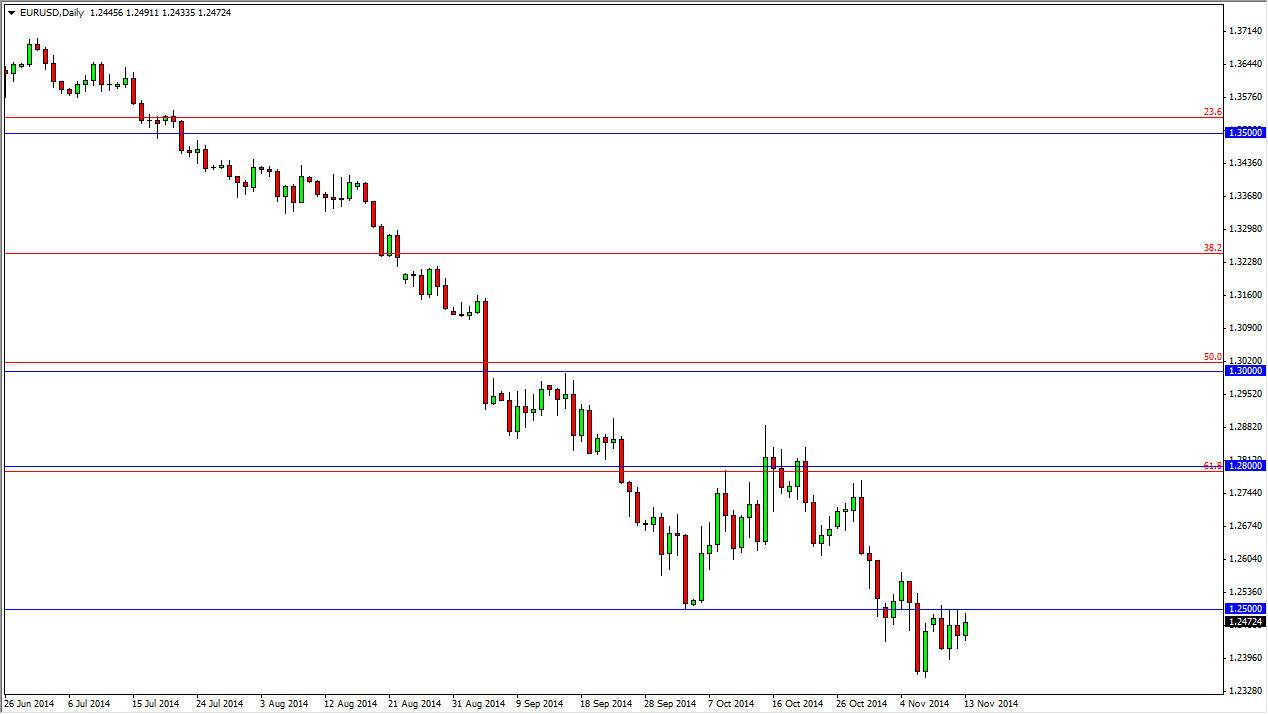

The EUR/USD pair continues to test the 1.25 level for resistance. That area of course has been very firm and I don’t expect it to change anytime soon. Ultimately, I think that the marketplace could break down and head to the 1.2050 level, which would essentially be a “round-trip” of the entire move higher. Ultimately, I feel that this market is one that can continue to be sold, because quite frankly I don’t want to go against the value the US dollar at this point in time. With the Federal Reserve exiting the quantitative easing game, it’s very likely that the US dollar will continue to strengthen overall.

Looking at this pair, I can see that there is quite a bit of noise between 1.25 and the 1.28 levels, and that is a lot of possible selling orders between here and there. So because of that it only strengthens my resolve to sell this market and not buy it.

The trend is set, no need to fight it

The trend is set in this market, so there’s really no need to fight it. I think that the market will continue to offer selling opportunities every time it rallies, as the Euro will certainly suffer because of the European Central Bank having to loosen its monetary policy. I think that it’s only a matter of time before we break down completely, but at this moment I think that it’s going to be more of a slow grind. Nonetheless, if you are patient you can just simply sell this pair every time it tries to rally, and collect some profit.

It is not until we break above the 1.30 level that I would consider buying this market, because it is so bearish. Above that level, I would have to rethink a lot of things in this market, and it would certainly catch everyone’s attention. I really doubt that’s going to happen though, so I think that we will be selling the Euro time and time again for the rest of the year.