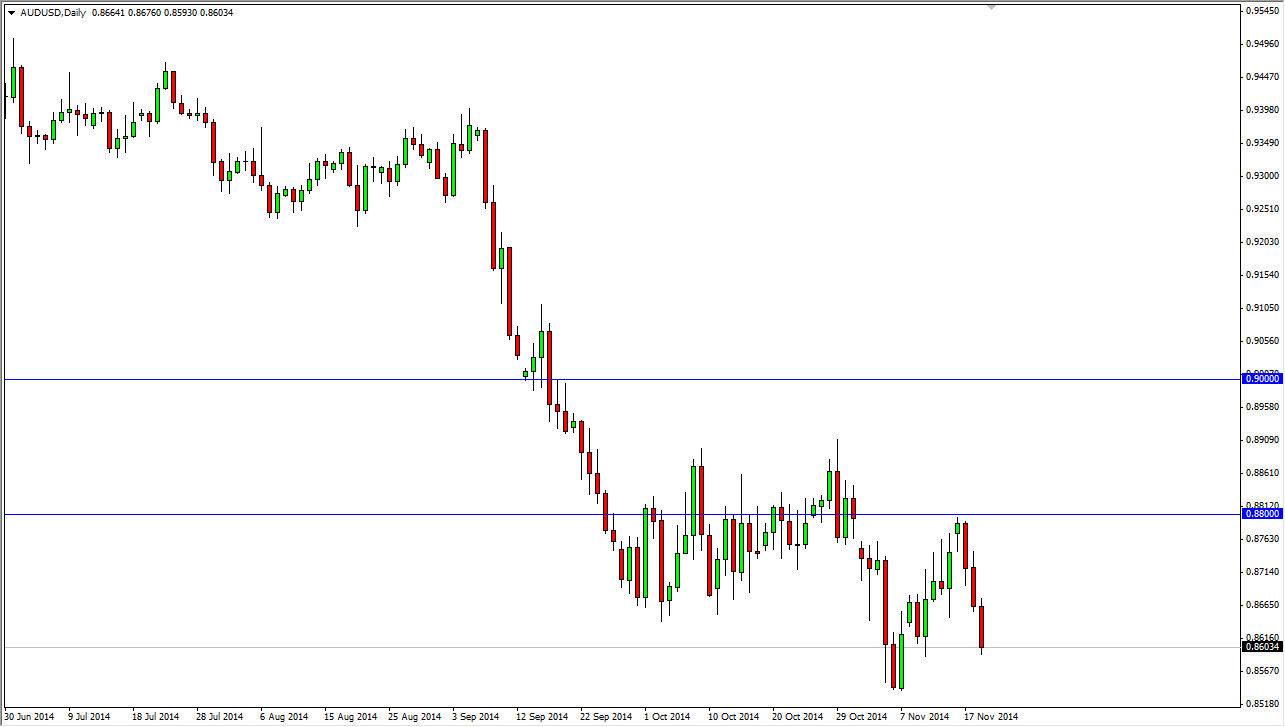

The AUD/USD pair fell during the course of the day on Wednesday, testing the 0.86 level for support. Ultimately, we feel that this market should continue to fall, but we recognize there could be a little bit of support at the 0.85 handle as well. Ultimately, this market should continue to go much lower, probably down to the 0.80 handle given enough time. Any rally between here and there is a selling opportunity as far as I can see, and therefore I’m looking to short-term opportunities to continue to profit from US dollar strength and Australian dollar weakness.

The gold markets certainly are not helping the Australian dollar overall, and gold seems to be looking straight into the face of a massive amount of resistance at the moment. Ultimately, the US dollar should strengthen overall, and of course the Australian dollar will be punished as a result considering that it is so sensitive to commodities.

Continue trend, keep selling

The 0.88 level above has been resistive in the past, and as a result it appears of the market should continue to find sellers in that general region. I think that there will be a little bit of a bounce of the 0.85 level, but quite frankly it should be an opportunity to continue selling. I think that all commodities in general are going to get beat up, and that of course will weigh upon the Australian dollar in general. Remember, even though gold is very influential on the Aussie dollar, the truth is that copper, as well as many other hard minerals will come into play as well. Australia has a mining economy, which of course is a large mover of the currency itself.

I believe that the US dollar continues to strengthen overall, and therefore I’m not interested in shorting the US dollar against anything, let alone anything that is commodity-based. Ultimately, if we do get above the 0.90 level, at that point in time I would consider buying but I do not anticipate seeing that anytime soon.