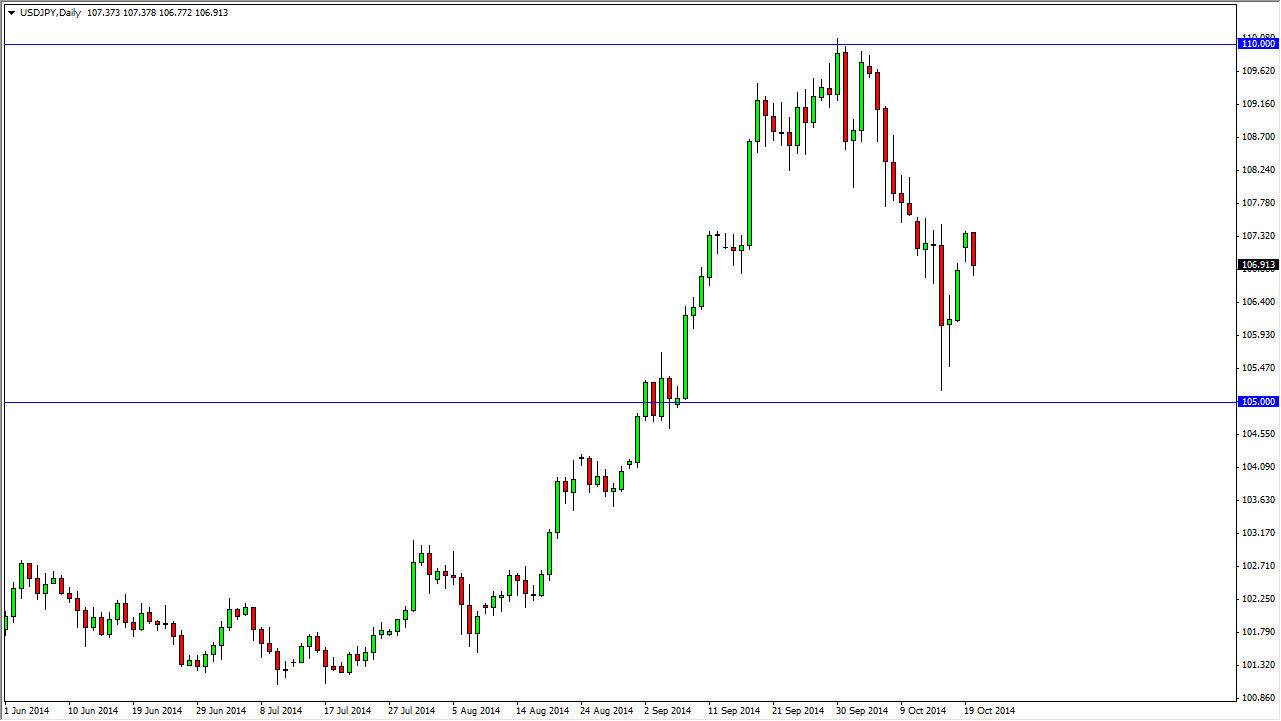

The USD/JPY pair gapped higher at the open on Monday, and then turned back around to fill that very gap. This is classic technical analysis, and normally means that we are continuing to go higher. Nonetheless, I believe that this market goes higher anyway, based upon the longer-term trend and the fact that the Federal Reserve continues to step out of the quantitative easing game while the Bank of Japan looks likely to step on the accelerator when it comes to that very same action. With that in mind, the US dollar should continue to go higher against the Yen of the longer term as well.

I see the 105 level below has a significant support level, and therefore have no interest whatsoever in shorting this market with any conviction, and I believe that any pullback at this point in time should end up being a nice buying opportunity as we continue the uptrend overall. I also think that the 110 level will continue to attract the market, therefore the market should go back to retest that area for resistance.

The Bank of Japan will make sure this continues

I believe that the Bank of Japan will do whatever it takes to make sure that this kind of behavior in the Yen continues to happen. The US dollar of course is on a diametrically different course anyway, so this will be the first market to look towards as far as selling the Yen is concerned. Ultimately, it’s likely that the market will continue to offer buying opportunities every time he drops, as the support will more than likely come in over and over. In fact, I believe that if the market does somehow break below the 105 level, the Bank of Japan may very well intervene. It most certainly will verbally.

Ultimately, if we get above the 110 level, I believe that we then head to my longer-term target of 115, which I still believe is very possible by the end of the year even though we’re getting close to November. However, keep in mind that this won’t happen overnight, and therefore it’s likely that it will be several different “buy on the dip” type of trades to get us there.