By: Stephanie Brown

Correctly using Twitter Inc. (NYSE:TWTR) is turning out to be a tall order even for people who ought to be proficient at it. The giant social network’s chief financial officer, Anthony Noto, mistakenly tweeted how he was planning to buy a company in December and how he intended to go about it. The message was posted on the social platform but later deleted with the company’s spokesperson Jim Prosper confirming that Noto wanted to send the message privately. The errant tweet arose a heated debate on which company Twitter might be looking to buy.

No details have been given on who the message was intended for or the company that Noto is looking to acquire. It is not the first time that Direct Message (DM) fails have occurred on this magnitude. Back in 2010, a startup investor Dave McClure mistakenly tweeted that another investor, Ron Conway was trying to throw him under the bus, with allegations that he was trying to control startup funding. Other past instances include US Airways tweeting pornographic related content, as well as an anti-Obama message by KitchenAid and past antics of Congressman Anthony Weiner

Twitter did not fare too well this year, as the stock is already down by 17%, with the company in October admitting that its user growth was slowing. Remarks about a possible acquisition come in the wake of revelations that Twitter has already conducted talks with Shot, a selfie app, regarding a possible acquisition due to Shot’s extensive user base

Technical Analysis

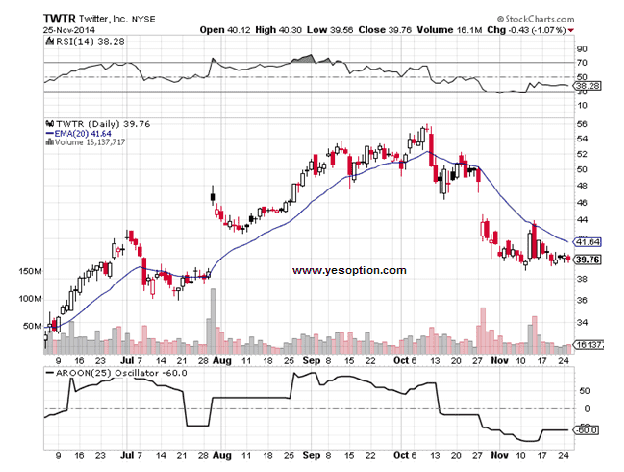

Twitter has been trading down for quite a long period of time. The stock is almost always experiencing sell-off on every rally. It is currently trading below its 20-Day EMA of 41.64, with an RSI of 38.28. Its Stochastic Oscillator stands at 60, indicating that the stock’s overall trend is down

Actionable Insight

Sell Twitter Inc. (NYSE:TWTR) below $39.55 for target between $38.70 and $39.20, with a stop-loss of $39.75