By: Stephanie Brown

Yesterday the Bank of Ukraine announced via its website that Bitcoins cannot be used as a form of payment in Ukraine. The country’s regulators stated Bitcoins and other such “crypto-currencies” lack the legal backing and will not be recognized any time soon by the National Bank of Ukraine. However, it is imperative to state that there is no official ban on the usage of Bitcoins, as no official law has been officially passed. Many in Ukraine believe that their regulators are unable or unwilling to understand the various advantages that the Bitcoin can provide.

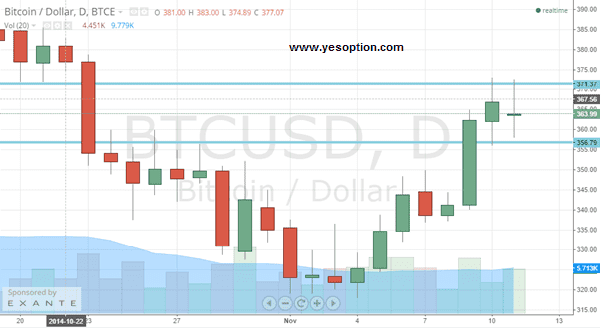

The BTC/USD continued to found near its resistance zone at the $371 level. In today’s session so far, just like yesterday, the crypto-currency climbed above the resistance zone but is unable to sustain itself.

Some analysts rightfully feel that its current upward trend may lose some steam if the BTC/USD is unable to move above the critical zone mentioned above. As of now it continues to trade below its important daily moving average, with support coming near the $356 level, which if broken will almost definitely cause the BTC/USD to revisit its previous lows that it hit earlier in the month.

The stochastic oscillator for the BTC/USD is showing the very first sign of a potential reversal from the overbought zone, while the relative strength index on the other hand is trending in the no-trade zone, but with a negative bias.

Actionable Insight:

Short the BTC/USD if it breaks below $356 for an intermediate target at $321, with a stop-loss above $371.

Long the BTC/USD if moves above $371 for an intermediate target at $400, with a stop-loss below $363.