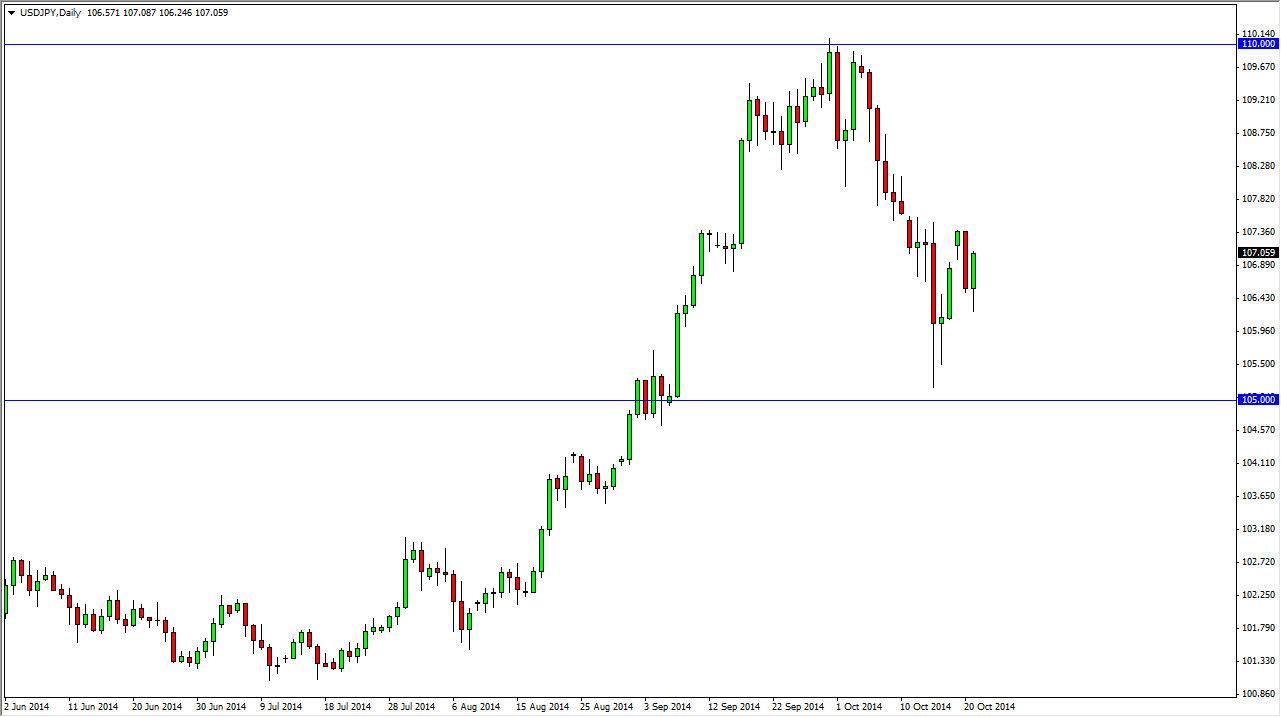

The USD/JPY pair initially fell during the session on Tuesday, but we found enough buyers below the 107 level to turn things back around and form a fairly positive looking candle. It isn’t necessarily a hammer, but it does look similar in its impression. Because of this, I feel that the market is ready to continue going higher and the fact that we have been in a longer-term uptrend to begin with certainly doesn’t hurt that argument. Because of that, I feel that the market will eventually break above the 107.50 handle, which is the gateway to higher levels, more specifically the 110 handle.

I believe that the market is inherently bullish, and therefore I have no interest in selling it. After all, the US dollar is by far one of the most favored currencies in the world right now. On the other hand, the Bank of Japan has in fact work against the value the yen, so I think this is a marketplace it should continue to grind higher. I look to buy pullbacks as “value”, and therefore will continue to add to my already long position.

Continued uptrend for the rest of the year

I think that the markets continue to grind higher for the rest the year, and I also expect us to go above the 110 level given enough time. It may not happen the first time we get back there, but eventually we will break above there as the Bank of Japan is going to continue to work against the value of the Yen, as well as the Federal Reserve being in a situation where they may very well have to continue tapering off of quantitative easing, or possibly even raise interest rates given enough time. Regardless, they are most certainly closer to raising interest rates than the Bank of Japan is, so at the end of the day this is a pair that should continue to go higher unless of course we get some type of financial crisis again. Ultimately, I continue to “buy on the dips.”