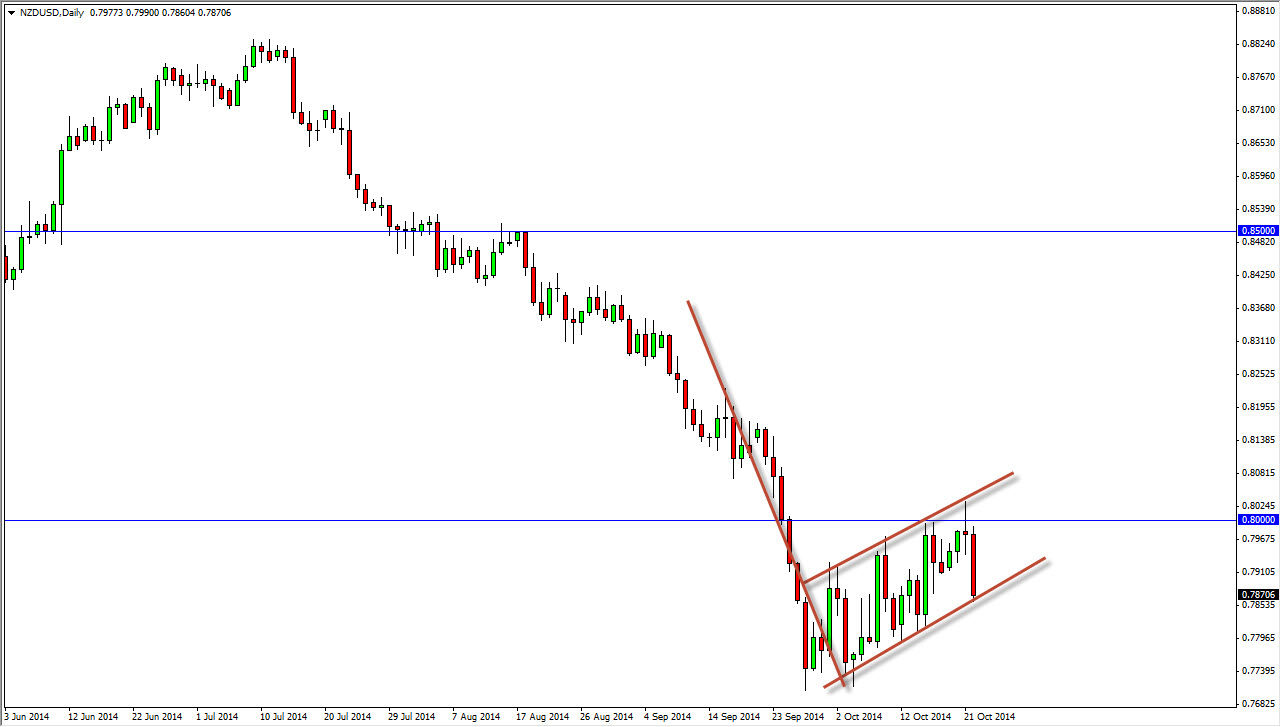

The NZD/USD pair broke lower during the session on Wednesday, breaking the bottom of a shooting star from Tuesday. This is without a doubt one of the most bearish signals that you can find, and adding to that we ended up struggling at the 0.80 level, which is obviously a large, round, psychologically significant number. With that I feel that this market is telling us that it’s time to start selling yet again. After all, the New Zealand dollar is highly sensitive to commodity prices and the Royal Bank of New Zealand has actually stepped into this marketplace to bring down the value of the Kiwi dollar.

I do believe that much lower prices are in store for this marketplace, especially considering that the above-mentioned central bank is looking to push this market down to the 0.68 handle, a place that actually makes quite a bit of sense on the longer-term charts as it was once a very supportive level.

The Federal Reserve and monetary policy.

I believe that the Federal Reserve will get out of the quantitative easing game altogether, and that of course will push this market lower. After all, we don’t know exactly what to expect out of New Zealand, although than attempts to bring down the value of the Kiwi. On the other hand, it does appear that the US economy is starting to strengthen a bit. Because of this, the US dollar course has been picking up value and the bond yields should continue to rise as the Federal Reserve buys less and less, and then eventually none.

On top of that, Asian economic numbers are so-so at best, and that of course has a massive influence on the ceiling in general. Because of that, I feel that Pacific and Asian currencies in general will struggle for the time being. Also, a lack of major Asian demand of course will put a drag on commodities overall, and that of course puts some bearishness in this marketplace as well. I do not make it a habit to fight the central banks, so if the bankers in Wellington want this pair lower, I’m not standing in the way.