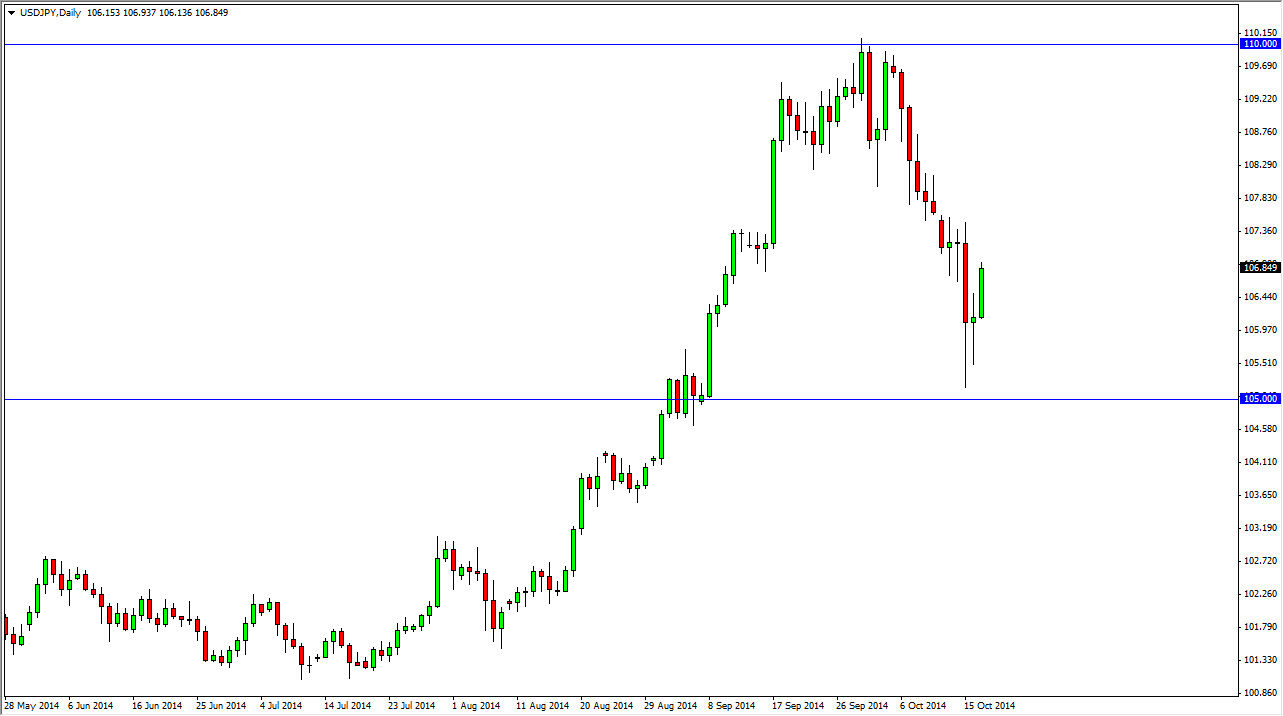

The USD/JPY pair broke higher during the course of the session on Friday, clearing the top of the hammer that informed on Thursday. What is most important as far as I can see on this chart is the fact that the Wednesday candle slammed into the 105 level, but failed to break below it. That being the case the market looks as if there is a massive amount of buying pressure near the 105 level, something that I have been anticipating for some time now. After all, it was an area that had been so resistive in the past.

Deceiver the candle is fairly strong, but really I’m looking at this more or less as a longer-term trade anyway. I realize that the market will continue to go back and forth and cause a bit of volatility, but at the end of the day I don’t see any other direction in this market but up. I feel that the 105 level is massively supportive, and even at that point time I would be very leery about selling this market if we did close below that handle.

Interest-rate differential should still favor the US dollar longer-term

Interest-rate differential between the two currencies and the bond markets in the 10 year notes should still favor the United States for the foreseeable future. Because of this, the market will of course continue to rise, although it must be stated that recently the Federal Reserve looks less likely to be anywhere close to raising rates themselves. Nonetheless, getting out of the quantitative easing game should bring the yields in the 10 year notes higher due to the Federal Reserve not stepping in and buying them, but that means we will probably get more of a slow and gradual move higher.

I also believe that the Bank of Japan would not hesitate to step into this market if we started to fall rapidly. I believe that 100 is the “line in the sand” for the Japanese, as it essentially means parity. The Japanese economy is massively dependent on exports, and a strong Japanese yen is doing that economy no favors.